Editor's Note: Recently, JUUL indicated on its official website that NJOY's product, NJOY Ace, allegedly infringes on a number of JUUL's patents. JUUL has filed an application for a 337 investigation against NJOY with the U.S. International Trade Commission (ITC) and the U.S. District Court for the District of Arizona, requesting that the ITC prohibit NJOY's infringing products from continuing to be imported and sold in the United States.

Patent litigation is a commonly used tactic by international companies in their business competition. So what is the reason behind JUUL's initiation of the 337 investigation this time? What patents are involved? Will it lead to NJOY ceasing the sale of the implicated products? To address these questions, Lawyer Liu Peiling from the team of Tang Shunliang, a specialist in the tobacco and next-generation tobacco at Zhong Lun Wende (Kunming) Law Firm and a special consultant for 2FIRSTS, provides a professional interpretation of the patent case.

In this article, Liu Peiling suggests that based on the lawsuit documents filed by JUUL, there is a high possibility of patent infringement risk in NJOY's product structure, which is one of the reasons why JUUL initiated the lawsuit. However, NJOY still has the opportunity to file for invalidation of certain claims of the patent, which could potentially impact the subsequent litigation.

Special Announcement:

This article only represents the views and position of the author, 2FIRSTS solely publishes for industry reference and learning, not responsible for the accuracy, reliability or completeness of the content contained.

On June 30th, prominent American enterprise JUUL Labs, Inc. (hereinafter referred to as "JUUL") partnered with VMR Products LLC (hereinafter referred to as "VMR") to file a complaint as the plaintiff with the United States International Trade Commission (ITC) requesting a 337 investigation against NJOY LLC, NJOY Holdings, Inc., Altria Group, Inc., Altria Distribution Company, and Altria Client Services, LLC.

JUUL has recently filed its fourth 337 investigation application regarding "vaporizer devices and their components" in the past five years, capitalizing on the benefits gained from the previous three 337 investigations.

The author presents several specific questions to gradually uncover the motives behind the 337 investigation.

What is the underlying reason behind the 337 investigation this time?

In the US e-cigarette market, VUSE currently holds the top position with a market share of 41.8%, followed by JUUL with 26% market share, and NJOY with 3% market share. However, recently, Altria ended its 5-year investment in JUUL and instead announced the acquisition of NJOY for a price of $2.75 billion. The reason behind this decision is due to:

NJOY is a company that has obtained the FDA's PMTA authorization for its products.

JUUL is currently embroiled in lawsuits with various states across the United States due to marketing violations. They are being compelled to pay substantial settlement fees. Additionally, the Food and Drug Administration (FDA) has previously rejected product applications from JUUL. In response, JUUL has taken legal action.

After its acquisition by Altria, NJOY will gain access to its existing network of 200,000 traditional tobacco sales channels, enabling NJOY to rapidly expand its market presence. If NJOY products can successfully integrate with Altria's distribution channels, there is a high possibility that NJOY could surpass JUUL to become the second-largest brand in the US e-cigarette market. This is precisely why JUUL has been consistently employing patents as weapons and repeatedly filing 337 investigation applications - a battle behind the scenes to seize a slice of the lucrative e-cigarette market.

Is the patent involved in this 337 investigation the "diamond cutter"?

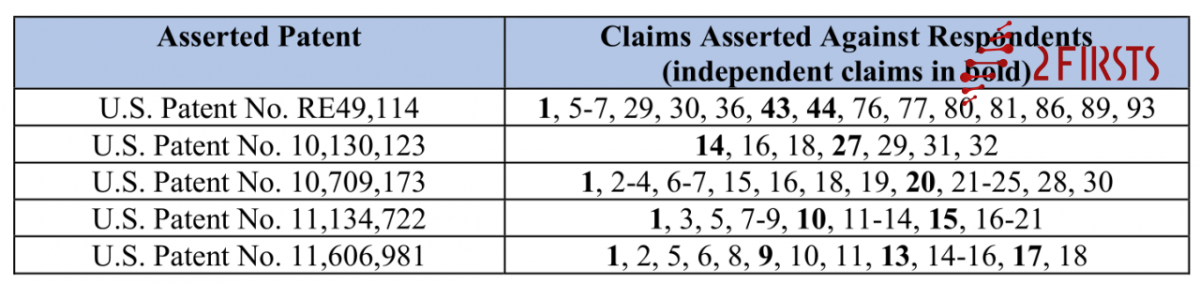

According to the application documents submitted by JUUL, it involves five US patents (namely: USRE49114E, US10130123B2, US10709173B2, US11134722B2, US11606981B2). The specific claims of rights that NJOY is accused of infringing are shown in the table below.

From the perspective of this group of patents, JUUL, which was abandoned by Altria, seems to be at a dead end. During the honeymoon period of cooperation with Altria, some important patents have already been acquired by Altria. Judging from the patents presented this time, the final ruling of the ITC is full of uncertainties, and NJOY, will naturally not give up the IPR procedure of patent invalidation declared by the US Patent and Trademark Office. The major tobacco companies are no strangers to patent litigation in the US market and are adept at handling them.

Why did JUUL join forces with VMR to bring this 337 investigation?

Is the 337 investigation from JUUL a patent infringement case or a strategy to delay their decline; wait for the product ban lawsuit to make a comeback and target NJOY to capture the market? From the content of the application documents, it appears that there is a lack of confidence.

In fact, VMR Corporation is a wholly-owned subsidiary of JUUL. Upon further investigation, it was found that JUUL is the patent holder for three patents (USRE49114E, US10130123B2, US10709173B2), while VMR Corporation is the patent holder for two patents (US11134722B2, US11606981B2). This helps explain why JUUL and VMR Corporation have jointly filed this 337 investigation request.

What claims are involved in this 337 investigation application?

JUUL seeks a limited exclusion order under 19 U.S.C. § 1337(d)(1) to prohibit the entry and importation into the United States, and/or sale in the United States after importation by or on behalf of Respondent, of any atomiser device, vape cartridges used in conjunction with such device, and components thereof, that infringes one or more of the asserted patents.

JUUL also seeks a permanent cease and desist order pursuant to 19 U.S.C. § 1337(f) prohibiting Respondent and its affiliates, subsidiaries, successors, or assigns from importing, selling for importation, marketing, demonstrating, distributing, repairing, refurbishing, offering for sale, selling after importation, or transferring (other than for export), including the shipment of inventory in the U.S. or soliciting U.S. agents, distributors or aiding and abetting other entities in the importation, sale for importation, sale after importation, or transfer (other than exportation) of atomiser devices, cartridges used in conjunction therewith, and components thereof, that infringe one or more of the asserted patents.

Pursuant to 19 U.S.C. § 1337(j), JUUL further requests that a bond be levied on infringing products already imported during the 60-day review period.

What are the technical points of alleged infringement in this 337 investigation application?

Due to space constraints, this article will only analyze the JUUL system (using patent US10709173B2 as an example) mentioned as a key point in the complaint.

The 337 investigation application states that the respondent has infringed on multiple claims of the patent, including claims 1, 2-4, 6-7, 15, 16, 18, 19, 20, 21-25, 28, and 30. Among these claims, only claims 1 and 20 are independent claims, with little distinction between them, while the remaining claims are dependent claims. Due to space constraints, this article will only analyze claim 1, which is translated as follows:

A device that includes:

- A cigarette cartridge comprising a mouthpiece, a storage chamber holding a vaporisable material and a heating chamber for heating the vaporisable material, said heating chamber is equipped with a resistive heating element, wherein the vaporisable material is heated to generate an aerosol, said aerosol comprising the vaporisable material and air passing through the path of the airflow; and

- A body comprising a container insertable to receive said smoke projectile, wherein said heating chamber is provided within the said container when the smoke projectile is inserted into said container and snapped into place with the container;

Wherein said airflow path comprises: an air intake channel, the first side of which is formed by an outer surface of said smoke cartridge and a second side of which is formed by the inner surface of said container, wherein said air intake channel is capable of delivering air into the heating chamber when the smoke cartridge is inserted into and snapped into said container; and

A fluid connector, said fluid connector being provided within said smoke cartridge for connecting said heating chamber to said mouthpiece.

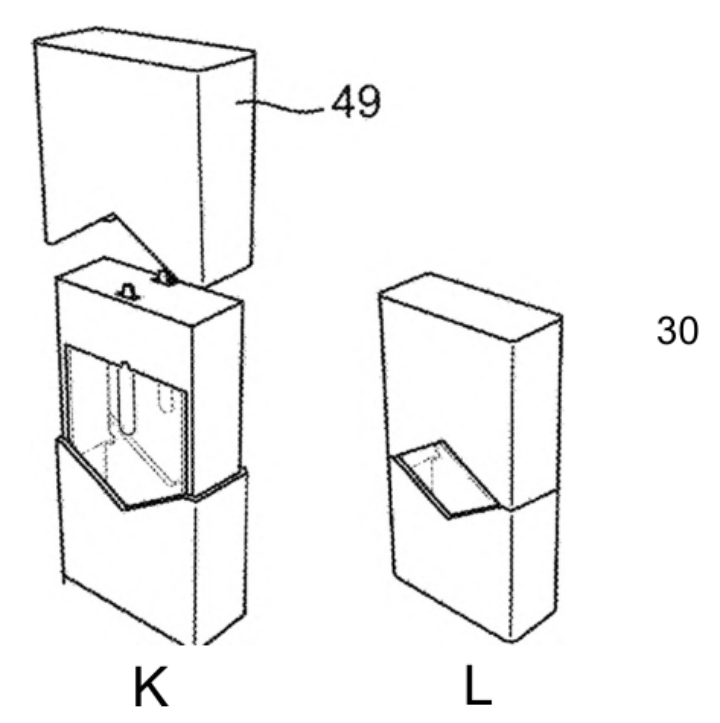

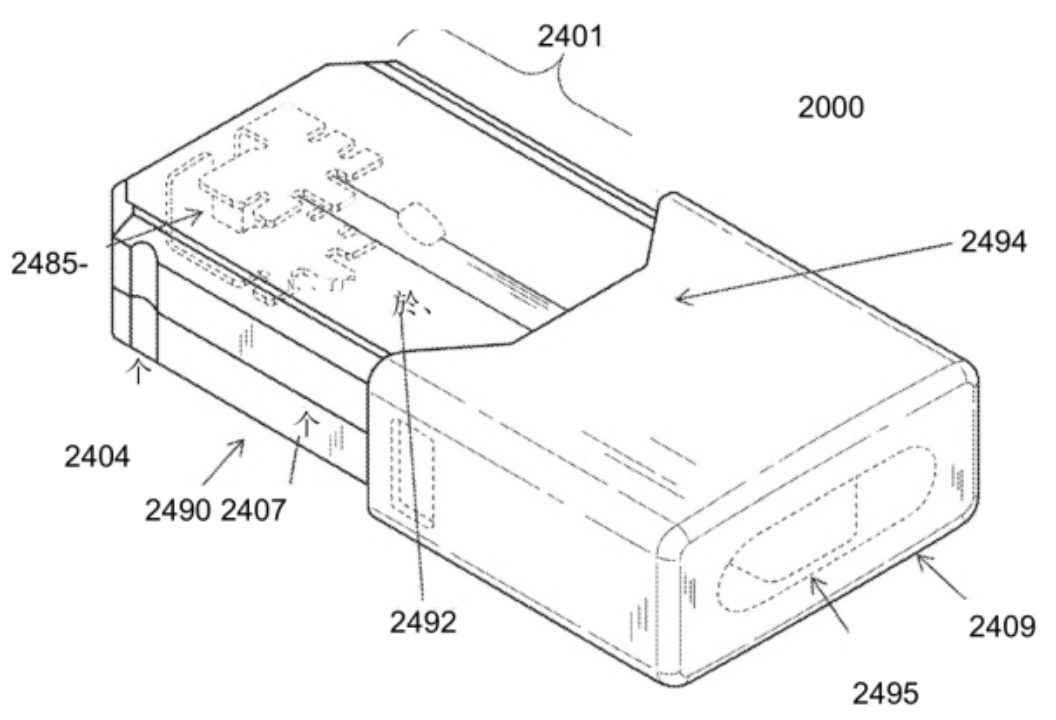

The following are some of the specifications accompanying drawings of the patent, as well as the physical drawings of the product referred to in the pleadings, in order to facilitate the reader's understanding of the technical points.

From the above claims and complaint documents, it appears that JUUL's allegations of technical comparisons are directed towards NJOY's pod and airflow passages. Claim 1 does not specify the specific location and connection methods of the components, instead describing the basic structure of the e-cigarette vaporizer using functional terms, especially the airflow passage. This wide scope of protection potentially exposes NJOY's product structure to the risk of patent infringement. However, simultaneously, due to the overly broad protection provided by claim 1, NJOY is also afforded an opportunity to file a partial invalidation application against this patent.

Conclusion:

Will the patent litigation for e-cigarettes and heat-not-burn tobacco come to a conclusion in the second half of 2023?

The outcome depends on the strategic focus of multinational tobacco companies. At the IQOS core patent sharing event on January 12th last year, experts predicted a weakening intensity of patent litigation in the heated tobacco product (HNB) sector. This was due to the strong market position of PMI company and the generational difference in ILUMA patents. PMI shifted its strategic focus towards untapped markets and employed price competition. Even without the threat of litigation, they hold a significant advantage in terms of commercial profit.

However, the landscape of electronic vaporizers is relatively complicated, with global regulatory governance becoming the most important setting from 2023 to 2025. Big companies' HNB products are being squeezed by PMI to compete and intensify the fragmentation, and competition in the electronic vaporizer market.

In a bid to seize more market share, e-cigarette brands may potentially trigger a fresh wave of patent litigation. E-cigarette companies in China will be confronted with the threat posed by overseas e-cigarette patent holders, as well as competition from industry peers launching patent lawsuits abroad.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.