On July 12th, Kunshan Kersen Technology Co., Ltd. (603626, hereinafter referred to as "Kersen Technology") issued a reply announcement to the information disclosure regulatory work letter regarding the 2023 annual report. Prior to this, the Shanghai Stock Exchange had issued a work letter requiring Kersen Technology to verify and respond to six specific issues. 2FIRSTS noted that in its response, Kersen Technology introduced the company's layout and current market performance in the HNB e-cigarette (heat-not-burn tobacco, HnB) business.

HNB structural components business is steadily developing.

According to reports, Kersen Technology has maintained a stable partnership with Technocom Systems Sdn. Bhd. since 2021, supplying them with HnB components. The transaction amount was 194.27 million yuan in 2021, 134.45 million yuan in 2022, and reached 136.46 million yuan in 2023.

According to reports, Technocom Systems Sdn. Bhd is a manufacturing company based in Malaysia that specializes in diodes, transistors, and similar semiconductor devices. It offers a full range of electronic manufacturing, original design manufacturing, and electronic manufacturing services.

It is worth noting that Flextronics Mechanical Marketing (L) Ltd was also one of the key HnB structural component customers for the company in 2021, with a transaction amount of 144,800,200 yuan. However, the company did not appear in the top five customer list for the company in 2022 and 2023.

Flextronics Mechanical Marketing (L) Ltd is a part of the Flextronics International Ltd group, which is a globally renowned provider of electronic manufacturing services (EMS) and original design manufacturing (ODM).

In terms of supply chain management, Jiangsu TELIANG New Material Technology Co., Ltd. is an important partner for HnB structural components, providing continuous production for the company's products from 2021 to 2023 through external processing. The transaction amounts were 55.37 million yuan in 2021, 84.05 million yuan in 2022, and 38.38 million yuan in 2023.

It is understood that Jiangsu Terri Bright New Materials Technology Co., Ltd. is located in Hudai Industrial Park, Wuxi, Jiangsu, with a total investment of 400 million RMB. The company's main business covers areas such as vacuum coating, surface treatment, mainly used in digital 3C electronic products, household appliances, white goods, automotive parts and other industries.

Vietnam's new factory will start operating in July.

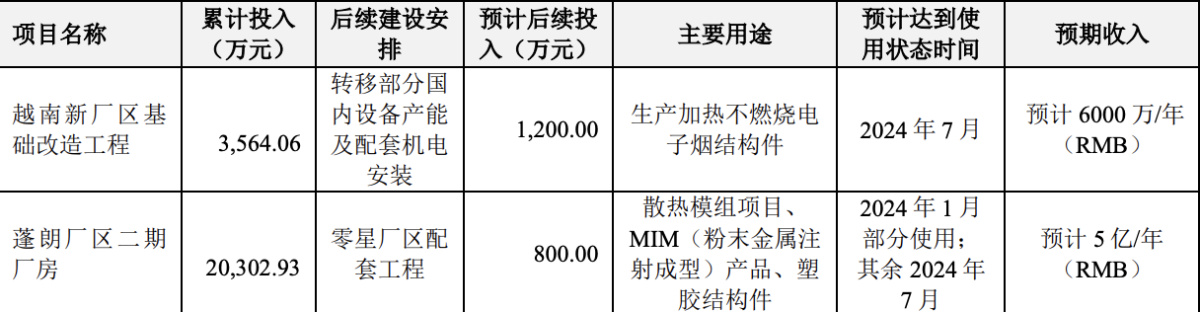

In April of this year, Kersen Technology mentioned in a report the progress of its factory in Vietnam. Kersen Technology stated that the Vietnam factory is a proactive effort by the company to step out in consideration of long-term industrial development trends. The Vietnam factory is expected to begin trial production in May 2024, with the first production project being HnB products.

In this report, it is stated that the factory is expected to commence operation in July 2024, with an estimated annual revenue of 60 million RMB.

Kersen Technology provided a rational explanation for investing in a factory in Vietnam, stating that the company currently has a significant proportion of its business overseas. For example, in 2023, overseas revenue was 16.68 billion, accounting for 64% of the total, with production capacity mainly concentrated domestically.

On one hand, the company can better expand and meet the diverse needs of overseas customers; on the other hand, the company's asset size, industry competitiveness, overseas market share, and overall risk resistance capacity can also be effectively enhanced, in line with the company's strategic planning.

The initial plan for the Vietnamese factory is to primarily produce the structural components of HNB e-cigarettes, as there is currently stable demand for these products in the market.

Intensified competition leads to a decrease in profit margin of 36.6 million yuan.

Despite steady business growth, Kersen Technology is also facing the challenge of intensified market competition. The report shows that in 2022 and 2023, due to increased market competition, customer price reductions led to a decrease in gross profit of 35.7 million yuan and 36.6 million yuan respectively for the HnB structural components business. In addition, the gross profit margin for overseas operations in 2023 decreased by 4.99 percentage points compared to the previous year, and equipment utilization rates decreased, leading to an increase in fixed cost expenses per unit of product.

In response to changes in the market, Kersen Technology has stated that they will actively adjust their strategy, attempt to develop new e-cigarette customers, and expand into businesses such as graphite heat dissipation modules in order to increase the utilization rate of their assets. They will continue to optimize their product structure and business layout to enhance their market competitiveness and profitability.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com