On the morning of July 20, 2023, at 9:00 AM Eastern Time, Philip Morris International held its second-quarter and first-half 2023 earnings conference, where they presented the performance results for the second quarter and first half of the year. 2FIRSTS closely monitored the entire conference and provided a summary.

2023 SECOND-QUARTER HIGHLIGHTS

|

| Second-Quarter | ||||||

|

|

|

| Change vs. Q2 2022 | ||||

|

| Amount |

| Reported |

| Adjusted | ||

Total Cig. & HTU Shipment Volume (units bn) |

| 188.4 |

| 3.3% |

|

|

| |

HTU Shipment Volume (units bn) |

| 31.4 |

| 26.6% |

|

|

| |

Oral Product Shipment Volume (mn cans) (1) |

| 197.4 |

| +100% |

| 13.8% | (2) | |

Net Revenues ($ bn) |

| $9.0 |

| 14.5% |

| 10.5% | (3) | |

Smoke-Free Product Net Revenues ($ bn) |

| $3.2 |

| 34.1% |

| 17.7% | (3) | |

-% of Total Net Revenues |

| 35.4% |

| 5.2pp |

|

|

| |

Operating Income ($ bn) |

| $2.6 |

| (16.0)% |

| 6.9% | (3) | |

Diluted Earnings per Share |

| $1.01 |

| (29.4)% |

|

|

| |

Adjusted Diluted Earnings per Share |

| $1.60 |

|

|

| 16.9% | (4) | |

(1) Excludes snuff, snuff leaf and U.S. chew | ||||||||

(2) On a pro forma basis (including Swedish Match in all periods) | ||||||||

(3) On an organic basis | ||||||||

(4) Excluding currency | ||||||||

- Reported net revenues up by 19.0%, excluding currency

- Pro forma (including Swedish Match in all periods) adjusted net revenue growth of 11.1%, excluding currency

- Combustible tobacco net revenue growth of 6.0%; growth of 7.4% on an organic basis, driven by pricing of over 9%

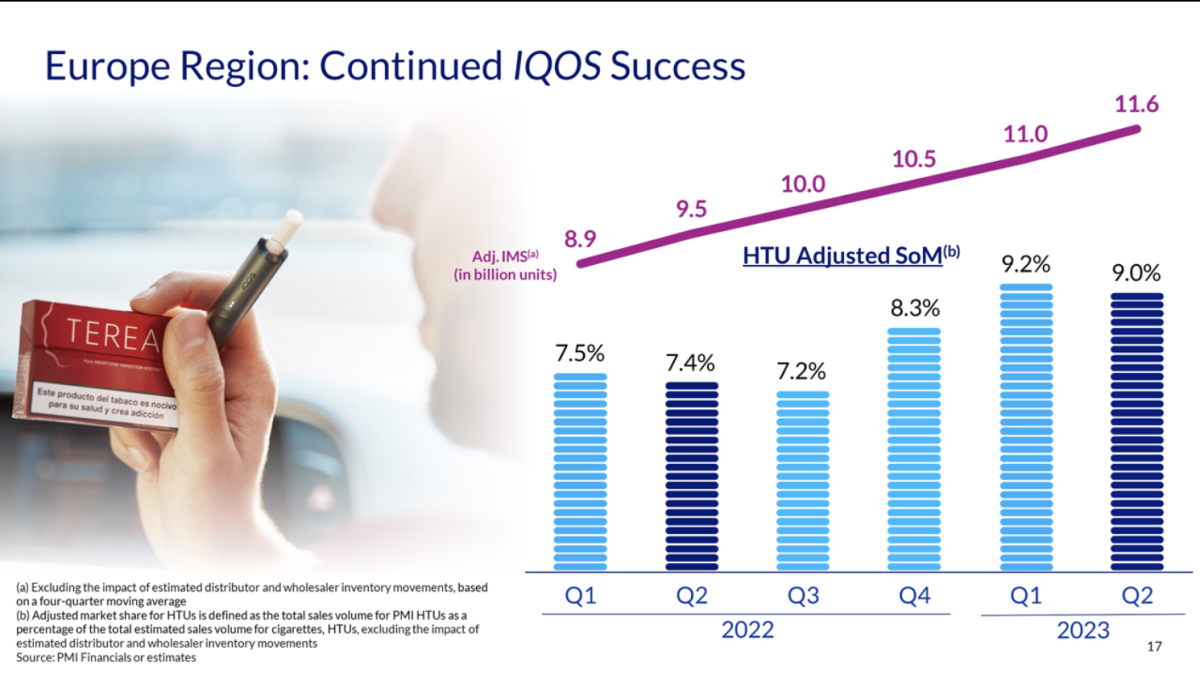

- Market share for HTUs in IQOS markets up by 1.6 points to 9.2%

- Adjusted in-market sales volume for HTUs, which excludes the net favorable impact of estimated distributor and wholesaler inventory movements, up by an estimated 16%

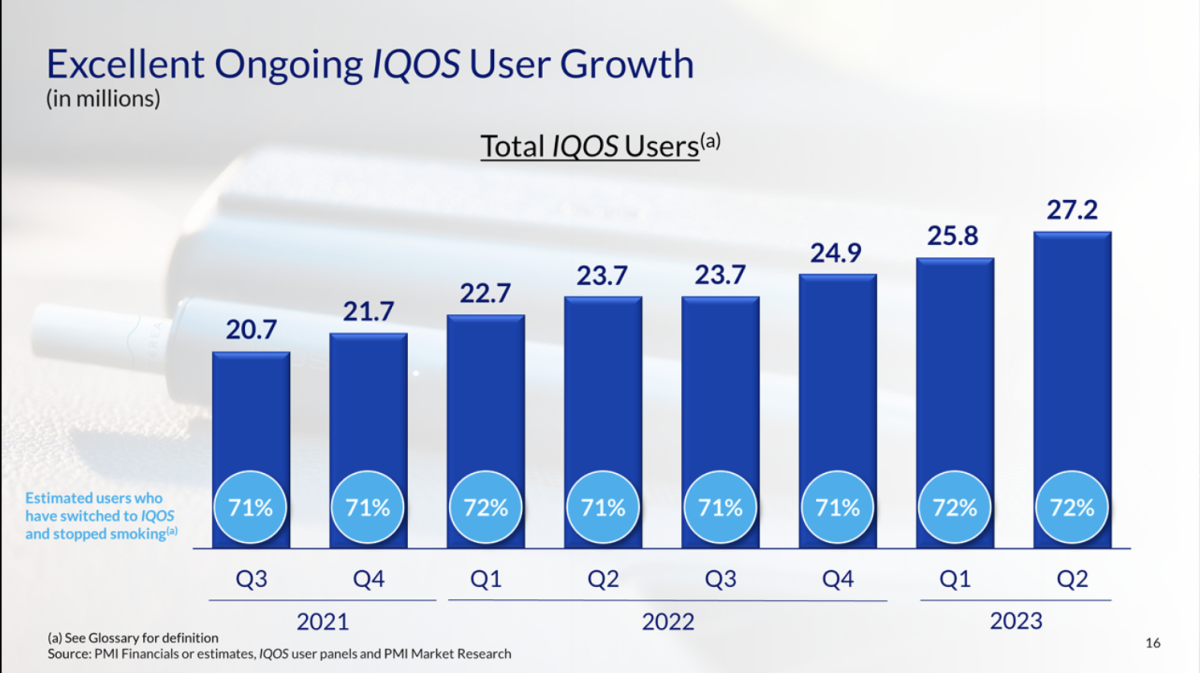

- Total IQOS users at quarter-end estimated at approximately 27.2 million (up by 1.4 million versus March 2023), of which approximately 19.4 million had switched to IQOS and stopped smoking

- ZYN nicotine pouch (NP) shipment volume in the U.S. of 89.9 million cans, representing growth of 53.1% versus second-quarter 2022 Swedish Match shipments of 58.7 million cans

- Declared regular quarterly dividend of $1.27 per share, or an annualized rate of $5.08 per share

2023 FULL-YEAR FORECAST

| Full-Year | |||||||||

| 2023 Forecast |

| 2022 |

| Growth | |||||

|

|

|

|

|

|

|

|

|

| |

Reported Diluted EPS | $5.36 | - | $5.45 |

| $ 5.81 |

|

|

|

| |

Adjustments: |

|

|

|

|

|

|

|

|

| |

Asset impairment and exit costs | 0.06 |

| — |

|

|

|

| |||

Termination of distribution arrangement in the Middle East | 0.04 |

| — |

|

|

|

| |||

Tax benefit associated with Swedish Match AB financing | (0.06) |

| (0.13) |

|

|

|

| |||

Impairment of goodwill and other intangibles | 0.44 |

| 0.06 |

|

|

|

| |||

Amortization of intangibles | 0.16 |

| 0.09 |

|

|

|

| |||

Costs associated with Swedish Match AB offer | — |

| 0.06 |

|

|

|

| |||

Charges related to the war in Ukraine | — |

| 0.08 |

|

|

|

| |||

Swedish Match AB acquisition accounting related item | 0.01 |

| 0.06 |

|

|

|

| |||

South Korea indirect tax charge | 0.11 |

|

|

|

|

|

| |||

Fair value adj. for equity security investments | 0.01 |

| (0.02) |

|

|

|

| |||

Tax items | — |

| (0.03) |

|

|

|

| |||

Total Adjustments | 0.77 |

| 0.17 |

|

|

|

| |||

Adjusted Diluted EPS | $6.13 | - | $6.22 |

| $ 5.98 |

|

|

|

| |

Less: Currency | (0.33) |

|

|

|

|

|

| |||

Adjusted Diluted EPS, excluding currency | $6.46 | - | $6.55 |

| $ 5.98 |

| 8.0% | - | 9.5% | |

2023 Full-Year Forecast Assumptions

This forecast assumes:

- An estimated total international industry volume decline for cigarettes and HTUs, excluding China and the U.S., of 0.5% to 1.5%;

- Total cigarette and HTU shipment volume growth for PMI of up to +1%;

- HTU shipment volume of 125 to 130 billion units, broadly in line with anticipated adjusted in-market sales volume and reflecting an acceleration in growth versus 2022;

- A cigarette shipment volume decline of approximately 1.5% to 2.5%;

- Net revenue growth of approximately 7.5% to 8.5% on an organic basis;

- Strong full-year performance for Swedish Match’s existing operations, underpinned by strong shipment volume growth for ZYN in the U.S.;

- An adjusted operating income margin decline of 50 to 150 basis points on an organic basis, with the decline likely toward the upper (150 basis point) end of the range, notably due to technical factors;

- Incremental investments to drive future growth, including the commercialization of ILUMA and around $150 million with a broadly even split between the U.S. and the Wellness and Healthcare segment;

- Wellness and Healthcare segment net revenues of around $300 million (including smoking cessation products), with an adjusted operating loss of around $150 million, primarily due to investments in research and development;

- No contribution from any potential favorable court ruling related to the legality of a supplemental tax surcharge on HTUs in Germany, which went into effect in 2022 (see PMI's first-quarter 2023 press release from April 20, 2023, for additional detail). PMI expects to have greater visibility on the likely outcome toward the end of this year;

- The contribution of the company's operations in Russia and Ukraine for the entire year;

- Full-year amortization and impairment of acquired intangibles of $0.60 per share, which includes amortization related to the Swedish Match acquisition based on preliminary purchase price allocation that may be subject to change;

- A full year’s net positive earnings contribution from Swedish Match including related interest expense, with Swedish Match included in PMI's organic performance as of November 11, 2023;

- Net financing costs of around $1.2 billion;

- An effective tax rate, excluding discrete tax events, of approximately 20.5% to 21.5%;

- Operating cash flow of $10 to $11 billion at prevailing exchange rates, subject to year-end working capital requirements;

- Capital expenditures of approximately $1.3 billion, partly reflecting increased investments behind smoke-free product manufacturing capacity, including for ILUMA consumables and Swedish Match's portfolio;

- No share repurchases in 2023;

- Third-quarter adjusted diluted EPS in a range of $1.60 to $1.65, including an unfavorable currency impact, at prevailing exchange rates, of $0.06 per share, notably reflecting HTU shipment volume of around 31 to 33 billion units and high-single-digit organic top-line growth;

- Strong second-half 2023 organic adjusted operating income growth that supports second-half adjusted operating income margin expansion on the same basis, with notably strong performance in the fourth quarter.

Factors described in the Forward-Looking and Cautionary Statements section of this release represent continuing risks to these projections.

Scientific Update

PMI has developed a product assessment program to provide scientific evidence for novel tobacco products that can potentially reduce disease risks. They received authorizations for IQOS and blade versions from the FDA and are planning to submit IQOS ILUMA for market authorization in the US.

Clinical trial results for an inhalable aspirin product showed variability in dose, requiring product design improvements.

PMI conducted time trend analysis studies on heated tobacco products, but due to inaccuracies in methodology and data presentation, they no longer rely on these studies. They have published over 500 scientific publications supporting tobacco harm reduction and have future scientific studies planned.

Reference: Philip Morris International Reports 2023 Second-Quarter and First-Half Results

*This article is an original article of 2FIRSTS Technology Co., Ltd. The copyright and license rights belong to the company. Any entity or individual shall make link and credit 2FIRSTS when taking actions to copy, reprint or distribute the original article. The company retains the right to pursue its legal responsibility.