On August 16th, RELX Technology (RLX Technology Inc.) (NYSE: RLX) released its unaudited financial report for the second quarter of 2024 (Q2).

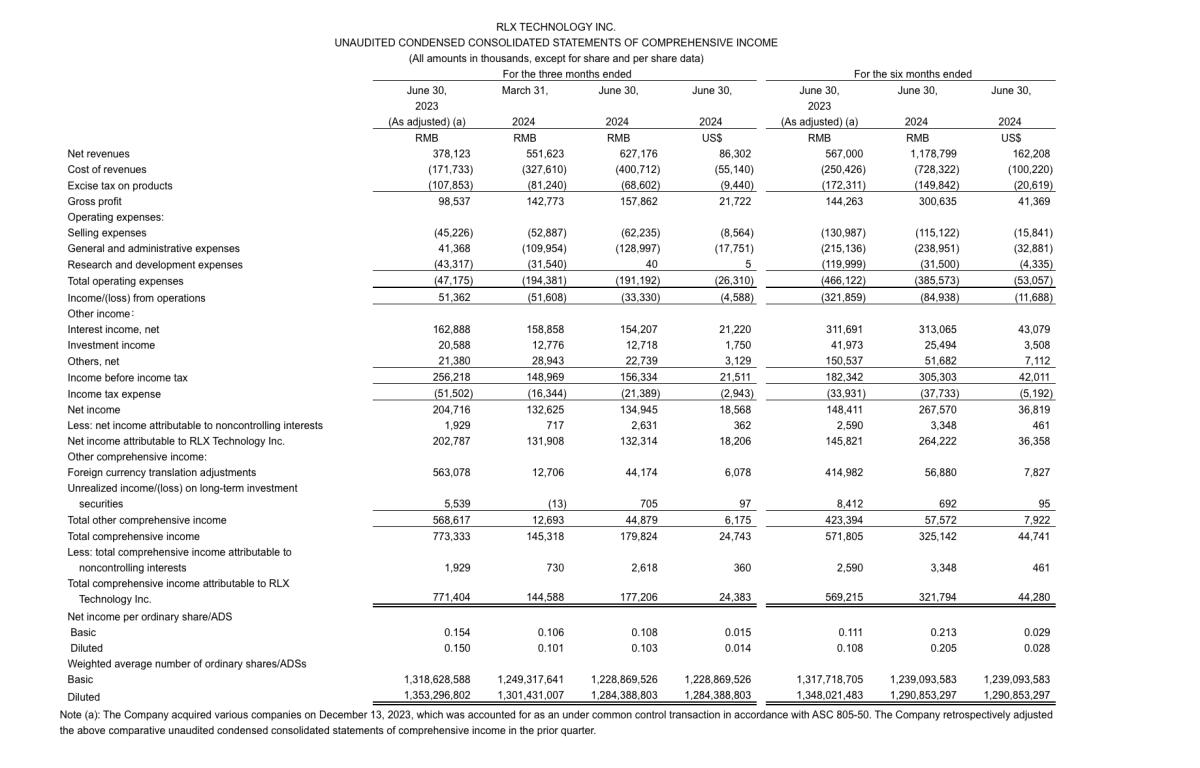

The financial report shows that RELX Technology's net revenue for the second quarter of 2024 was 627.2 million Chinese yuan (86.3 million US dollars), a 13.7% increase compared to the previous quarter and a 65.9% increase compared to the same period last year, mainly due to its international expansion. In terms of non-US GAAP, the adjusted net profit for the second quarter was 210 million Chinese yuan (29.32 million US dollars), a 2.7% increase quarter-on-quarter and a 147.1% increase year-on-year.

- In the second quarter of 2024, the main financial highlights are as follows: revenue was 1.579 billion RMB (217 million USD), compared to 98.5 million RMB in the same period in 2023;

- Operating expenses were 1.912 billion RMB (263 million USD), down from 472 million RMB in 2023;

- Sales expenses were 62.2 million RMB (8.6 million USD), up from 45.2 million RMB in 2023 mainly due to increased stock incentive expenses;

- Gross profit margin was 25.2%, down from 26.1% in 2023 primarily due to unfavorable changes in revenue structure;

- US GAAP net income was 1.349 billion RMB (186 million USD), compared to 2.047 billion RMB in 2023;

- Non-GAAP net income was 2.131 billion RMB (293 million USD), up from 86.2 million RMB in 2023;

- As of June 30, 2024, RELX Technology had total cash, restricted cash, short-term bank deposits, short-term investments, long-term bank deposits, and long-term investment securities totaling 149.3 billion RMB (20.5 billion USD).

RELX Technology Founder, Chairman, and CEO Kate Wang stated,

Our strong performance in the second quarter was mainly due to the continued expansion of our international business. With deep insights into the global e-cigarette market and extensive experience in regulatory compliance, we are able to tailor effective market entry strategies, maintaining a leading position amid rapidly changing global regulatory environments. We will continue to focus on product innovation, enhancing user experience, and increasing market share, while closely collaborating with local partners to launch more attractive products. As a trusted brand among adult smokers, we are committed to providing high-quality, compliant products and seizing growth opportunities in diverse global markets.

RELX Technology's CFO, Lu Chao, stated,

In the second quarter, we achieved a net income of 630 million yuan, an increase of 65.9% year-on-year, demonstrating our ability to seize growth opportunities in the international market. Through strict cost control, we have successfully improved the operating profit margin under non-US GAAP. We are committed to creating long-term stable value returns for shareholders. Looking ahead, we will continue to drive steady growth in international market revenue and continuously optimize operational efficiency to further enhance business performance and profitability.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com