Key points:

·Disposable products accelerate their retreat: In Scotland, disposable e-cigarettes were already showing a decline before the ban was implemented. After the ban took effect, they quickly exited the main channel, and the market share of 2ml small capacity pods jumped to 38.4%, making it the largest category.

·Large capacity and multi-functional products are accelerating penetration: In addition to small pods, the market share of 12ml large capacity devices and 4-in-1 combination products is continuously increasing. Consumers are shifting from disposable products to replaceable and rechargeable products.

·Price and promotions as main tools: Retailers guide consumers to complete product replacements through price comparisons and brand activation activities. Consumers show high stickiness to brand continuity and consistent taste.

·Illegal products remain active: Despite the ban being implemented, disposable e-cigarettes still account for 6.3% of total sales. Frontline retailers have reported that insufficient enforcement resources have led to the difficulty of eradicating illegal circulation.

【2Firsts News Flash】The British media outlet SLR cites the latest report from retail data consultancy firm Talysis, which analyzed the Scottish e-cigarette retail market. The data shows that disposable e-cigarettes, which used to dominate the Scottish market, were already declining before the ban was implemented and quickly exited mainstream channels once the policy took effect. Meanwhile, small capacity 2ml pod devices have surged in popularity and now hold the highest market share at 38.4%.

Meanwhile, high-capacity equipment and all-in-one packages are accelerating penetration, while retail terminals are guiding consumers to switch products through pricing and brand promotions. Despite the gradual establishment of a new order for compliant alternatives, illegal disposable products are still active in the market, and regulatory enforcement urgently needs to be strengthened.

This article outlines the changing trends in product categories and market share in the Scottish e-cigarette market following the impact of the ban.

A report has revealed that from January to May 2025, e-cigarettes accounted for 17.2% of total tobacco sales in Scotland, a decrease of 10.4% compared to the same period in 2024. This trend is consistent with the overall performance in the UK, where e-cigarettes made up 17.8% of total tobacco sales and saw a decrease of 10.8%.

However, following the implementation of the disposable e-cigarette ban, the decrease in Scotland was greater than in the southern region.

In the four weeks leading up to June 28, 2025, the market share of e-cigarettes in Scotland has dropped to 13.9%, a 33% decrease from the previous year. Talysis reports that the ban has had a relatively minimal impact on the entire UK, with market share falling to 15.2% and sales dropping by 26%.

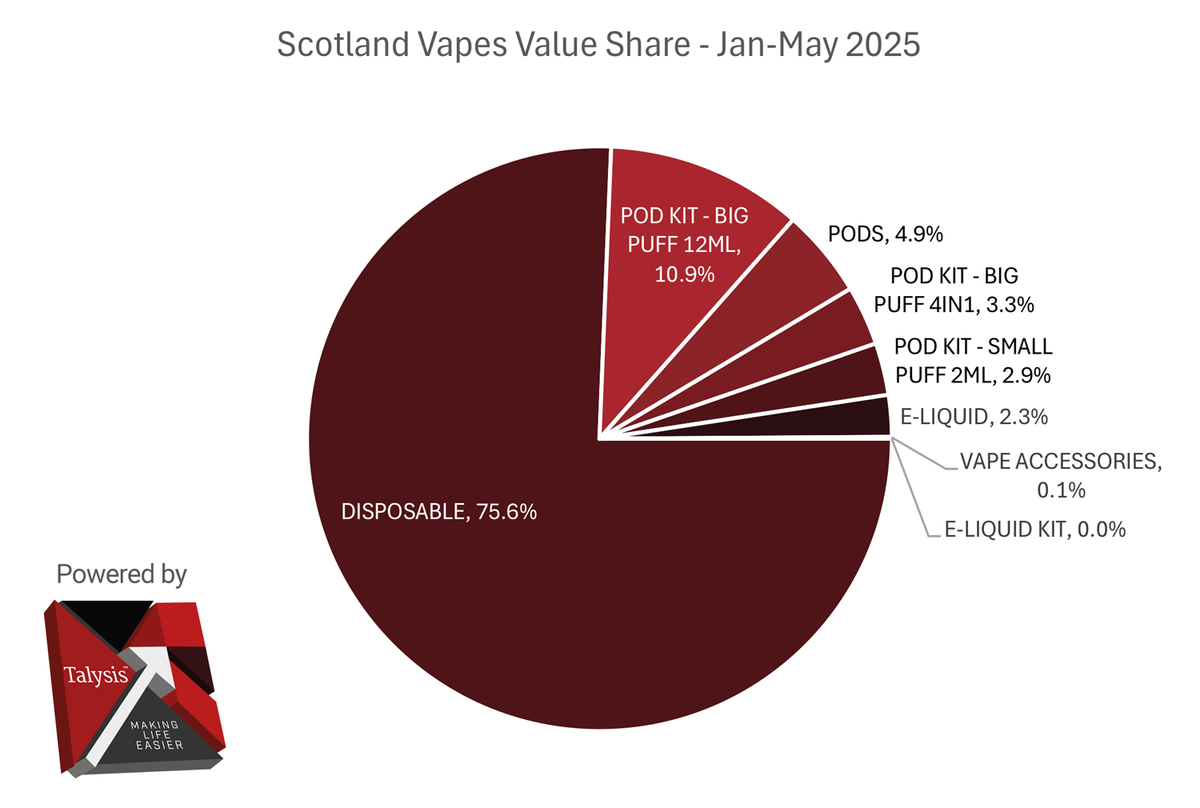

Before the ban went into effect, disposable e-cigarettes accounted for three quarters of Scotland's e-cigarette sales (as of May 2025), but sales have since dropped by 27% as manufacturers have shifted towards alternative products. The second largest subcategory is 12ml high-capacity pod kits, which make up 10.9% of sales.

In the following weeks, a completely different scene unfolded.

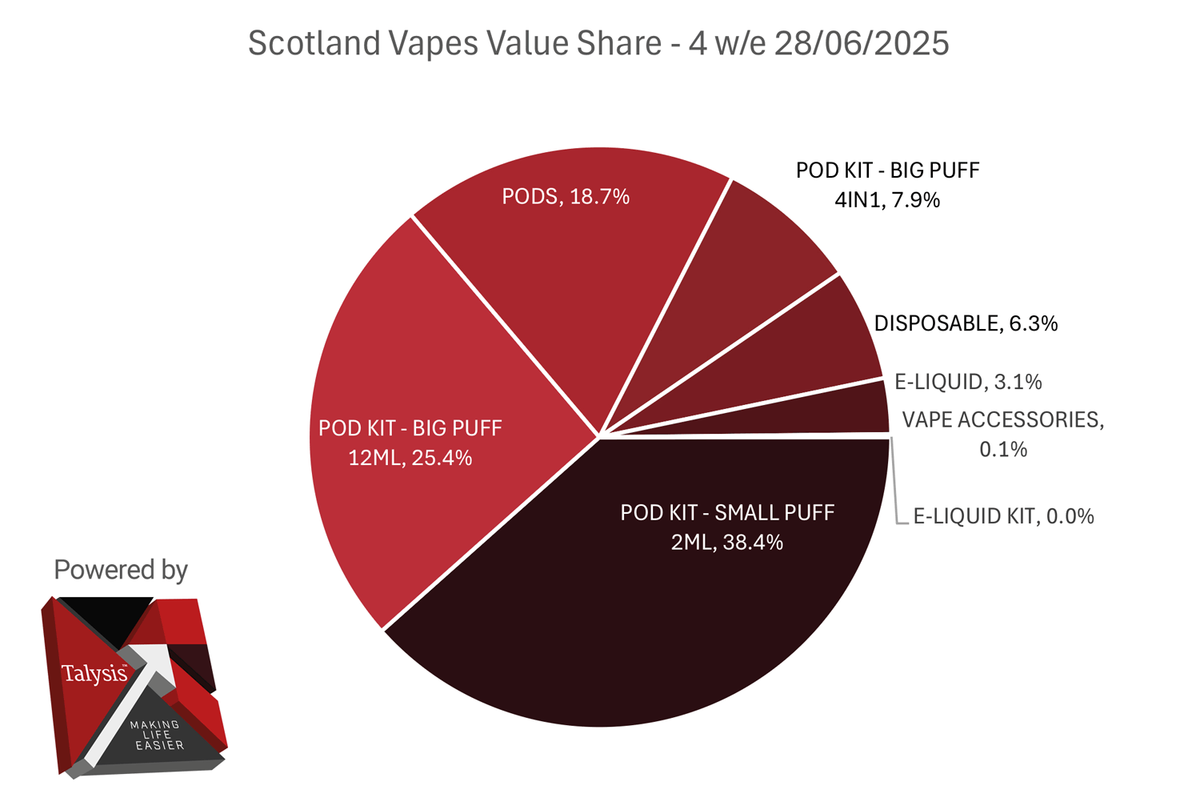

·In the latest data from the four-week period ending June 28, 2025, the 2ml small mouth count pod pack now dominates the market with a market share of over a third (38.4%).

·Coming in second is the 12ml large count pod pack with a market share of 25.4%. Pods are the third largest subcategory, with a market share of 18.7%, while the large count four-in-one pod pack holds 7.9% of the market.

“As the ban has only recently come into effect, it is still too early to fully determine its impact. However, it is certain that the convenience and wide range of flavors offered by electronic pods are leading to a rapid increase in their purchase and usage compared to disposable products.”

The market manager for the Empire brand in the UK, Andrew Malm, stated.

The owner of the convenience store chain "Racetrack", Guna Sud, believes that many consumers choose small-sized e-cigarettes because their concept is similar to disposable e-cigarettes.

“I think many customers are stubborn because they have previously used Crystal Bar, so they want to continue using the compliant version because they are familiar with its use, satisfied with the brand, and satisfied with the taste," he said.

However, in the long term, he expects the market to shift towards large-caliber cigarettes. "I believe the growth in new customers will come from large-caliber cigarettes. It's too cost-effective for customers. You can spend 5 pounds (about $7) to buy 600 cigarettes, whereas spend 10 pounds (about $13) to buy 10,000 cigarettes. It really requires marketing to customers, explaining the cost of switching cigarettes and the savings. We are trying to lower prices for customers to try through brand activation.

Concerning is that in the first four weeks following the ban, disposable e-cigarettes still accounted for 6.3% of total e-cigarette sales.

Malm said, "For those consumers who still do not know about the ban, how can they just tell at a glance that the product is illegal?

Some illegal sellers will tell consumers that only certain types of disposable e-cigarettes are illegal. These criminals will confuse consumers by disseminating counter-information, leading them to believe that these illegal products are compliant, so it is crucial to ensure that consumers understand the relevant regulations.

Gunar claims that it is easy to find retailers selling disposable e-cigarettes. "I can walk 200 yards to any nearby store and still find non-compliant products being sold. The ban was supposed to deploy over 100 Trading Standards officers in Glasgow on June 1st to crackdown on all illegal stock sales, but we have not seen this happening. I haven't heard of any investigations being carried out by Glasgow Trading Standards. I believe that retailers will continue to sell these products until they start investigating.

Further reading:

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com