Key points:

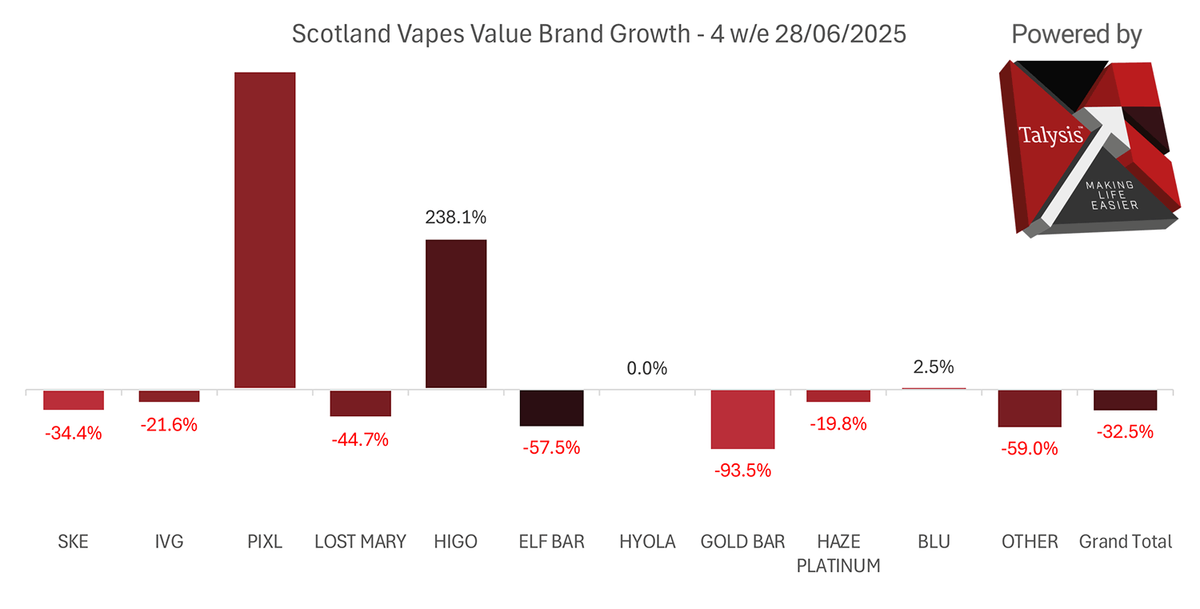

·Top brands are under pressure: According to data from Talysis, the top ten e-cigarette brands in Scotland occupy 93% of the market share, among which traditional strong brands like Elf Bar, Lost Mary, and SKE have seen significant declines in sales, with Gold Bar plummeting by 93.5%.

·Emerging brands rise: Pixl and Higo break through with rapid compliance response and market promotion, jumping to third and fifth place with market shares of 13.5% and 7.1% respectively; Alternative products such as Hyola and blu also show promising performance.

·Mainstream brands are promoting reusable products: Elfbar and Lost Mary have launched pre-filled pod versions, while Imperial Brands has introduced blu bar and blu box products to seize the compliant market, strengthening product diversity and user retention.

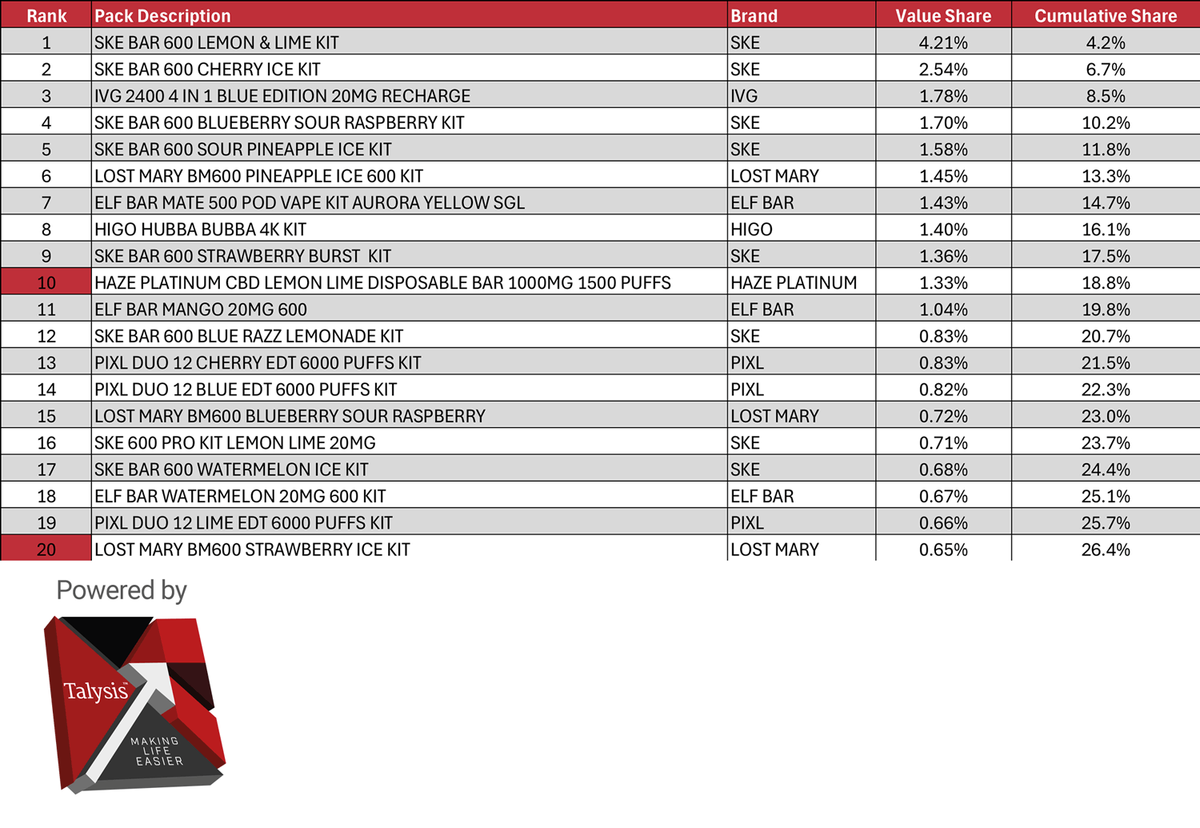

·Taste remains the core driving force: According to data from Talysis and brand partners, fruit and sweet flavors are still the most popular choices, with lemon lime, cherry, and watermelon among the top frequent choices.

【2Firsts News Flash】British media SLR cited the latest report from retail data consulting company Talysis, analyzing the Scottish e-cigarette retail market. The report stated that in the first month after the implementation of the disposable e-cigarette ban in Scotland, the market showed a clear trend of "brand reshuffling." This article summarizes the changes in the brand landscape of the Scottish e-cigarette market and the brand response strategies.

Data from Talysis shows that the top ten e-cigarette brands account for 93% of the market's sales value, but traditional strong brands are collectively under pressure: Elfbar plummeted by 57.5%, Lost Mary dropped by 44.7%, SKE declined by 34.4%, and Gold Bar fell by a staggering 93.5%. Meanwhile, emerging brands such as Pixl and Higo are rising strongly, while compliance alternative products like Hyola and blu are performing well.

Elfbar and Lost Mary have recently released reusable versions of their popular disposable devices. The Elfbar 600 pre-filled pod kit replaces the original Elfbar 600, while the Lost Mary BM600 pre-filled pod kit continues the BM600 line. Both products are rechargeable and can be used with pre-filled pods.

The company claims that the reusable Lost Mary BM6000 has quickly become a best-selling product in the high suction category and has been upgraded to meet the requirements of new regulations. Angelo Yang, Deputy General Manager of Elfbar UK, said: "Sales data shows that there is a continuous growth in demand for high suction devices, and the upgraded version ensures that retailers can continue to access one of the top-performing products in this category.

While some major e-cigarette brands have been impacted by the disposable e-cigarette ban, there are also new brands rising rapidly. Pixl, which debuted in June 2024, saw a remarkable growth in sales, capturing a 13.5% market share to become the third best-selling e-cigarette brand. Meanwhile, Higo surged by 238% to claim a 7.1% market share, landing in fifth place.

SKE is our best-selling product, followed by IVG, and then Pixl in third place. Both before and after the ban was implemented, we arranged for Pixl sales representatives to conduct promotional activities in the store, promoting products that comply with regulations. Higo has seen astonishing growth, with sales rapidly increasing. In the past two weeks, sales of one SKU from Higo have exceeded all other brands. Brands that are quickest to launch new devices often perform the best. For us, Lost Mary may be at the bottom. We are not heavily promoting Lost Mary and Elf Bar; our promotional efforts are primarily focused on other brands," said Guna Sud, owner of the Racetrack convenience chain store. She has been collaborating closely with multiple suppliers to conduct promotions in-store, where sales representatives can educate consumers on alternatives to disposable e-cigarettes.

Hyola is a brand known for this type of marketing strategy. The representative said, "Last week, we had Hyola products in our store and they were selling at half price. If they continue to sell sets at half price, then in the coming weeks, we will see a significant increase in sales of matching sets, which is why they are continuing to sell them.

Talysis pointed out that since the ban was implemented, Hyola has risen from 10th place to 7th place in the top ten brand rankings, with a market share of 2.5%.

As of May 2025, Gold Bar had a market share of 5.8%, but in the first month of the ban's implementation, its market share had dropped to just 1.5%. Gunaw, said, "Gold Bar has really lost its market here. They still have 600 cartons of cigarettes, but sales were already declining before the ban was implemented, and they have never introduced other (compliant) versions.

In the past four weeks leading up to June 28th, blu has climbed to tenth place with a market share of 1.2%.

Malm said, "Before the ban was implemented, many retailers had already decided to prioritize supplying compliant alternative products, such as our blu bar kit. The blu bar kit offers up to 1000 puffs per pod, providing consumers with a rechargeable, reusable e-cigarette device that can deliver the same flavor experience and convenience as existing disposable e-cigarettes preferred by consumers.

Imperial Brands stated that the success of the blu bar kit has also led to the introduction of another product, the blu box kit, catering to the one-quarter of disposable e-cigarette customers who prefer box-style e-cigarette devices.

Although many of his customers have already transitioned from disposable e-cigarettes, activation services have now become a core component of Racetrack e-cigarette replacements.

Guna said: "I believe we have not lost any e-cigarette customers. Our customer base may have only grown because of our advertising efforts, arranging for sales representatives to communicate with customers, and giving out free gifts. People come here now expecting to see strong promotional activities. But that's good, because it keeps them coming back to the store every week. They will try new products, but that means we have to work even harder to collaborate with brands to ensure we can also offer quality promotions. We need to keep our promotion lineup running smoothly, otherwise they may not come back.

Overall, Guna is pleased with the ban coming into effect and consumers adapting to the new normal.

Gunar said, "Setting aside the sales surge caused by panic buying in May, our sales actually increased by 5% compared to April. Now that the ban is in effect, we are much happier. We have more compliant equipment, and other brands are following suit, so we are feeling much better now. We are back to selecting and analyzing sales, seeing which products are underperforming and which ones can be replaced by others. Everything is back on track.

Looking at the SKU level, after the ban on disposable e-cigarettes, over a quarter of the value sales of the e-cigarette market in Scotland comes from the top 20 products. Among them, four out of the top five products are from SKE. Talysis research shows that lemon lime flavor is the most popular, followed by cherry flavor. These two flavors were also the most popular in disposable e-cigarette products as of May 2025.

Angelo Yang, Deputy General Manager of Elfbar UK, said, "Fruit flavors continue to be the most popular type among adult smokers and those trying to quit smoking. A recent study commissioned by Elfbar, conducted by Opinium in December 2024, with over 6,000 British adults, confirmed this — 68% of e-cigarette users stated that a wide range of flavors helped them reduce their smoking habits or quit tobacco altogether, with nearly 48% of users preferring fruit or other sweet flavors. In Scotland, the best-selling Elfbar flavors include watermelon, blueberry, and blueberry lemon. As for the Lost Mary brand, the top-performing flavors are pineapple ice, strawberry ice, and blueberry sour raspberry.

Considering that taste selection is a key factor for consumers when making a purchase, Empire Tobacco has recently launched a series of new flavors for the blu pod series.

These pods are compatible with the company's rechargeable blu devices. Each pack of two replaceable blu pods can provide consumers with up to 2000 puffs of rich flavor, available in a total of 15 flavors, including 11 new flavors such as strawberry ice, kiwi passion fruit, mint, and triple melon.

Related reading:

1.Scotland E-Cigarette Market Report (1): Sales Drop by 33% Year-on-Year, 2ml Pod Share Rises to 38.4%

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com