Key points:

·Market growth trends: Before and after the ban, sales of oral nicotine in Scotland have both increased significantly, with a 58% increase in May and a 51% increase after the ban, leading to market share rising from 1.1% to 1.3%.

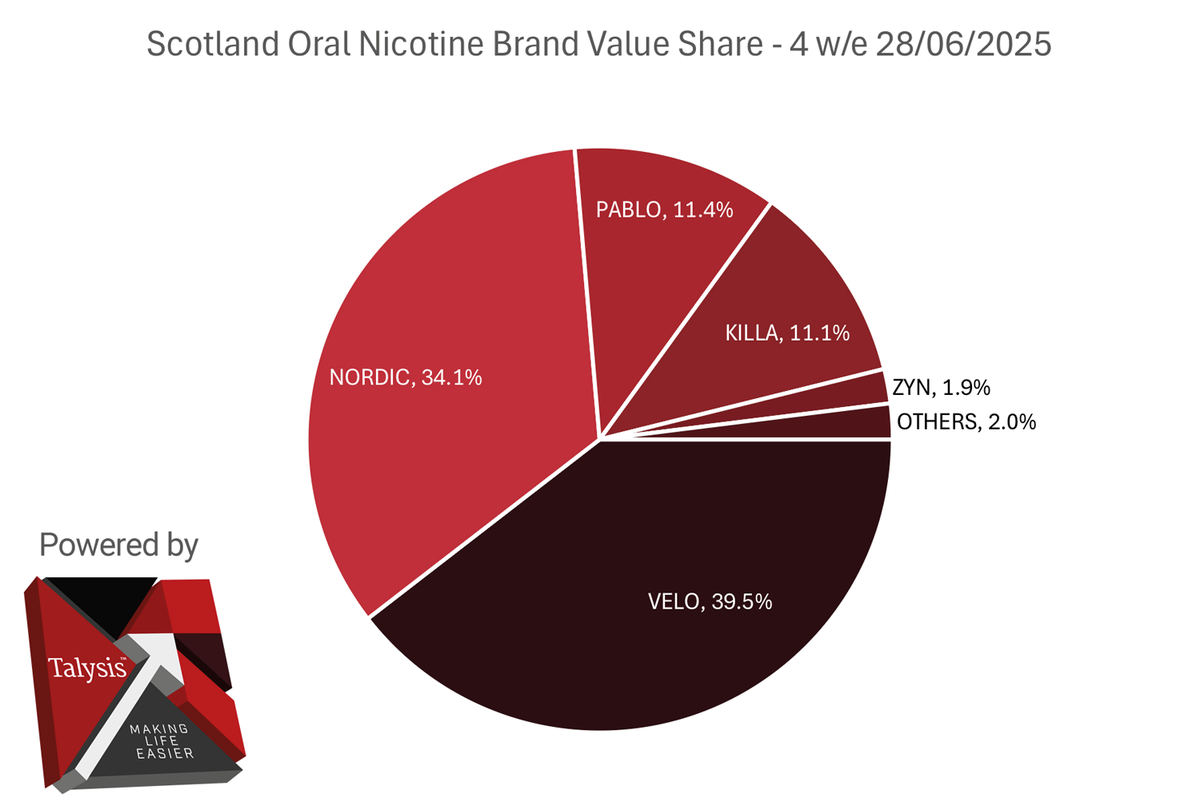

·Brand landscape: As of four weeks ending on June 28th, the top five brands were Velo (39.5%), Nordic (34.1%), Pablo (11.4%), Killa (11.1%), and Zyn (1.9%), accounting for 97% of sales.

·Overall performance in the UK: Total sales of nicotine pouches are close to £158 million (approximately $2 billion), with sales volume increasing by 71% year-on-year, convenience store channels showing the fastest growth, with sales nearly doubling over the past 12 months.

【2Firsts News Flash】The latest report from retail data consultancy firm Talysis, cited by UK media SLR, analyzed the Scottish e-cigarette retail market. The report shows that in the context of the disposable e-cigarette ban in Scotland, nicotine pouch products have become one of the fastest growing alternatives. This article examines the brand landscape in the Scottish nicotine pouch market.

According to reports, in the four weeks leading up to June 28, 2025, Velo was the top brand in terms of value share at 39.5%, followed by Nordic at 34.1%, Pablo in third place at 11.4%, Killa in fourth place at 11.1%, and Zyn at 1.9%.

The owner of Racetrack convenience chain store, Guna Sud, stated, "The sales of nicotine pouches are still growing for us. There were a few months where sales were stagnant, so I reached out to some brands like Killa and Pablo, who ran promotions in-store, such as buy two get one free, and gave out merchandise. This helped boost sales. I believe that due to the ban, we saw a significant increase in nicotine pouch sales from May to June. Pouch sales have increased by at least 10%. There are many brands selling nicotine pouches on the market, but we generally only stock them if there is demand from customers. For us, the main brands are Killa, Pablo, and Velo.

Prianka Jhingan, the UK marketing manager for Scandinavian Tobacco Group (STG), said, "Our latest data shows that total sales of nicotine pouches in the UK have reached nearly £158 million (approximately $200 million), with a year-on-year sales growth of 71%. Although more sales currently occur in the grocery channel, convenience stores have actually seen the fastest growth rate. In fact, our latest data shows that in the past 12 months, nicotine pouch sales in convenience stores have almost doubled. Our in-house brand XQS is performing particularly well in this channel, ranking as the fifth best-selling brand with significant further growth potential. Overall, nicotine pouches have a profitable profit margin, but I am pleased to confirm that XQS has one of the highest profit margins among all pouch brands, which is another reason to ensure adequate stocking. We believe that the ban on disposable e-cigarette products presents a great opportunity for nicotine pouch brands like XQS, as many new generation nicotine users are now seeking alternative products, and nicotine pouches provide a credible alternative. This is mainly because, unlike e-cigarettes, nicotine pouch users can use them on public transport, at work, at sports events, concerts, or anywhere they like.

In January 2025, Scandinavian Tobacco Group launched two new flavors for XQS: black cherry and citrus mint. Recently, they have added three more flavors: raspberry black currant, strawberry kiwi, and berry banana mix.

Talysis focuses on the analysis, interpretation, and application of retail sales data in the fast-moving consumer goods category. Currently, Talysis partners with retail and manufacturing giants in Ireland and the UK to help brand owners, retailers, and wholesalers make the most of their data and maximize sales. Talysis' customized data applications are its key strength, providing clients with actionable insights to help them make strategic decisions and interventions.

Further reading:

1.Scotland E-Cigarette Market Report (1): Sales Drop by 33% Year-on-Year, 2ml Pod Share Rises to 38.4%

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com