Special Statement

1.This article is an expert opinion submission, and 2FIRSTS has obtained the author’s authorization for publication.

2.The views expressed herein represent solely the author’s personal opinions and do not reflect the stance of 2FIRSTS.

3.2FIRSTS shares this article for the purpose of disseminating information and offering diverse perspectives. Readers are advised to exercise discretion when interpreting and citing the information and viewpoints contained herein.

Contributed by 聚菁荟萃. A long-time researcher in capital markets.

The English translation is for reference only. Please refer to the Chinese version as the authoritative text.

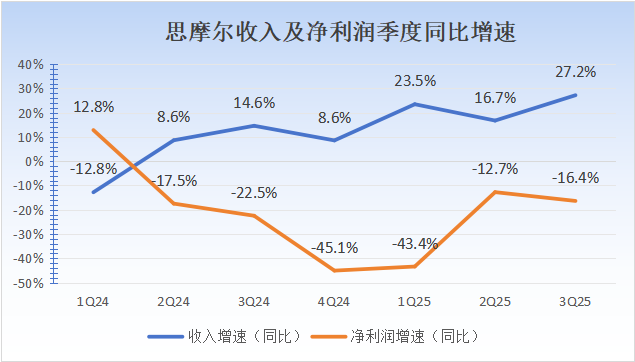

Smoore International announced its third-quarter operating results on Sunday, October 12, showing a profit growth rebound compared with the first half of the year.

In the third quarter of 2025, Smoore’s revenue surged by 27.2% year-on-year, while its adjusted profit (excluding the impact of share-based compensation) increased by 4.0%. This marks a clear improvement over the first half, when revenue rose 18.3% and adjusted profit declined 2.1%. On Monday’s market open, despite the Hang Seng Index falling 3.5% due to Donald Trump’s renewed tariff threats against China, Smoore’s stock rose 2.2% (as of midday), reflecting investor satisfaction with the company’s performance.

Investors’ main questions focus on two aspects:

Why did profits grow only slightly while revenue surged — did the company overspend or engage in low-margin business? Is its strategy sound?

How long will this “strong revenue but mild profit” trend last?

Falling Profit Margins: The Three-in-One Cause

Smoore’s revenue growth inflection point appeared in the second quarter of 2024, which was also when its profit turned downward. Considering inventory buildup ahead of shipments, that quarter coincided with Smoore beginning to supply new heated tobacco products to its major client, British American Tobacco (BAT).

Note: The net profit figures above are reported net profits and include the impact of non-cash share-based compensation.

The launch of this much-anticipated heated tobacco product caused Smoore’s profits to decline, not due to product failure, but as a necessary phase in market rollout.

An analogy can be drawn to printers — the printer itself is priced low, but once consumers adopt a model, they must keep buying the brand’s ink cartridges. The real profit lies in the consumables, not the device. Similarly, in the e-cigarette business, devices (vape kits) have low margins, while pods generate high margins.

During early market entry, the sales ratio of devices is typically high. Consumers first purchase starter kits (device + pods) and later transition to buying pods only. Over the past few quarters, Smoore entered new markets such as Serbia and Japan, likely selling large quantities of heated devices — a necessary upfront investment rather than profit contribution. Whether these users will stick with Smoore’s ecosystem depends on its ability to develop and retain them through future pod sales.

Atomization Products: Rapid Iteration Compresses Profit Margins

While stronger enforcement against illegal vapor products benefits legitimate players, the pace of product iteration in the vaping industry remains exceptionally fast — a constant race between regulation and innovation.

Since Q4 2024, to comply with European environmental standards, small-puff disposable vapes have been phased out, replaced by large-puff atomization products. These have greater capacity but lower prices. On a per-nicotine-unit basis, these new models are roughly 20–30% cheaper than previous products. This structural shift, which began in late 2024, has continued through 2025 and is reshaping the market, gradually transmitting margin pressure from retail to manufacturing. Consequently, Smoore’s profitability has also been affected.

Fourth-Quarter Profit Growth Expected to Rebound

Based on the above analysis, there are signs that profit margins may begin to recover. Although heated tobacco products will continue to influence margins as new markets open, the impact of atomization product transition should subside by Q4 2025, as the large-puff product switch will have been completed for a full year. Year-on-year comparisons will thus normalize, allowing for further profit improvement on top of the third-quarter rebound.

However, the vaping market remains highly dynamic, and several factors could once again widen the gap between revenue and profit growth — such as accelerated expansion of heated products into new markets, regulatory shifts in different countries, or intensified competition driven by new product iterations. These developments warrant close monitoring for their potential impact on Smoore’s stock performance.

Source: Originally published on WeChat 聚菁荟萃

Cover Image: Smoore International Official Website