By Ellesmere Zhu

A district-level state taxation administration held a lecture on the e-cigarette industry on November 7, 2022. The Bao’an branch of Shenzhen Tax Service is at the centre of China’s e-cigarette industry since most Chinese e-cigarette companies are based in this district and contribute to the tax revenue of the district.

Li Hanliang from the tax administration gave the lecture through a virtual classroom. Over 100 e-cigarette entrepreneurs attended the lecture. Li Hanliang retrospected the development of the Chinese e-cigarette regulatory policy, which at present regulates all tobacco (e-cigarette) companies including their downstream e-liquid and device manufacturers in the Chinese mainland.

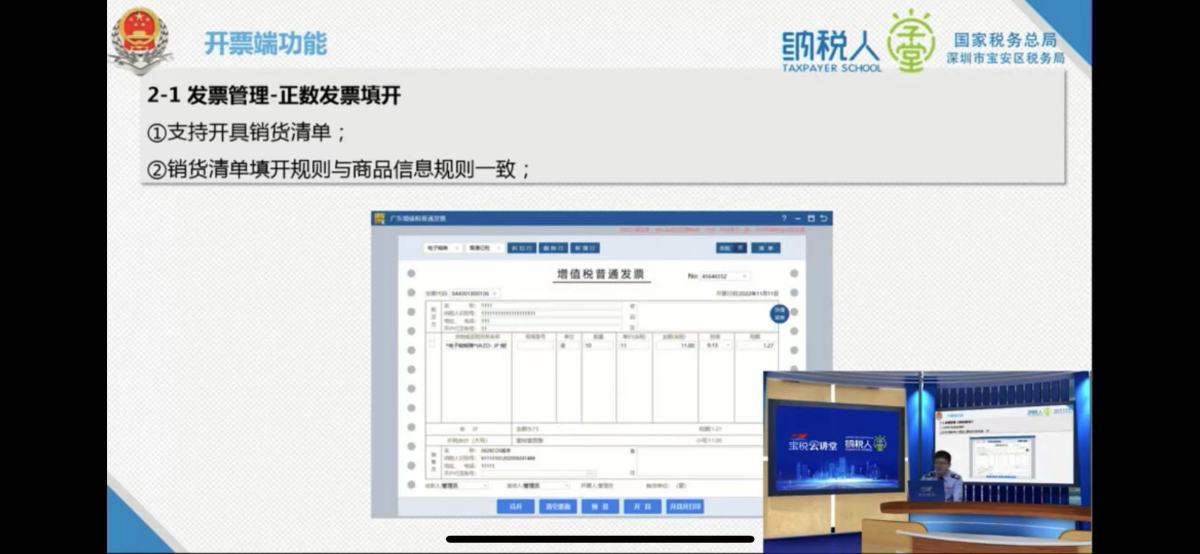

Screenshot of the virtual class

Li Hanliang noted that once the announcement of the e-cigarette consumption taxation policy is released, a lot of confusion and heated discussions were triggered, so the Administration felt obligated to inform and instruct all taxpayers in and out of the district to dispel any confusion.

Then Li elaborated on the policy by reiterating the significance of strengthening the regulation of e-cigarettes, protecting minors from e-cigarettes, and accelerating the improvement of the regulatory system, therefore the necessity of improving a fair and unified consumption tax system.

In general, the policy was designed in comparison to cigarettes, while taking into account the unique characteristics of e-cigarettes and determining the relevant tax elements, with specific provisions introduced in five parts as follows:

1. Tax items and objects of taxation

Electronic cigarettes are included in the scope of consumption tax collection. A subcategory is added for e-cigarettes under the cigarette tax heading.

The policy defines e-cigarettes as the electronic transmission system used to generate aerosols for inhaling, including vaping cartridges (pods), vaping devices, and both that are sold in bundles.

2. Taxpayers

The policy defines entities and individuals that produce, import and/or distribute e-cigarettes as the e-cigarette consumption tax taxpayers and enterprises with a production license or holding a trademark, authorized to use the license of another company as production. That said, OEM suppliers are excluded as taxpayers.

3. Applicable tax rate

The tax rate sets at 36% on production (import) and 11% on wholesale.

4. Taxed price

The taxed price has not accounted for VAT and fixed as per the definition of the taxpayer (see section 2. Taxpayers).

5. Export policy

Taxpayers who export electronic cigarettes are entitled to the export tax rebate (exemption) policy. However, the exemption policy does not mean export products are exempt from reporting.

Li demonstrating the SOP of declaration

To conclude, Li answered questions concerning import & export, manufacturing, and wholesale in the Q&A session.

Feel free to use it 2FIRSTS’ consumption tax calculator has come online.

For more information on the new consumption taxation policy, please go to the policy.

2FIRSTS will be following up on the new dynamics of the Chinese domestic market. Please stay tuned.

*This article is an original article of 2FIRSTS Technology Co., Ltd. The copyright and license rights belong to the company. Any entity or individual shall make link and credit 2FIRSTS when taking actions to copy, reprint or distribute the original article. The company retains the right to pursue its legal responsibility.