[Taco Tuinstra, 2Firsts, reporting from Argentina] Stakeholders in the global tobacco farming community gathered in San Salvador de Jujuy, Argentina, April 23-26, for the International Tobacco Growers Association’s (ITGA) Americas regional meeting. Hosted by the Cooperativa de Tabacaleros de Jujuy (CTJ), the event attracted about 50 delegates from key tobacco sourcing areas, including Argentina, Brazil, the United States and the Dominican Republic. Participants included not only farmer representatives, but also leaf buyers, market analysts and politicians, along with at least one cigar manufacturer. As a global media outlet focused on the tobacco and nicotine industry, 2Firsts was invited to attend the event. Taco Tuinstra, 2Firsts’ Editor-in-Chief, was present on site to conduct interviews and report on the proceedings.

In his welcome word, Juan Carlos Abud Robles, economic development and production minister of Jujuy Province, highlighted the significance of tobacco to his district. “Tobacco has long played a vital role in our region, creating jobs and accelerating the wheels of our economy,” he said. “For this reason, the provincial government remains committed to supporting tobacco production.”

Argentina is home to more than 16,000 tobacco farmers, who produce approximately 80 million kg annually, according to the ITGA. Leaf tobacco exports generate more than $224 million annually. In addition to Jujuy, which specializes in flue-cured Virginia (FCV), tobacco is cultivated in Salta Province (FCV) and Misiones Province, which focuses on burley.

Along with Brazil, Canada, Malawi, Zimbabwe and the United States, Argentina also was a founding member of the ITGA, which was established in 1984 to promote the shared interests of tobacco growers worldwide. Reiterating the group’s founding principles, ITGA President José Aranda, who hails from Argentina, stressed the need for stakeholders to work together to confront the many challenges facing the tobacco sector.

“I am proud to know that from my country we have worked to keep this organization strong and united,” he said. “I want to emphasize the importance of collaboration across the value chain because without it, the sector has no future.”

Market Updates

Like their colleagues throughout the nicotine value chain, tobacco farmers face considerable competitive and regulatory pressures. In addition to mounting compliance requirements, they must contend with rising production costs, thin profit margins and tight labor markets, along with shifting climate patterns.

Last year was a case in point, according to ITGA Research Manager Ivan Genov, who updated the Jujuy audience on the latest developments in key sourcing areas. Excluding China, global production FCV—the world’s most widely cultivated tobacco style—dropped from 1.95 billion kg in 2023 to 1.86 billion kg in 2024. The decline was driven by climate-related disruptions, including drought in Africa, excessive rainfall in Brazil and ill-timed hurricanes in the United States.

For 2025, Genov anticipates most tobacco-producing countries to increase production. Buyers have been encouraging farmers to plant more tobacco to help alleviate the lingering global leaf shortage. This development, he said, is already starting to depress prices, which had risen sharply in previous years.

Meanwhile, tobacco production in China, which cultivates tobacco primarily for its giant domestic market, grew from 1.75 billion kg in 2020 to 1.92 billion kg in 2024—almost all of it FCV. Accounting for half of global cigarette consumption, the nation has also been importing more tobacco following the lifting of lockdowns and resumption of international travel after the Covid-19 pandemic. Between 2020 and 2023, its tobacco imports jumped from about 90 million kg to more than 180 million kg.

China has been particularly active in Africa, where it accounts for at least half of the purchased quantities. According to Genov, Chinese tobacco companies have very specific leaf type requirements, and they pay among the highest prices. “This makes them a preferred buyer in many of the markets that ITGA covers,” said Genov, who also noted China’s growing interest in cigar tobacco—a development of particular interest for the Latin American ITGA members gathered in Jujuy.

Excessive rainfall in Brazil—the world’s largest exporter of leaf tobacco—resulted in a 2024 crop that, at 540.96 million kg of all types, was significantly smaller than in the previous seasons, pushing up prices and leaving buyers scrambling to secure their requirements. Thanks to better weather and a well-organized tobacco-growing sector (see interview with Afubra President Marcilio Drescher), Brazil is likely to produce significantly more tobacco this year. At nearly 700 million kg, Genov expects the country’s 2025 crop to be the largest since the late 2010s.

Tobacco farmers in the United States also lost volumes to adverse weather conditions in 2024, with hurricanes impacting production particularly in North Carolina, which produces most of the country’s FCV. Flue-cured volumes dropped from 142.26 million kg in 2023 to 104.6 million kg in 2024, according to preliminary data from the U.S. Department of Agriculture. American farmers must also cope with high cost of production, especially for labor, according to Genov. Some growers, he said, are experiencing difficulty finding workers at any price point. The pressures are likely to mount even further. With up to a third of its FCV tobacco destined for China, the U.S leaf tobacco sector is heavily exposed to the trade wars unleashed by the Trump administration.

Zimbabwe’s 2024 growing season was a mirror image of that in Brazil. While their South American counterparts scurried to save their leaf from saturated fields, growers in the southern African nation struggled to coax tobacco from parched earth. Last year’s drought, which caused the Zimbabwean government to declare a state of disaster, slashed the nation’s tobacco crop from 296.14 million kg in 2023 to 231.76 million kg in 2024. The outlook for this growing season is brighter: With more favorable weather conditions so far this year, observers expect Zimbabwe to harvest close to 300 million kg in 2025, nearly all of it FCV.

Dominated by smallholder production, Zimbabwe’s tobacco growing sector faces a unique set of challenges, including power shortages and exchange rate restrictions. Unreliable provision of electricity forces farmers to rely on expensive generators, while government rules allow growers to retain only a share of their earnings in hard currency, making it difficult to pay for agricultural inputs, most of which are imported.

Production in Malawi—a leading supplier of burley—has been steadily rising since hitting a weather-induced low of 70 million kg in 2022. Genov anticipates burley production to exceed 154 million kg in 2025, which is still short of requirements. The strong demand for burley, combined with the entry of new buyers into the Malawi market, has boosted competitiveness and will likely result in higher prices this marketing season.

Another market to watch, according to Genov, is Tanzania, which has been encouraging rapid growth of its tobacco sector. In 2020, the country produced 37.55 million kg of all leaf types. This year, it anticipates a whopping 223.64 million kg. The government considers tobacco a strategic crop and aims to surpass Zimbabwe as Africa’s largest tobacco exporter. It has backed its vision with massive investments in the tobacco sector. In August 2024, Tanzanian President Samia Suluhu Hassan laid the foundation stone for a $300 million cigarette factory in Morogoro.

A Tale of Resilience

While global demand continues to exceed supply, 2025 could be a turning point as multiple countries have been boosting production, according to Genov. The increased volumes, he noted, have already started impacting growers’ earnings, with average per-kg prices down in Zimbabwe, for example. At the same time, buying companies still have low levels of uncommitted stocks—around the 10 percent mark—suggesting continued appetite for tobacco.

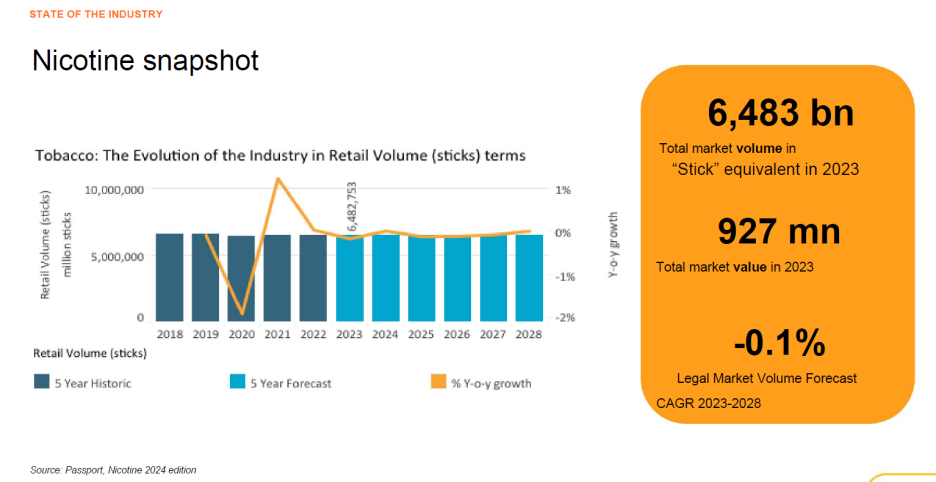

The enduring demand for leaf is driven by a remarkably resilient global market for nicotine products. Despite mounting restrictions, rising taxation and declining smoking prevalence in nearly every country, sales of nicotine products have been stable in recent years, with population growth offsetting declines in the share of people smoking. In 2023, consumers worldwide bought 6.48 trillion stick equivalents, valued at $927 million, through official retail channels—a volume virtually unchanged since 2018, according to Erwin Henriquez, global insights manager at Euromonitor International, who updated the ITGA audience on global nicotine trends. Between 2023 and 2028, Henriquez expects the legal volume to contract at a compound annual growth rate of -0.1 percent.

The global trend conceals significant regional differences. The Asia Pacific market, which accounts for the lion’s share of worldwide nicotine product sales, contracted slightly in 2023—a decline that would have been more pronounced without China, which dominates the region. Vapor and heated tobacco products (HTP) grew significantly in Europe, the Middle East, Africa and Latin America. In North America, by contrast, sales of e-cigarettes grew slowly, and there was only limited development in the HTP segment. Sales of nicotine pouches however skyrocketed in that market.

The global nicotine market continues to be dominated a handful of large players, including Philip Morris International, British American Tobacco, Japan Tobacco International, Altria Group, KT&G Corp., Imperial Brands, Eastern Co. and ITC. Between 2019 and 2023, the respective market shares of these players barely the budged. International brands such as Marlboro and Winson continued to dominate global sales outside of China, but in some regions faced formidable competition from local trademarks, such as Cleopatra (in the Middle East and Africa), and Gudang Garam (in Asia Pacific). HTPs featured in the Top 5 nicotine brands in Asia Pacific (Terea) and Eastern Europe (HEETS) in 2023, while North America’s five bestsellers include two smokeless brands—Copenhagen and Grizzly.

Worldwide, next-generation products (NGP) continue to gain popularity, but not enough to offset the loss in cigarette sales. The movement of users between the various nicotine products remains a complex network of interactions, according to Henriquez, with users not only switching from one product to another, but often also using multiple products side by side.

Like their colleagues on the farm, tobacco manufacturers face heavy pressures, including flavor restrictions, sustainability rules and generational bans, along with competition from illicit reduced-risk products. The decrease in prevalence and industry visibility contributes to the ‘denormalization’ of smoking, observed Henriquez, reinforcing the idea that smoking is undesirable and clearing the way for further restrictions.

Coping with COP

Picking up on the topic of regulation, Michiel Reerink, Alliance One International’s corporate affairs director and managing director, and ITGA CEO Mercedes Vasquez, shared their insights into the 11th Conference of the Parties (COP11) to the World Health Organization’s Framework Convention on Tobacco Control (FCTC), which will take place in Geneva Nov. 17-22 this year. It’s an event that warrants close scrutiny because the decisions taken at the COP tend to have profound implications on the nicotine business, impacting not only manufacturers but every part of the supply chain, including farmers. Major policies, such as plain packaging and flavor restrictions, were floated at the COP before they were adopted by leading markets.

At the time of the ITGA gathering, the FCTC had 183 parties, but several prominent members of the international community, including the United States (the world’s most lucrative nicotine market), Indonesia (the world’s second-largest tobacco market by volume), Switzerland (home to major tobacco multinationals) and Argentina, had failed to ratify the treaty. Malawi, the world’s most tobacco-dependent economy, joined in 2023.

The FCTC aims to “protect present and future generations form the devastating health, social, environmental and economic consequences of tobacco consumption and exposure to tobacco smoke.” Rather than mandating laws directly, the treaty sets a minimum legislative framework, which member states then translate into national legislation.

From the tobacco growers’ perspective, three FCTC articles are of particular significance: Article 5.3, which aims to protect tobacco control policies from the tobacco industry’s commercial and other vested interests; Article 17, which promotes “economically viable alternatives”; and Article 18, which calls for protection of the environment.

According to Reerink, Article 5.3 is often incorrectly applied to prevent interactions with the industry, to ban corporate social responsibility or ESG activities and to screen or exclude non-health delegates from COP, as ITGA representatives experienced during the most recent gathering of the FCTC parties in Panama last November.

Meanwhile, finding the economically viable alternatives to tobacco production described in Article 17 is more challenging than proponents suggest, according to Reerink. The supply chains for other crops are often less developed than the tobacco supply chain, which includes well-organized extension services and a ready market to absorb the product. For example, while soybeans or corn may be suitable for tobacco-growing regions, these crops receive heavy subsidies in the international markets, which affects the ability of smaller countries to compete on quality and price. As Reerink noted, if a viable alternative to tobacco existed, farmers would need no regulatory prodding; they would have switched to it on their own accord.

As far as environmental protections are concerned, the tobacco growing industry is doing better than it is given credit for. For example, Brazilian farmers are self-sufficient in curing energy, sourcing wood from dedicated plantations rather than indigenous trees, according to Afubra. Buyers, meanwhile, tend to have strict rules on the type of agrochemicals that may be used.

ITGA vowed to remain vigilant and united in defense of its members. Despite the COP’s resistance to tobacco grower participation in its debates, the group is determined to raise its voice again when the parties meet in Geneva. Multiple participants in Jujuy meeting stressed the importance of speaking up for tobacco at a time when few others are willing to do so. In this context, Aranda expressed bafflement of the position of Brazil, which despite earning some $3 billion from leaf exports in 2024, has been one of the most vocal anti-tobacco voices at COP.

"Let us not underestimate the power of the anti-tobacco narrative,” said Reerink. “It is increasingly shaping public opinion—often without solid evidence to back it. If we fail to actively engage and respond to what is being said about our sector, that narrative risks becoming accepted as truth by the broader public.”

Cover photo:The ITGA Americas meeting brought together grower representatives from prominent tobacco sourcing areas | Image courtesy of ITGA

Click to read the ITGA special report: