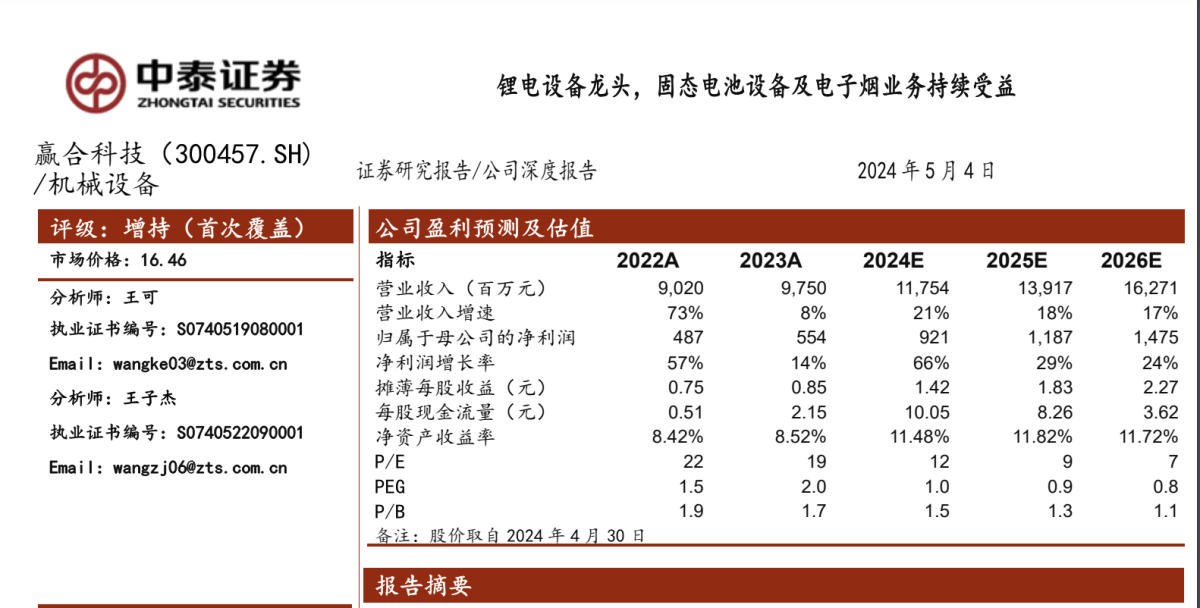

On May 4th, Zhongtai Securities conducted research on Yinghe Technology (300457) and released a research report titled "Leading in Lithium Battery Equipment, Solid State Battery Equipment, and Continued Benefits in the e-cigarette Business." The report recommended a buy rating for Yinghe Technology (300457).

2FIRSTS compiled the following information based on the original article.

Yinghe Technology's ODM business for e-cigarettes is expected to become the company's second growth trend. The e-cigarette business primarily focuses on brand services, providing customers with e-cigarettes, pods, vaporizers, and other e-cigarette accessories. In 2023, Yinghe Technology's e-cigarette business achieved rapid growth, with operating income reaching 3.341 billion yuan (470 Million USD), accounting for 34% of the company's total operating income.

The e-cigarette products offered by Sikary's subsidiary have gained wide popularity among European users due to their rich flavors and high quality. Particularly, the SKE brand has shown outstanding performance in the UK market, with its market share continuously soaring. Sikary has achieved groundbreaking developments in its brand operations in the UK and other European countries. By August 2023, SKE's market share in the UK had risen to third place.

Yinghe Technology has over 5000 employees and has established a branch factory in Shajing, with a manufacturing base of over 20,000 square meters, ensuring high-quality product output with a monthly shipment volume of over 20 million units. On September 21, 2022, the company's subsidiary e-cigarette company, Sikary, obtained a tobacco monopoly production enterprise license, which will help seize industrial development opportunities and further expand and layout the new tobacco market both domestically and overseas.

The company is actively expanding into overseas markets, especially in the UK where it has established a wholly-owned subsidiary to expedite the TPD certification of new products and increase market share.

Although the e-cigarette industry is rapidly growing, the company has also highlighted potential policy risks, as the new tobacco industry is still in its early stages of development and policy changes domestically and internationally may impact business growth.

Yinghe Technology receives its first "buy" rating, with expectations of continued growth in net profits in the coming years, benefiting from developments in new technologies and expansion into overseas markets.

In summary, Zhongtai Securities stated that Yinghe Technology's e-cigarette business has gained a foothold in the global market through continuous product innovation and market expansion, demonstrating good market competitiveness and growth potential. At the same time, the company is actively addressing potential policy and market risks to maintain the sustainable and healthy development of its business.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com