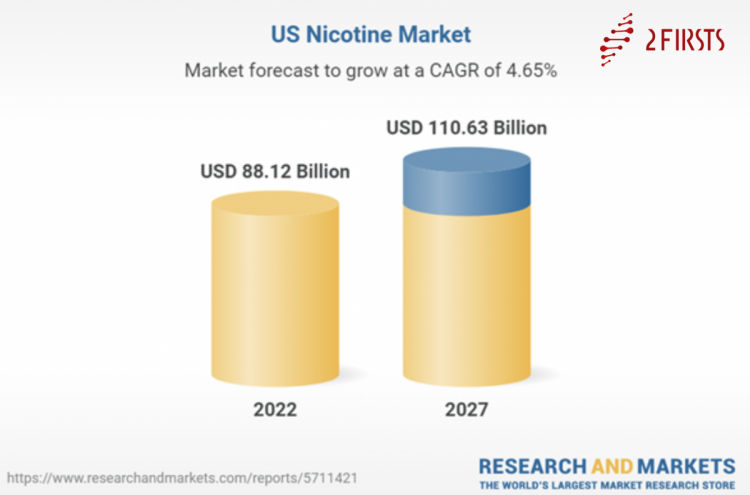

On January 6th, renowned market research firm, Research and Markets, released their 2022-2027 market report and forecast for the United States. The report revealed that the tobacco market in the US is expected to reach a size of $88.12 billion in 2022. In contrast, according to data published by Hunan Beizheshi Information Consulting Co. Ltd., China's cigarette market is projected to reach RMB 491.256 billion ($71.83 billion) that same year.

Source: Research and Markets.

Market Segmentation: By Product: According to this report, the market is divided into five segments based on product: cigarettes, e-cigarette products, moist snuff tobacco (MST), cigars and cigarillos, and nicotine pouches. By 2021, cigarettes hold the largest share of the market in both value and quantity, followed by e-cigarette products. As people become increasingly aware that e-cigarette products are safer than traditional cigarettes, particularly among young people, the future of the e-cigarette market looks promising. On the other hand, due to growing interest in alternative products, the nicotine pouch market is expected to grow significantly in the coming years with a compound annual growth rate. By Distribution Channel: According to this report, the market is divided into two segments based on distribution channel: offline and online. In 2021, the offline segment holds the majority share of the market. Small and large companies sell their products through offline retail channels due to the presence of large consumer groups such as grocery stores. Online channels are expected to achieve the highest compound annual growth rates in the predicted years due to increased advertising and promotion expenses by major players operating in the market, thereby bringing significant growth to this segment in the coming years.

Market trends: Growth drivers: One of the most important factors impacting the nicotine market in the United States is the increase in the number of smokers and the growth of the workforce. As lifestyles become centered around work and offices, the stress and anxiety levels of workers are increasing, causing an increase in the consumption of stress-relieving agents such as nicotine. Additionally, factors such as personal income increases, the popularity of e-cigarettes, a shift towards next-generation products, peer influence among young people, and increased investment in research and development have led to the market's growth over the past few years. Challenges: However, the market has been facing specific challenges such as strict regulations, increased taxation on tobacco products, and the harmful effects of nicotine. Trends: Due to various new trends such as the increasing influence of social media, the growing influence of parties and popular culture, the strong penetration of organized retail networks, and the popularity of smoke-free alternatives, the market is expected to rapidly grow for nicotine products such as oral nicotine during the forecast period. Party and bar culture is increasingly popular among the millennial and working-class communities, especially stimulating demand for flavored and unflavored cigarettes. Additionally, social media is being used more and more to increase awareness of the health benefits of transitioning from combustible smoking to e-cigarettes and vapor products. This has heightened personal accessibility to different brands, thereby increasing demand for non-combustible nicotine products.

Competition Landscape:

Due to a relatively small number of market players, the nicotine market in the United States is concentrated. Altria is the market leader in tobacco products and dominates the entire nicotine industry.

The main participants in the American nicotine market are:

British American Tobacco P.L.C. (BAT), Turning Point Brands Inc., Altria Group Inc. (Altria), Scandinavian Tobacco Group, Imperial Brands PLC, Philip Morris International Inc. (PMI), Swedish Match AB, JUUL Labs, Inc., Swisher, and Vector Group Ltd. are all major players in the tobacco industry.

Altria is the leading company in the United States market for tobacco and moist snuff products. However, its share is expected to decrease in the coming years due to the unfavorable shift towards niche markets, such as e-cigarettes, that are below Altria's index, as well as some losses in the tobacco and moist snuff markets. The share and market leadership of e-cigarettes have been rapidly changing, with JUUL's leadership since 2019 being replaced by BAT's VUSE. Meanwhile, although JUUL's share in the US e-cigarette market is expected to decline, its market value share is predicted to increase by 2025.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.