Disclaimer: 1. This article is limited to industry research and is only for the exchange of professionals within the industry. 2. This article does not involve any investment forecasts or recommendations, nor does it involve comments on the capital market. 3. Due to the author's professional ability, the data and analysis in this article should not be used as a basis for any decision. All data and information should be based on the public data and announcements of relevant companies.

Editor's note: On August 19, Smoore International (06969.HK) released its 2024 first-half performance report. Prior to this, 2FIRSTS conducted a simple data analysis of the report (for more details, see: Data analysis| Smoore interim financial report: Sales revenue has decreased for two consecutive years, pod system sales in European and other markets have increased against the trend by 22.5%). The following is a more detailed feature analysis of the report by 2FIRSTS.

Smoore's performance report for the first half of 2024 shows that the group achieved sales revenue of approximately RMB 5,037,242 million during the reporting period, a decrease of about 1.7% year-on-year. Gross profit was RMB 1,914,597 million, an increase of 3.2% year-on-year, and net profit for the period was RMB 683,198 million, a decrease of 4.8% year-on-year. The following are the key points identified by 2FIRSTS based on the content of Smoore's financial report.

Sales revenue has decreased year-on-year for the past two years.

According to a comparison of Smoore's mid-year reports for 2023 and 2024, it was found that the company's year-on-year sales revenue has decreased for two consecutive years, with a decline of 9.4% and 1.7%, respectively.

The company's revenue structure has changed, with the proportion of revenue from proprietary brand business increasing from 12.7% to 22.1%.

One of the highlights of Smoore's mid-year report for 2024 is the rapid growth of its own brand. Compared to the same period in 2023, the company's sales revenue from its own brand business increased from RMB 648,852 thousand to 1,115,607 thousand, a year-on-year growth of 71.9%. The proportion of this business also increased from 12.7% to 22.1%, indicating a shift in Smoore's revenue structure and a continuous expansion of its own brand business.

Europe and other markets: The growth of pod systems is struggling to make up for the decline in disposable e-cigarettes.

Due to changes in European regulatory policies, sales of traditional disposable e-cigarettes are declining, with consumers transitioning towards refillable or open system products. According to a report from Smoore, sales revenue from enterprise clients in Europe and other markets is declining, with a 16% year-on-year decrease. The proportion of revenue from these clients has decreased from approximately 45.9% in the same period last year to about 39.3% in the current period under review.

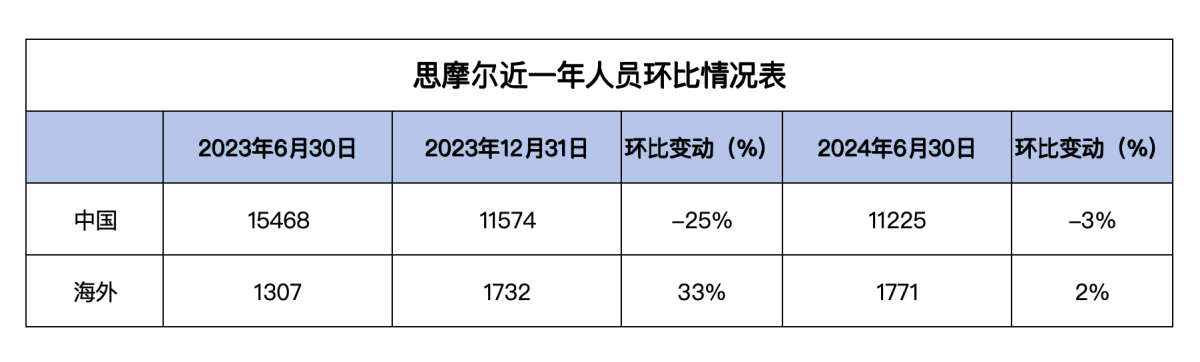

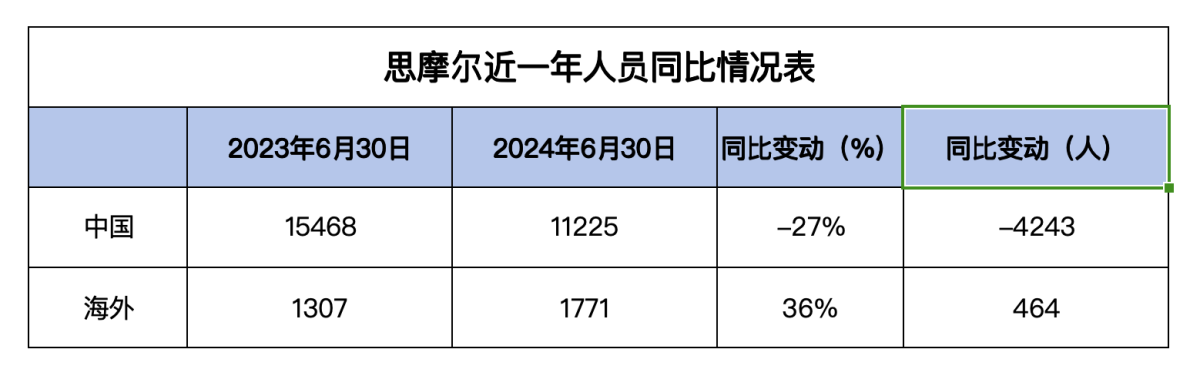

The number of employees in China decreased by 4243, a 27% decrease year-on-year, while the number of overseas employees increased by 464, a 36% increase year-on-year.

According to the data shown in the table, the number of overseas employees at Smoore has been steadily increasing since the first half of last year, while the number of Chinese employees has been declining. By comparing the numbers, the overseas employee count has increased by 36% year-on-year, while the number of Chinese employees has decreased by 4243 people, a 27% decline year-on-year. Specifically, by comparing Smoore's annual report for 2023 and its mid-year report for 2024, it can be inferred that between June 30, 2023, and December 31, 2023, Smoore underwent a certain level of employee optimization. As of this year, the number of Chinese employees has stabilized.

The main focus of research and development is on atomized medical and HNB products.

In the first half of this year, Smoore's research and development expenditure increased by 23.7% year-on-year. The main reasons for this growth were the aerosol medical and HNB products, which indicates the direction of Smoore's future product development.

With "reduce costs and increase efficiency" as the key phrase, product material costs have decreased.

In Smoore's 2024 mid-term report, there were multiple mentions of "reducing costs and increasing efficiency", appearing four times throughout the report compared to just once in the 2023 mid-term report. Data shows that Smoore's raw material costs as a percentage of revenue decreased from 49.8% in the previous year to 47.9% this year. The primary reasons for this decrease in percentage were the company's efforts to reduce costs and increase efficiency in its products, as well as a decrease in revenue from disposable electronic vapor products.

The mist inhalation medical device has been approved by European and American drug inspection agencies.

Smoore mentioned that during the period, they have completed the development and production layout of several drug delivery devices for asthma and COPD, as well as the development of a dozen drug formulations. These formulations and devices have been approved by European and American drug testing agencies and have entered the preclinical or registered batch production stages, but have not yet received market approval.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com