Key points:

Compliance benefits realized: BAT confirms Vuse's performance expected to significantly improve in the second half of the year, attributing the turnaround to federal enforcement actions against illegal competitors.

A 54% reduction in the black market: Data disclosed by the FDA suggests that rigorous enforcement may have temporarily decreased illegal market share from over 85% to 54% between February and September, creating a rare opportunity for compliant brands to gain market share.

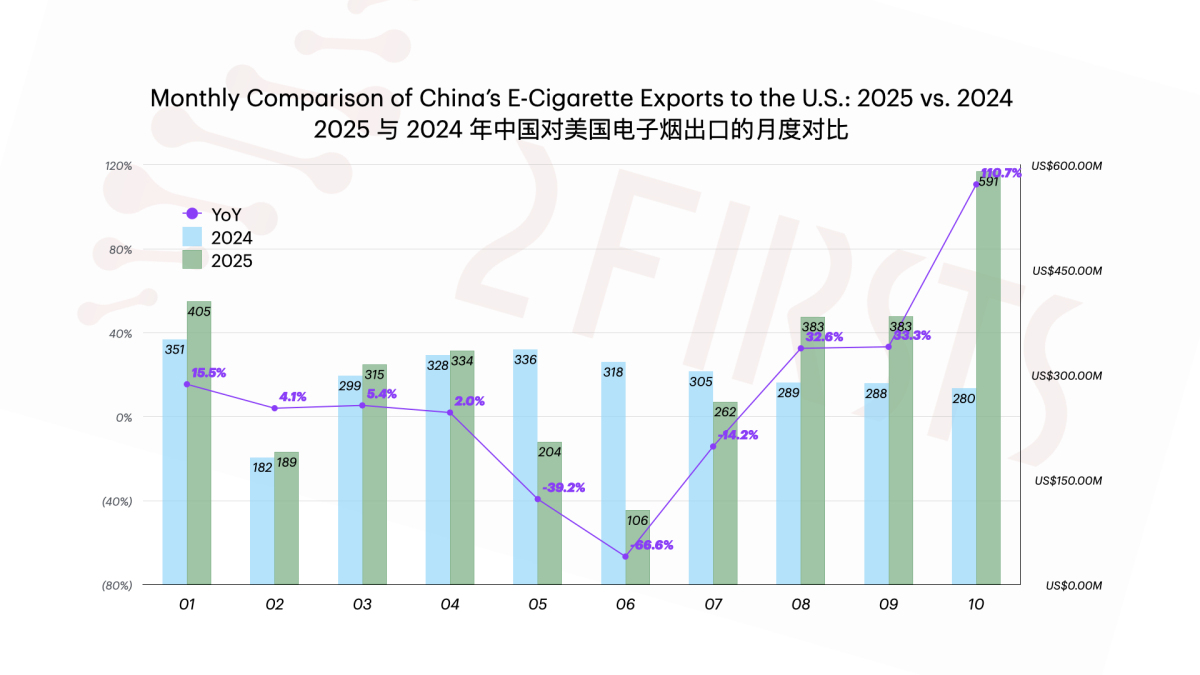

Inventory Peak Backlash: Market Alert Sounded - October saw Chinese exports of e-cigarettes to the US surge to a record-breaking $590 million, signaling that illegal supply chains are retaliating through a "whiplash effect" replenishment.

Strategic defense: BAT announces 1.3 billion pounds buyback plan to bet on compliance in the future, while proactively suspending the promotion of its unapproved product Vuse One, aiming to strengthen regulatory barriers.

In a first, after years of turmoil and competition, the "compliance dividend" of the US e-cigarette market seems to have finally landed in the pockets of the top players.

British American Tobacco (BAT) sent a clear signal in today's "2025 fiscal year-end trading update" that its flagship e-cigarette brand Vuse saw a significant improvement in revenue and sales in the US market in the second half of the year (H2). CEO Tadeu Marroco bluntly attributed this accomplishment to changes in the regulatory environment, stating that "federal and state enforcement actions are addressing the issue of illegal e-cigarettes.

This is not simply a PR statement. Behind BAT's rebound in performance lies a carefully timed "window of opportunity" harvest battle: seizing the momentary "market vacuum" that appeared as a result of Vuse successfully filling the gap in the market during a temporary crackdown on the illicit market by the FDA, based on previous isolated data and the latest supply chain intelligence analysis.

Signal of 54%: Confirmed Law Enforcement Gap and Market Void

BAT's improved performance did not come out of nowhere. Looking back to two months ago, a overlooked official statement actually foreshadowed this trend.

On September 30, 2025, Marty Makary, director of the US FDA, referenced a key data point in a statement aimed at promoting voluntary compliance among retailers, stating that as many as 54% of e-cigarette products currently sold nationwide are illegal.

This data did not attract much attention at the time and seemed quite isolated - because according to previous mainstream media references and industry common knowledge, the unauthorized illegal e-cigarette market share in the United States had long been as high as 85% or even higher.

Although the FDA did not elaborate on the source of the data in its statement, market analysts speculate that this relatively low 54% may reflect a temporary low point in the share of illegal products during a high-intensity enforcement period from February to September 2025. If this speculation is correct, it means that several months of strict enforcement temporarily disrupted the supply chain of some illegal competitors. This has created valuable market space for compliant brands like Vuse, allowing them to break through the long-standing pressure from high proportions of illegal products and achieve performance during this "time window".

Impact of 5.9 billion dollars: The backlash of the supply chain "bullwhip effect

However, the release of Vuse's performance is not yet clear if it is a long-term trend or just a temporary relief. Data from the upstream supply chain has raised concerns.

In a recent special report by 2Firsts, entitled "2Firsts Data Insights: China's Export of E-cigarettes to the US Soars to $5.9 Billion: Causes and Risks Behind Historic Highs", official data from China's customs authorities is cited to show that just one month after the FDA's statement in October 2025, China's exports of e-cigarettes to the US soared to a record high of $5.9 billion.

This unusual surge in data reveals another side of the market.

Bullwhip Effect" emerges: The peak in exports is not caused by a sudden increase in real demand from American consumers, but is a typical example of the supply chain "Bullwhip Effect." After undergoing severe confiscations in the previous months, channel partners have started retaliatory stock replenishment.

Subtle changes in enforcement: There is no definitive answer from the industry on the customs facilitation behind the surge in exports in October. Some observers believe that this may be related to personnel reallocation or scattered regulatory resources during the U.S. government shutdown crisis at the time, but it is more likely the result of a combination of various complex factors.

This means that Vuse, enjoying the advantage of a "market cleanse", could be at risk of a new wave of large-scale illegal inventory impacts at any time. This batch of inventory could potentially create price wars and competitive pressures on compliant brands like Vuse again in early 2026.

Compliance in Gambling: Building Strong Defenses and Strategic Retreats.

Faced with this intense volatility in the "cat-and-mouse game," BAT has chosen to confront uncertainty with capital strength and compliance barriers.

In today's announcement, BAT declared the initiation of a £1.3 billion (approximately $1.7 billion) share buyback scheme and reiterated confidence in its mid-term growth targets for 2026.

This move sends a clear message to investors: BAT is betting that tighter regulation is an irreversible long-term trend, while relying on FDA's MGO (marketing authorization) is the foundation for its survival in the US market.

It is worth noting that BAT appears to be quite cautious in its specific tactics as well. According to Reuters, BAT suspended its unauthorized disposable e-cigarette Vuse One promotional plans in the United States in October.

According to industry public information, the Vuse One series was formerly the Pacha brand product acquired by BAT - this series includes 17 flavored SKUs currently undergoing PMTA (Pre-Market Tobacco Application) review, renamed Vuse One after the acquisition. While calling on regulatory agencies to crack down on "illegal products," BAT has proactively suspended the promotion of one of its products in a "gray area" (i.e., undergoing PMTA review but not yet approved), perhaps as a defensive measure to strengthen its "compliance" image and avoid giving regulators a handle during a period of regulatory pressure.

Outlook: Fragile Victory in a Protracted Struggle

Vuse's improved performance in the second half of 2025 is a valuable breakthrough for its compliance strategy in the face of market structural constraints.

The success of BAT has proven that as long as enforcement mechanisms can temporarily alleviate market suppression, compliant products can quickly translate into real revenue and profits. However, the record surge in China's export data in October also serves as a reminder to the market: the war against illegal e-cigarettes is far from over.

With $5.9 billion in inventory at stake, the ability of Vuse to continue consolidating this breakthrough in 2026 will depend on whether the FDA's next enforcement actions remain strong.

AI-generated illustration

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com