On February 13, British American Tobacco (BAT) released its annual performance report on its official website, covering the period ending December 31, 2024.

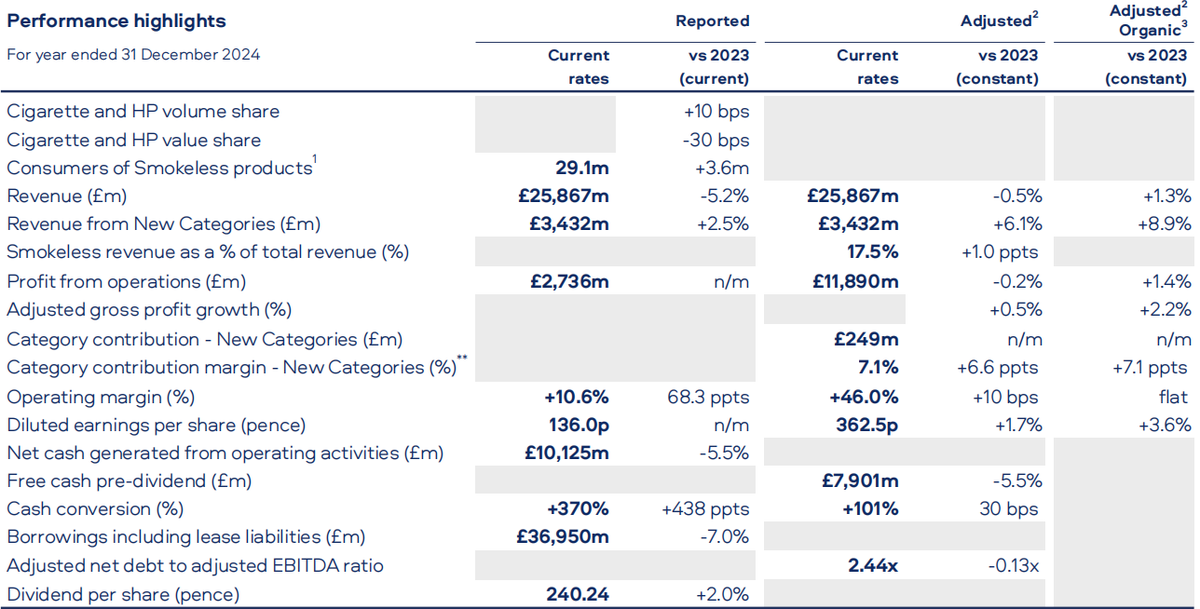

As of December 31, 2024, BAT's revenue was £25.867 billion, a decrease of 5.2% compared to the same period in 2023; operating profit was £2.736 billion, with £6.2 billion set aside in 2024 for a proposed settlement in Canada, while 2023 was mainly affected by negative impacts from disposable impairment charges in the US; new category revenue was £3.432 billion. New category tobacco revenue accounted for 17.5% of the company's total revenue, an increase of 1% from the 2023 fiscal year. The number of new category tobacco users reached 29.1 million, an increase of 3.6 million from the end of 2023.

The core contents of the report are as follows:

Income decreased by 5.2% due to the sale of businesses in Russia and Belarus in September 2023, as well as unfavorable foreign exchange rates. Organic revenue growth was 1.3% (calculated at fixed exchange rates), driven by an 8.9% increase in revenue from new product categories. Total revenue from combustible organic products increased by 0.1% (calculated at fixed exchange rates) as a 5.3% increase in organic product prices/composition was offset by a 5.2% decrease in sales volume. Adjusted organic operating profit increased by 1.4% (calculated at fixed rates), driven by AME and APMEA. Adjusted for organic and constant exchange rates, new categories contributed an additional £251 million, with a current category profit margin of 7.1%, up 7.1% from 2023. Free cash flow was £79.01 billion; adjusted net debt/adjusted EBITDA decreased by 0.13 times to 2.44 times (a decrease of 0.3 times calculated at fixed rates). Dividend increased by 2.0% to 240.24 pence, with plans to repurchase £9 billion in shares by 2025. The launch of Omni™ aims to help achieve a smoke-free world.

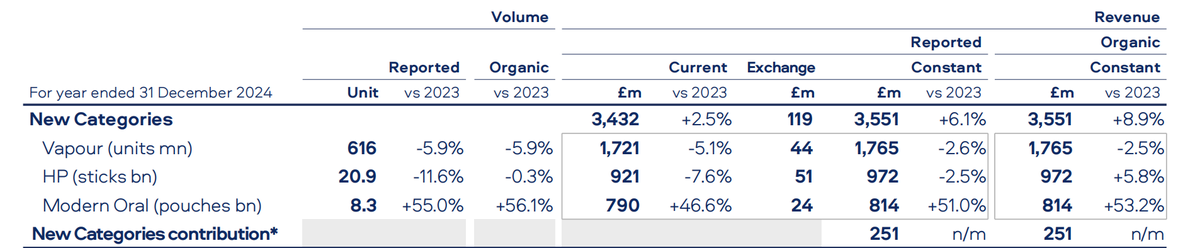

Sales of e-cigarettes have dropped by 5.9%, with adjusted revenue decreasing by 2.5% to £1.765 billion. In the US market, the market share value of e-cigarettes is at 50.2%, a 2.0% decrease from 2023. This is primarily due to the growth of illegal disposable e-cigarette products in the US and Canada, as well as the lack of enforcement of regulations on illegally sold products following a ban in Quebec province.

In 2024, sales of heated tobacco products decreased by 11.6%, and revenue decreased by 7.6%. However, when calculated at constant organic exchange rates, revenue increased by 5.8% to 972 million pounds. The market share is at 16.7%, which is a decrease of 40 basis points from 2023. The new product glo Hyper Pro has helped improve the organic financial performance.

In 2024, sales of modern oral tobacco products increased by 55.0%, with revenue growing by 46.6%. Calculated at constant organic exchange rates, the growth is 51.0% to £814 million. In the US market, the market share of modern oral tobacco is 6.6%, an increase of 2.1% compared to 2023.

BAT CEO Tadeu Marroco stated,

The year 2024 was a year of investment for our company, and our performance was in line with expectations. We continued our transformation this year, with 3.6 million new adult users of our new tobacco products. Currently, the total number of users of our new tobacco products has reached 29.1 million people, accounting for 17.5% of the company's total revenue, an increase of 1% from the previous fiscal year. Our sales accelerated in the second half of the year, thanks to the innovation of new product categories, business investments targeting the US market, and the release of related wholesaler inventory changes.

We have focused on quality growth and achieved higher returns through more targeted investments in all three new product categories, leading to a transformational improvement in our European operations. We have made further progress in increasing the profitability of new product categories, particularly excelling in modern oral care products.

In the United States, despite facing challenges from the macroeconomic environment and illegal disposable e-cigarette products, our targeted investments have strengthened our business. Through strategic business actions, our execution has been enhanced and performance is starting to improve, especially in the area of modern oral care products, where we have also identified untapped growth opportunities.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com