Recently, according to an 8-K filing submitted to the U.S. Securities and Exchange Commission (SEC) by American e-cigarette company Charlie's Holdings, Inc. (code: CHUC), it was revealed that the company had completed a significant asset sale transaction on April 16, 2025. The buyer was R. J. Reynolds Vapor Company, a subsidiary of British American Tobacco (BAT). The transaction involved 12 synthetic nicotine products and related assets submitted for PMTA (Pre-Market Tobacco Product Application) under the PACHA brand owned by CHUC.

The "Dual Route Strategy" of CHUC

Drawing from multiple sources of information, Charlie's Holdings, Inc. (symbol: CHUC) was founded in California in 2014. The company's two subsidiaries focus on nicotine and marijuana products, as well as alternative products.

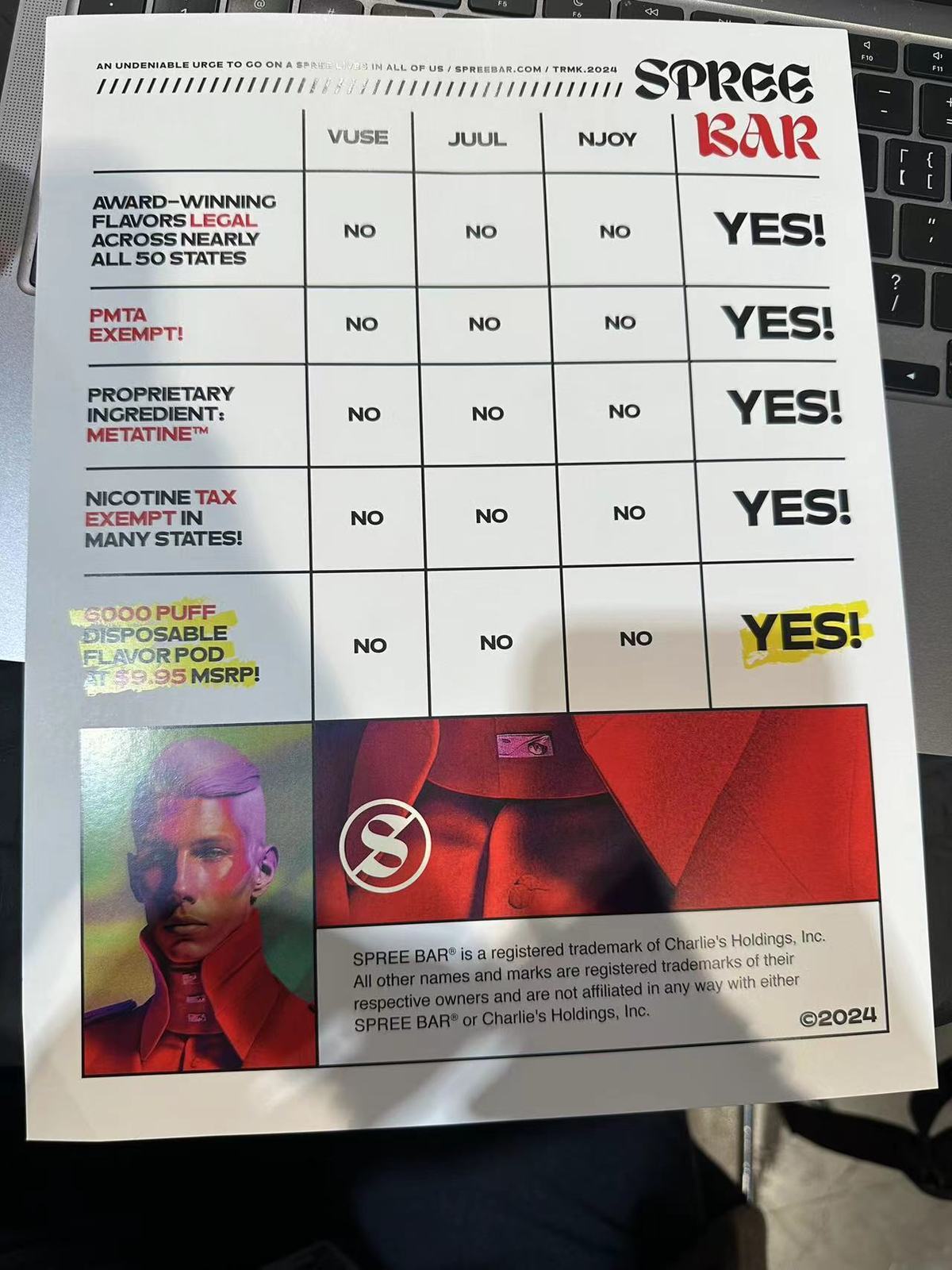

Charlie's Chalk Dust, LLC is responsible for nicotine/alkaloid products, alternative alkaloid vapor products such as SBX/SPREE BAR based on Metatine (its registered "hexamethyl nicotine" trademark).

Don Polly, LLC focuses on marijuana/CBD products, including PINWEEL (an alternative marijuana product). Don Polly/Pachamama CBD is no longer the primary focus of the business.

Reselling 12 PMTA pending products while retaining the brand trademarks

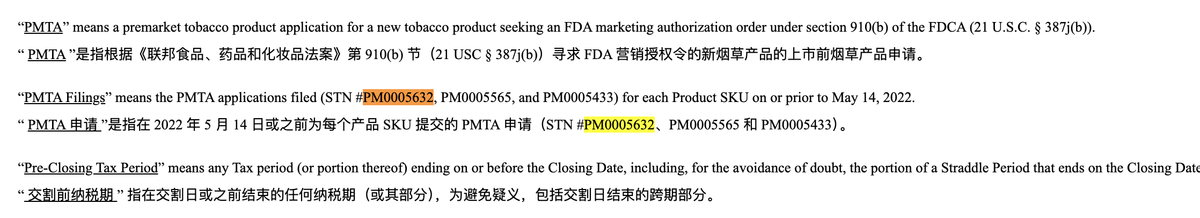

According to the 8-K filing submitted by CHUC, CHUC has sold 12 PACHA synthetic nicotine products and related assets (collectively referred to as the "Acquired Assets"). The key part of these assets is their corresponding PMTA applications, which were originally submitted in 2022, specifically involving FDA's acceptance numbers (STNs).These are reference numbers that may indicate specific documents, reports, or records.

- PM0005632;

- PM0005565;

- PM0005433;

The documents mention that the deadline for submitting these applications is no later than May 14, 2022.

The assets for sale also include specific intellectual property related to PACHA (but not the PACHA trademark itself), government licenses (including PMTA documents), necessary contracts, accounting records, etc. It is important to note that the core PACHA trademarks (PACHA, PACHA MAMA, PACHAMAMA) have not been sold and are excluded from the transaction.

Documents show that Renault e-cigarette company paid a $5 million transaction fee. In addition, the agreement also includes a contingent payment clause: based on Renault's sales performance within one year of commercializing these products, CHUC could potentially receive an additional $4.2 million in payments (calculated at $0.35 per unit net sales, with a cap of 12 million units).

The 8-K filing also states that Renault has the "sole discretion" to commercialize these products and is not obligated to maximize any potential payment. The asset purchase agreement was signed on April 16, 2025, and the transaction was completed simultaneously. As part of the transaction, $5 million in consideration included in the transaction was used to directly repay a specific promissory note debt from CHUC to Chemular, Inc.

The high cost of PMTA is leading to a shift in hedging risk towards SBX

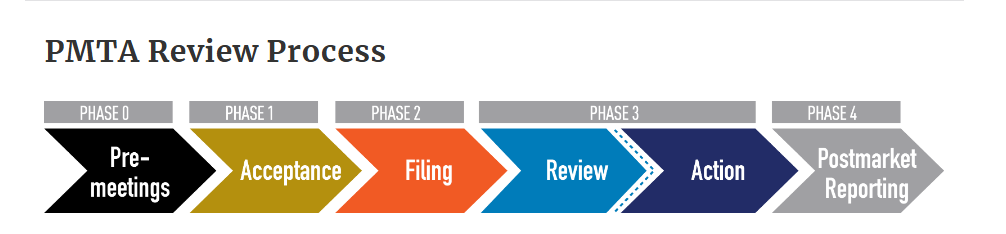

The timing of this transaction has also sparked speculation. Just a month ago on March 4th, CHUC announced that its 11 PACHA disposable flavor products had received acceptance for FDA PMTA filings.

CHUC emphasized that as of now, no company worldwide has received FDA approval for the marketing of disposable e-cigarette products with flavors other than tobacco or mint.

What caught people's attention in this public announcement was the mention of the concept of "important hedging" by CHUC.

The company is also developing nicotine alternative products not subject to FDA PMTA review process. The company's proprietary nicotine alternative alkaloids (patented by the company's chemical suppliers in the U.S. and China) do not meet the definition of nicotine, therefore Charlie's nicotine alternative products are not regulated by federal "tobacco product" oversight.

CHUC claims that they have now decided to commercialize "SBX," which is a more modern disposable device that is very similar to leading (nicotine) e-cigarettes on the market today.

According to the PMTA review process, obtaining acceptance is just the initial stage of the PMTA process, and continuous submission of review materials is still required in subsequent reviews. CHUC stated that it has invested heavily in PMTA, now totaling over $7 million, and has submitted PMTA applications for over 700 SKUs, including synthetic nicotine, natural nicotine e-liquid, and disposable products.

In this transaction, 11 out of the 12 PACHA synthetic nicotine products being sold have received acceptance documents from the FDA. These products mainly consist of 8ml, 50mg/ml disposable e-cigarettes in various fruit, dessert, and menthol flavors. According to the warranty clause in the agreement, the formulas of these products have not changed since April 14, 2022.

According to data, some early applications from CHUC (possibly submitted in 2020) are said to have entered the "substantive review" stage. However, the commercial potential and approval prospects of these remaining applications have become more uncertain after selling the highly anticipated PACHA product, especially against the backdrop of the FDA's stringent stance on flavored products.

Initially, CHUC positioned PMTA as a key strategy, investing heavily in an attempt to create a competitive advantage. However, facing the harsh realities of high costs, low efficiency, and financial pressure, the company's strategy has clearly shifted towards aggressively promoting its Metatine product line (SBX/SPREE BAR), which it claims is not subject to FDA tobacco product regulations and does not require PMTA.

The financial pressure behind the transaction

From another perspective, this transaction can be seen as a crucial step in the company's shift in focus, as it sells off high-risk PMTA assets to fund its Metatine business, which is believed to have more potential and can avoid regulation. This is because CHUC's current financial situation cannot support the company pursuing both ventures simultaneously.

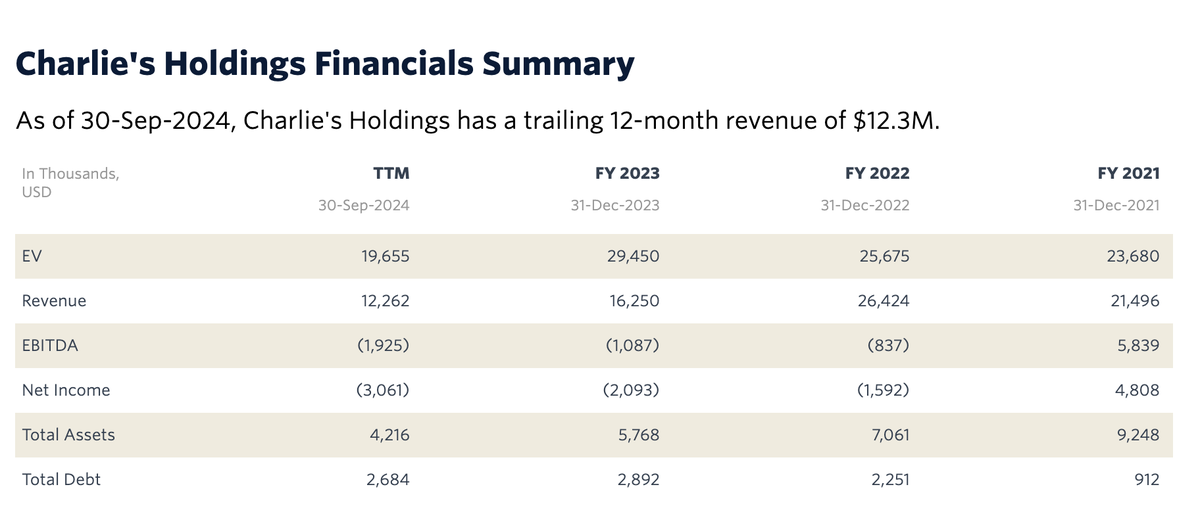

Due to the need for more time to complete and finalize the audit of its financial statements, CHUC has not yet released its 2024 annual report. However, the past 12 months of revenue up to September 30, 2024, amounted to $12.3 million. This represents a significant decrease compared to the 2023 fiscal year ($16.3 million), the 2022 fiscal year ($26.4 million), and the 2021 fiscal year ($21.5 million).

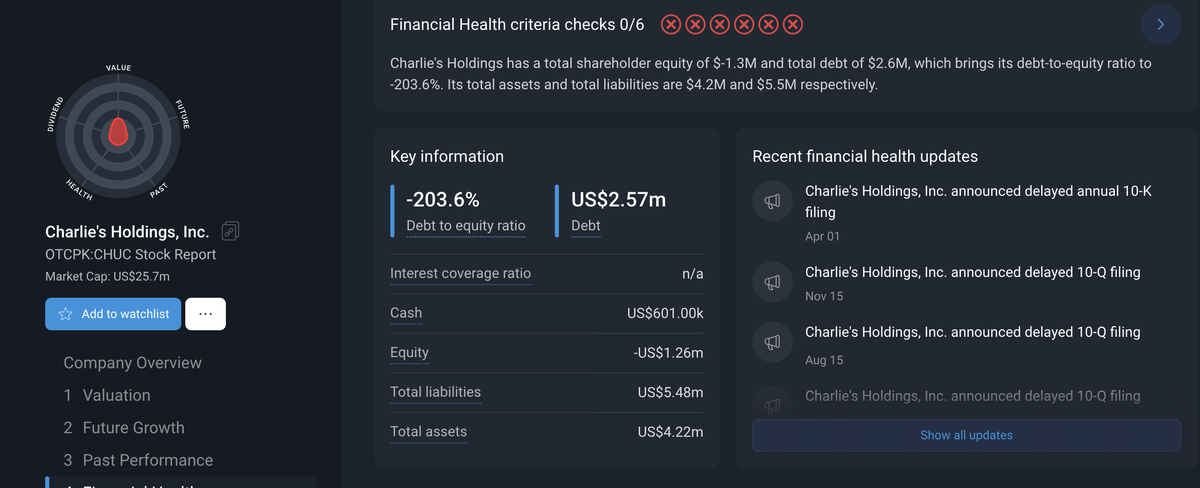

By the end of 2024/early 2025, its total debt stood at approximately $2.6 million, resulting in a negative debt-to-equity ratio of -203.6%, with total assets ($4.22 million) falling short of total liabilities ($5.48 million). The company attributed a portion of its revenue decline to a shift in strategic focus from traditional nicotine products to the development of nicotine alternatives.

By combining CHUC's previous strong promotion of the Metatine product and continuously emphasizing its "PMTA exemption" attribute, the sale of core PMTA assets further confirms that the company has fully shifted its strategic focus to the Metatine path, which is high-risk, high-return, but still has unclear regulatory status.

Against the backdrop of increasing financial pressure, it is not ruled out that CHUC may sell high-investment, uncertain prospects PMTA assets to obtain short-term cash flow to support new business expansion. For the acquirer, Renault e-cigarette company, this transaction also holds strategic value.

·These PACHA synthetic nicotine flavored disposable products have received FDA PMTA file acceptance and have certain compliance prospects;

·In some state-level markets where a "e-cigarette Product Directory" has been established, products in the PMTA review stage are considered "provisionally compliant" and can be legally sold in these states;

·For traditional tobacco companies that emphasize compliance and long-term planning, acquiring these products is a potential shortcut to gaining legal market access.

Therefore, this transaction may not only be CHUC's pragmatic choice to survive, but also Renault's strategic move to bet on potential products and seize future markets within the regulatory framework.

Schedule:

·In 2020, the FDA set the PMTA submission deadline for September 9th. CHUC submitted its first batch of applications and began a large-scale investment.

·By May 14, 2022, CHUC had submitted PMTA applications for 12 synthetic nicotine products later sold to Renault (STNs PM0005632, PM0005565, PM0005433).

·In 2024, CHUC launched the Metatine-based SPREE BAR/SBX product line, marking a shift in strategic focus. In December 2024, CHUC announced an additional investment of over $1 million for revising PMTA applications.

·In March 2025, CHUC announced that 11 flavored disposable PACHA products had received FDA acceptance for PMTA review.

·On April 16, 2025, CHUC signed and completed an asset purchase agreement with Renault e-cigarette company, selling 12 PACHA products under review and related PMTA assets, receiving a $5 million initial payment.

For more reading, please click:

R.J. Reynolds Buys 12 PMTA-Pending Synthetic Nicotine Disposable E-Cigarette Products for $5 Million

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com