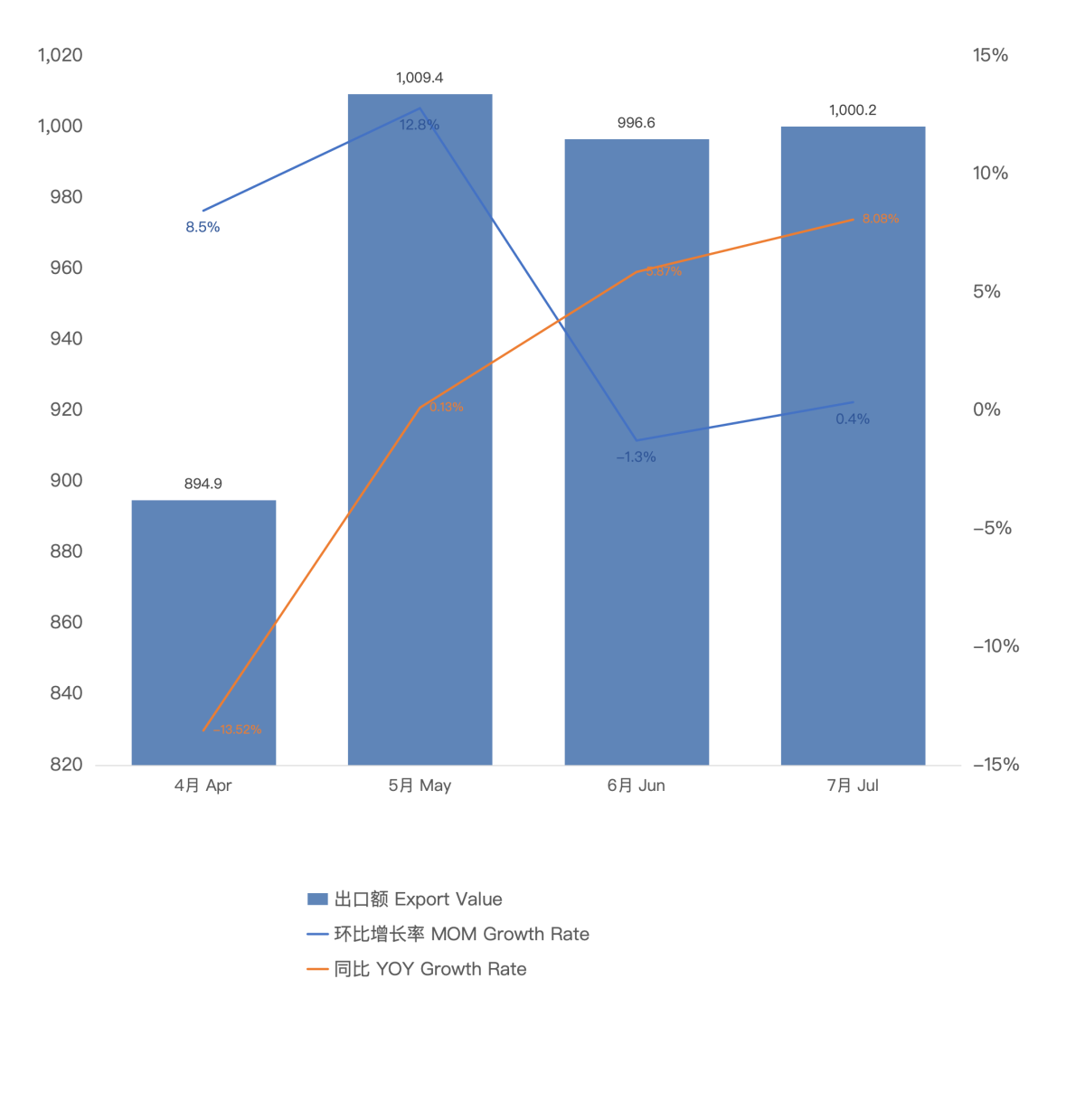

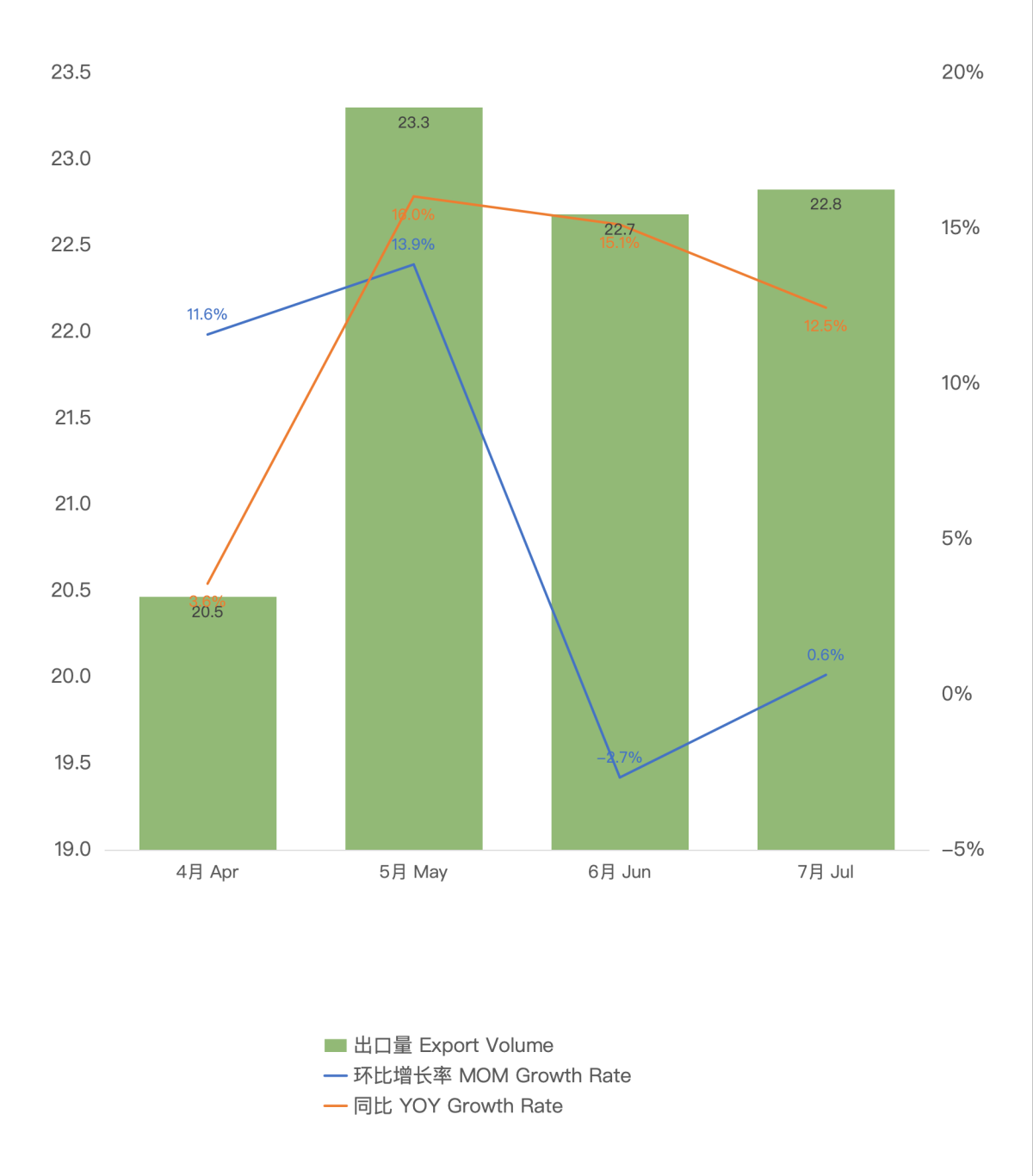

On August 21, the General Administration of Customs of China released the updated e-cigarette export trade data for July 2024. The data shows that in July, China's total e-cigarette exports amounted to approximately 1 billion US dollars, with a month-on-month increase of 0.36% and a year-on-year increase of 8.08%. The export volume was 28,400 tons, with a month-on-month increase of 0.64% and a year-on-year increase of 12.46%.

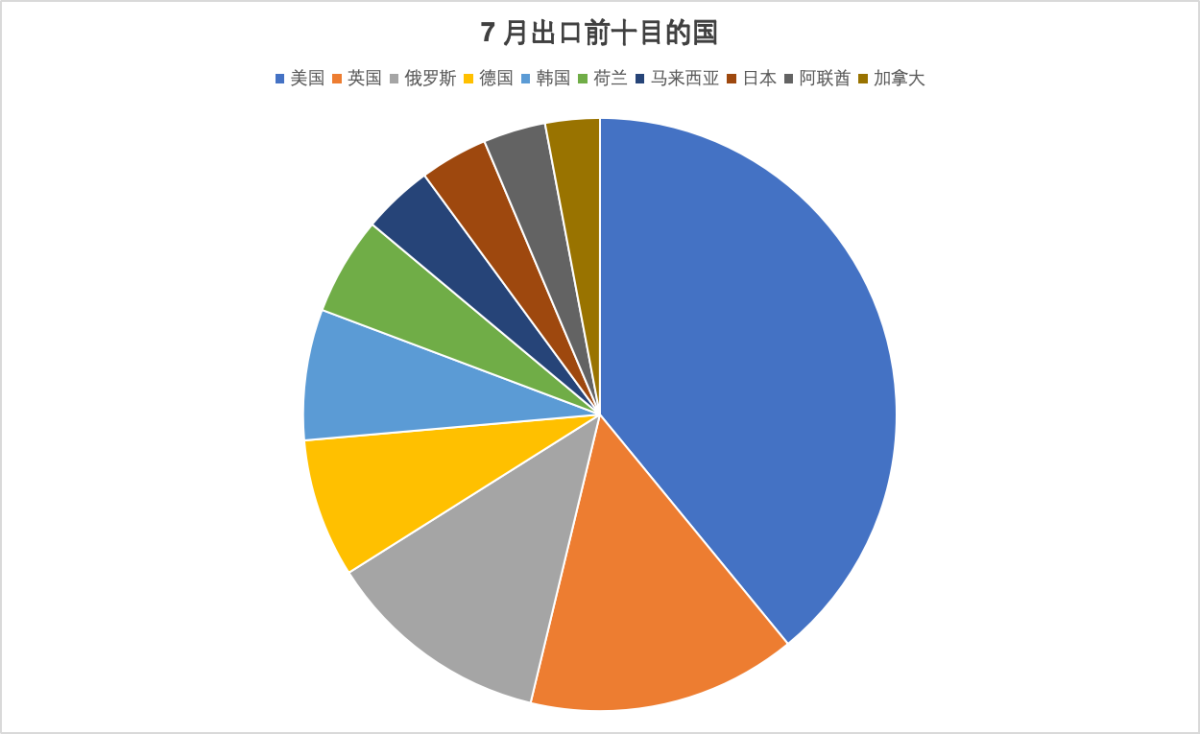

The United States, the United Kingdom, and Russia are the top three exports. Russia's exports increased by 232.23% year-on-year.

According to data, the top five markets (United States, United Kingdom, Russia, Germany, South Korea) collectively account for the majority of the overall export volume.

Specifically, the United States remains the largest export destination, despite a 4.31% decrease compared to the previous month, there is still a 19.3% year-on-year growth, with exports reaching $30.46 billion, holding an absolute market share.

Next comes the United Kingdom and Russia, with a significant decrease in exports to the UK at $114.5 million, a decrease of 7.58% compared to the previous month and a decrease of 14.75% year-on-year. On the other hand, exports to Russia have shown significant growth, increasing by 23.65% compared to the previous month and a whopping 232.23% year-on-year, reaching $95.9 million. Russia has become the fastest-growing market for Chinese e-cigarette exports.

The markets in Germany and South Korea have seen a decline, with exports totaling $58.95 million and $55.54 million respectively.

Other countries that made it into the top ten include the Netherlands ($41.69 million), Malaysia ($30.04 million), Japan ($28.89 million), the United Arab Emirates ($26.49 million), and Canada ($23.11 million).

In the UAE, there was a month-on-month growth of 17.82% and a year-on-year growth of 74.08%. Meanwhile, the Japanese market showed a strong rebound, with a month-on-month growth of 76.02% and a year-on-year growth of 22.91%.

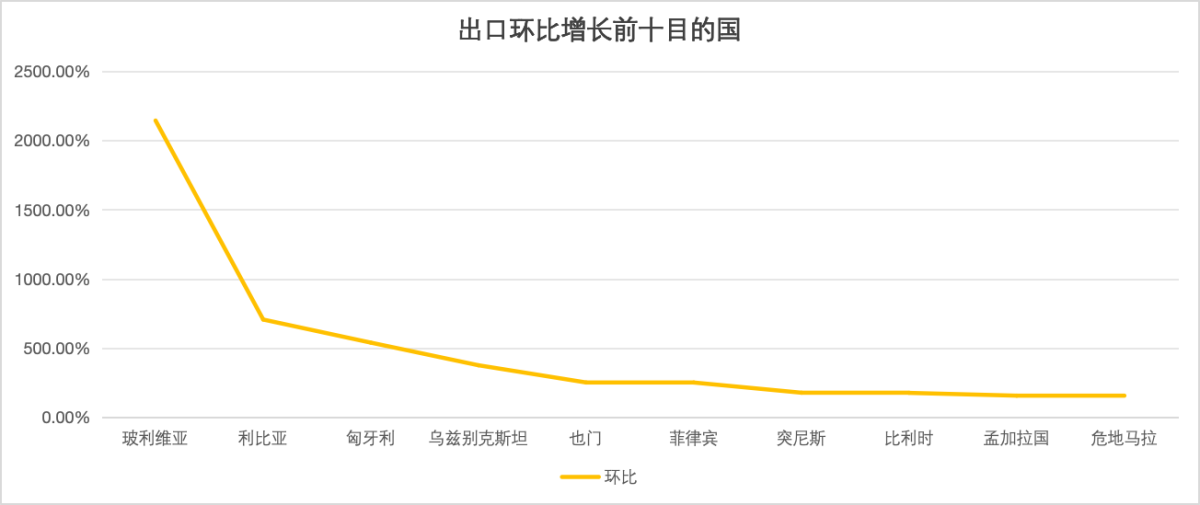

Emerging Markets Booming: Imported e-cigarettes Surge in Countries like Bolivia and Libya.

Recent data from July's top 10 monthly growth list shows some new changes as more emerging international markets are displaying strong growth, particularly in regions such as South America, Africa, and Central Asia in Southeast Asia. The data suggests that these markets are still in the development stage and have considerable potential for growth.

Bolivia in South America saw a staggering increase of 2142.41% in comparison with previous data. Despite the relatively low absolute number of $32,000, the growth rate is remarkably high. Libya in North Africa also experienced strong growth, with a monthly increase of 706.16%.

Central European country Hungary and Central Asian country Uzbekistan also showed strong growth, with month-on-month growth rates of 539.45% and 376.1% respectively. Middle Eastern country Yemen and Southeast Asian country Philippines also saw month-on-month growth rates exceeding 250%, with the Philippines' year-on-year growth rate reaching 26.91% and export revenue reaching $13.05 million.

The growth rates of the markets in Serbia and Belgium in Europe are 176.76% and 156.71% respectively, with Belgium's exports reaching 12.33 million. In South Asia, Bangladesh and Guatemala in Central America ranked on the list with growth rates of 156.71% and 151.73% respectively.

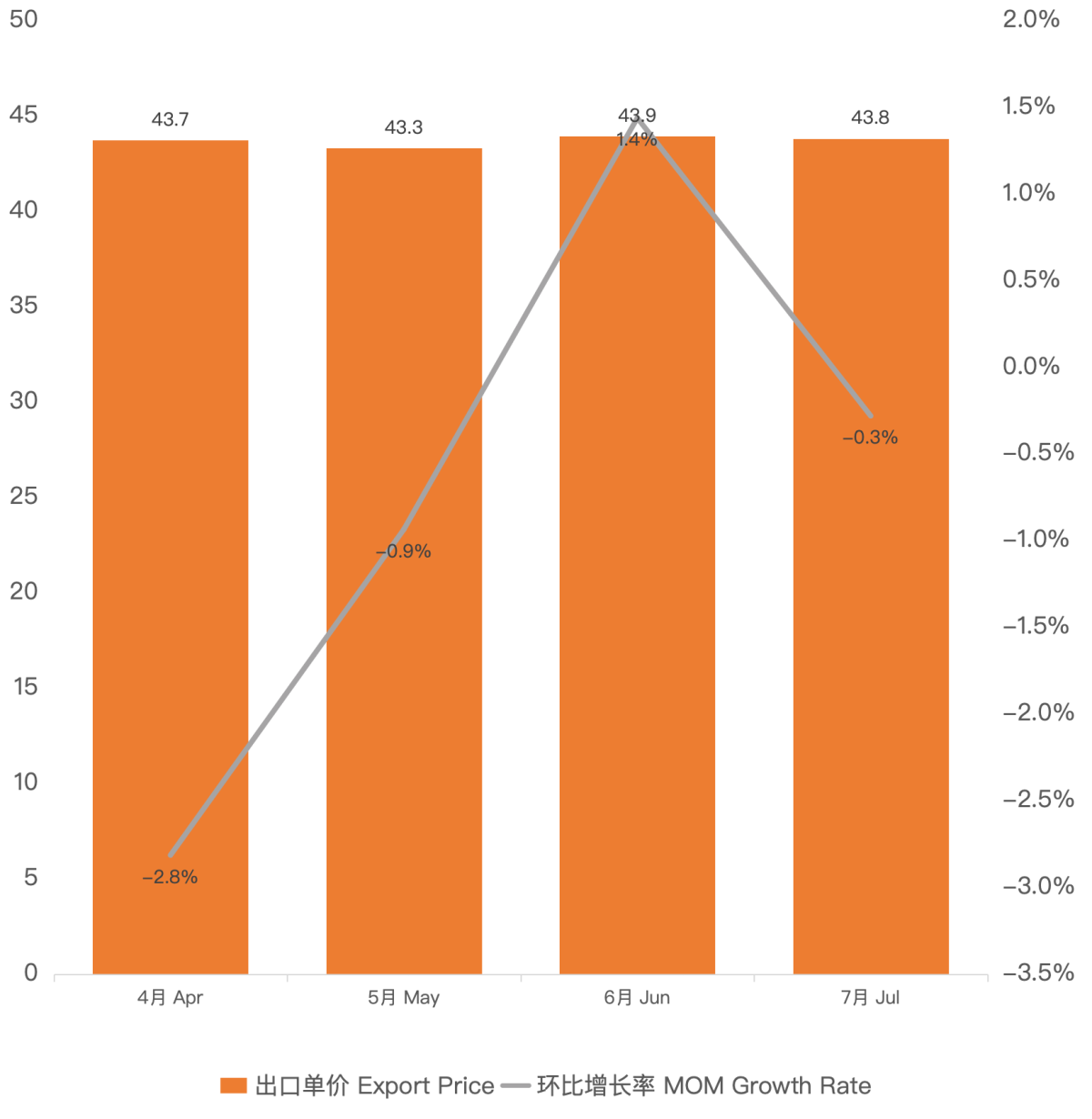

Export volume has increased, but export unit price is showing a decreasing trend.

In addition, the total export volume is approximately 28,400 tons, increasing by 0.64% on a monthly basis and by 12.46% year-on-year.

The export unit price is $43.81 per kilogram, down 0.28% month-on-month and 3.90% year-on-year; the average price of "e-cigarettes and similar personal electronic vaporizer devices" is $5.00 per unit.

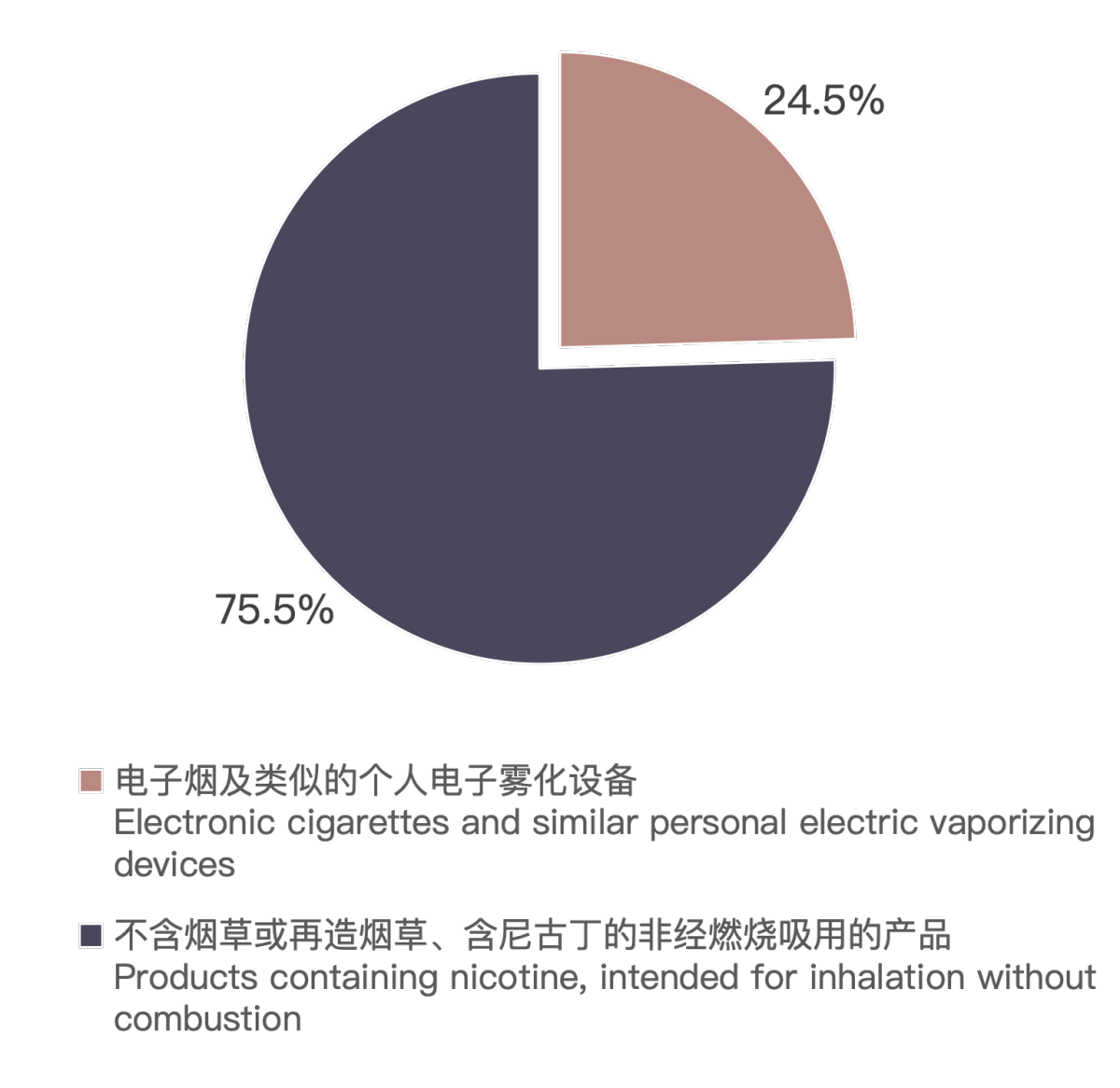

Among them, "e-cigarettes and similar personal electronic vapor devices" account for 24.5% of the export category, while "products not containing tobacco or reconstituted tobacco, containing nicotine and non-combustible products for oral use" account for 75.5%.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com