Statement:

This article is a reprint by 2Firsts of a report originally published by the U.S. media outlet Winston-Salem Journal.

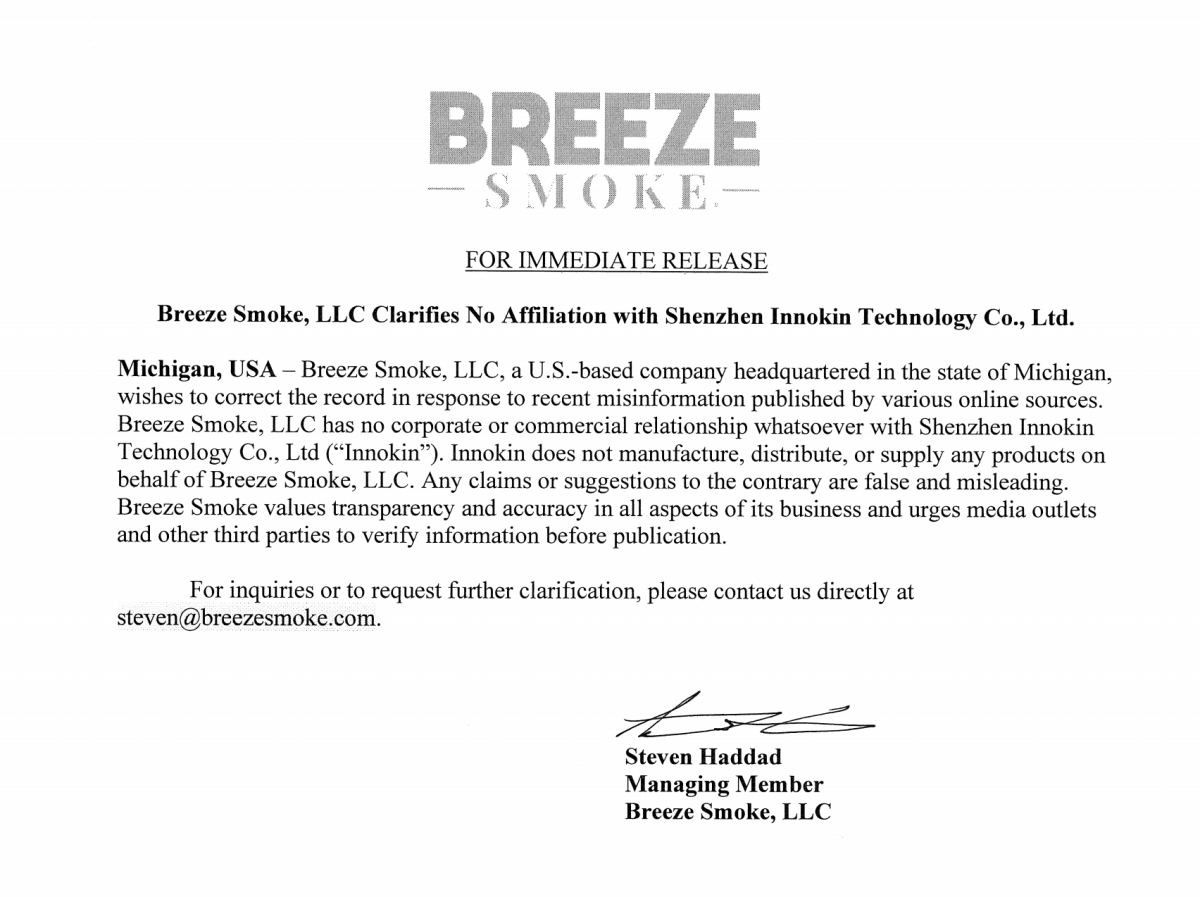

Following its publication, 2Firsts received an email from a lawyer—claiming to represent the vapor brand Breeze Smoke—of the law firm Keller and Heckman. The email pointed out that the original report had incorrectly identified Breeze Smoke as being associated with Shenzhen Innokin Technology Co., Ltd.

According to the clarification provided by the lawyer, Breeze Smoke explicitly stated that it has no commercial relationship with Innokin, and that Innokin has not manufactured, distributed, or supplied any products on behalf of Breeze Smoke.

Winston-Salem Journal has since corrected the relevant content in the original article in light of this clarification. To ensure the accuracy of the information presented, 2Firsts has also made corresponding adjustments to the reprinted version.

This statement is hereby issued.

Key points:

·The Rise of Chinese Brands: In the four weeks leading up to May 3, 2025, the combined market share of Guangdong QISITECH's Geek Bar, Raz, and Raz LTX brands accounted for 25.1% of the e-cigarette market in the United States, ranking second. Breeze Smoke brand ranked fourth with a market share of 7.3%.

·Market landscape changes: Vuse (British American Tobacco) still holds the top spot with a market share of 34.9%; Juul falls to third place with a market share of 18.5%; Altria's NJoy (4.1%) ranks fifth; other Chinese brands like HQD (1%), Mr. Fog (0.7%), and Kado Bar (0.6%) also have a presence in the market.

·Growth rates: Geek Bar Pulse saw a year-on-year increase of 729.2%, Raz grew by 232.6%, and Breeze increased by 105.2%. Sales for Vuse and Juul decreased by 11.2% and 15.2% respectively.

·Regulatory Gaps Raise Concerns: British American Tobacco (BAT) and Altria have stated that approximately 50% of the US market is dominated by "unregulated" e-cigarette products. Both companies have repeatedly urged the FDA to strengthen enforcement against illegal products, but with limited success.

According to a recent report by Bonnie Herzog, a senior beverage and tobacco stocks analyst at Goldman Sachs, Chinese manufacturer Guangdong QISITECH Co., Ltd. ranked second in market share in the U.S. e-cigarette market with its Geek Bar, Raz, and Raz LTX brands in the four weeks leading up to May 3. The Michigan-based Breeze Smoke brand ranked fourth, ahead of Altria Group’s NJoy and behind Juul Labs Inc.

According to reports, as of May 3, 2025, the U.S. e-cigarette market has shown the following pattern over the past four weeks:

·Vuse, produced by R.J. Reynolds Vapor Co., holds the top spot in the market with a 34.9% market share.

·Geek Bar, manufactured by China's Guangdong QISITECH Co., ranks second with a 21.1% market share.

·Juul comes in third with an 18.5% market share.

·Breeze Smoke ranks fourth with a total market share of 7.3%, comprising 5% from Breeze Pro and 2.3% from Breeze.

·NJoy (Altria Group-owned) takes fifth place with a 4.1% market share.

Additionally, other related brands from Guangdong QISITECH Co., such as Raz and Raz LTX, each hold a 2% market share, bringing the company's total share in the U.S. market to 25.1%.

The performance of other Chinese brands in the US market is as follows:

- HQD:1%

- Mr. Fog:0.7%

- Kado Bar:0.6%

Report showed that in the past 52 weeks, sales of Vuse decreased by 11.2%, Juul by 15.2%, while NJoy increased by 31.2%. In contrast, Geek Bar Pulse grew by 729.2%, Raz by 232.6%, and Breeze by 105.2%.

The report is based on data collected by Nielsen from large convenience store chains, while for smaller chains, Nielsen uses trend estimates, so changes in the report may not be immediate.

British American Tobacco and Altria claim that these unregulated synthetic products make up approximately half of the current e-cigarette market in the US. Both British American Tobacco (BAT) and Altria Group have repeatedly urged the FDA and other federal agencies to strengthen enforcement of unregulated Chinese e-cigarette products, but so far their efforts have seen limited success.

According to Altria's data, the three leading unregulated brands in market share are Zone, Fre, and Juice Head, as well as Elf Bar, Breeze, and Mr. Fog. Altria CEO Billy Gifford stated in February to analysts that these products are posing a threat to the long-term opportunity for harm reduction through FDA authorized e-cigarette products in the US.

However, unregulated imports of e-cigarettes and nicotine pouches may continue to eat into Reynolds' potential revenue growth, according to Herzog. She stated that insufficient federal enforcement against illegal e-cigarette products has limited short-term profit growth for publicly traded tobacco companies. Herzog predicts that as consumer demand for smokeless tobacco and nicotine products rises, their sales will surpass those of traditional cigarettes by 2035.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com