Investors are responding to recent earnings reports and the positive momentum of the Chinese stock market.

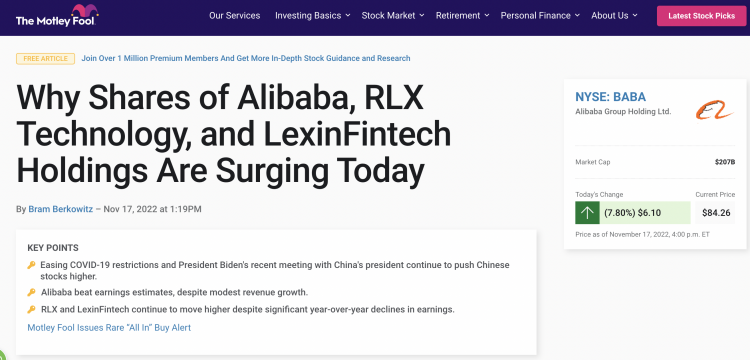

Despite a downturn in the overall market, several Chinese stocks saw an increase today following the recent release of their financial reports. As of 12:37 PM EST, the stock price of the large Chinese e-commerce company Alibaba (BABA 7.80%) rose by almost 8%. The stock price of Chinese e-cigarette company RLX Technology (RLX 20.14%) skyrocketed by over 20%, while Lufax Holding Ltd (LX 17.20%) saw a rise in stock price by over 17%.

After a brutal year for the industry, the Chinese stock market has been gaining momentum recently. Earlier this week, Beijing released a 16-point plan to help the struggling real estate sector. The Chinese government also hopes to ease some of the restrictive pandemic policies that have indeed hampered economic growth this year. China's leaders also appear to have had a productive meeting with President Joe Biden.

Alibaba recently reported an adjusted diluted earnings per share of $1.82 for its American depositary shares, with a total revenue of $29.1 billion for the quarter. While the adjusted earnings exceeded analysts' expectations, the revenue performance was poor, with only a 3% year-over-year growth.

Alibaba CEO, Zhang Yong, stated in the company's financial report that "the uncertainty of the global situation will only strengthen our determination to focus on building capability, which will bring sustainable, high-quality, long-term growth for our customers and our own business.

The Alibaba Cloud division, which has been closely monitored by management, experienced a 4% year-on-year increase in revenue this quarter. However, internal sales of Chinese e-commerce decreased by 1% compared to the previous year, while international e-commerce sales increased by 4%.

Yesterday, RLX announced a profit of $71 million, a decrease of 48% compared to the previous year. Net income also significantly declined to $146.8 million, as the company stopped production of several products due to new regulations. RLX is also preparing to respond to a new 36% tax on the production or import of electronic cigarettes, which may temporarily harm their profitability.

Lufax Financial Technology has reported a diluted earnings per American Depositary Share of $0.21 for the quarter, which marks a nearly 48% decrease year-over-year. The company's total operating revenue for the quarter was $378.2 million, a decline of approximately 9.4% year-over-year. Lufax also reported a growth in its registered user base with a total of 184 million users, which marks an increase of over 19% year-over-year, and a loan issuance growth of more than 31% year-over-year for the quarter. Lufax is a consumer finance technology company.

It can be confidently said that none of these quarterly reports are particularly noteworthy. Alibaba's growth is minimal, Yueke is dealing with a series of new regulations, and although customer and source numbers are increasing, LexinFintech's earnings have significantly declined year-over-year.

However, due to China's wider economic struggles and particularly the impact of its COVID-19 prevention measures, this outcome was largely anticipated. The country's stock market has also suffered heavy losses this year, but investors seem to believe that it may have hit its lowest point amid all the positive signs.

Despite its growth slowing down, I still like Alibaba and I believe that things will improve under better economic conditions. However, due to all these new regulations, I am not very interested in RLX or LexinFintech, even though the market potential is huge, because of the uncertainty around how Chinese consumers will be able to support it from a credit perspective.

Statement:

This article is a compilation of third-party information, intended for communication and learning within the industry.

This article does not represent the viewpoint of 2FIRSTS and we cannot confirm the truthfulness or accuracy of its content. The translation of this article is solely meant for industry communication and research purposes.

Due to limitations in translation abilities, the translated article may not completely reflect the original text. Therefore, please refer to the original text for accuracy.

2FIRSTS is fully aligned with the Chinese government regarding its stance and statements concerning domestic, Hong Kong, Macau, Taiwan, and foreign issues.

The copyright of compiled information belongs to the original media and author. Please contact us for removal if there is any infringement.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.