Core content:

A Tennessee lawmaker has proposed a 10% tax on certain e-cigarette products and requiring FDA approval before they can be sold.

The Senate Committee on Commerce and Labor passed the bill by a vote of 7 to 1, despite strong opposition.

The proposal has sparked controversy and may have an impact on the e-cigarette industry within the state.

According to The Tennessean on February 26th, lawmakers in Tennessee have proposed for the first time a 10% tax on certain e-cigarette products, including e-cigarette pens, e-cigarette molds, vaping products, and pods, and require approval from the U.S. Food and Drug Administration (FDA) before they can be sold.

On Tuesday (the 25th), the Republican Party proposed a 10% tax on e-cigarette products and additional consumer safety regulations. It is estimated that about 400,000 residents of Tennessee regularly use e-cigarette devices. According to data from the Tax Policy Center, Tennessee is one of approximately 20 states in the US that have not taxed e-cigarette products, many of which are located in the Southeast region.

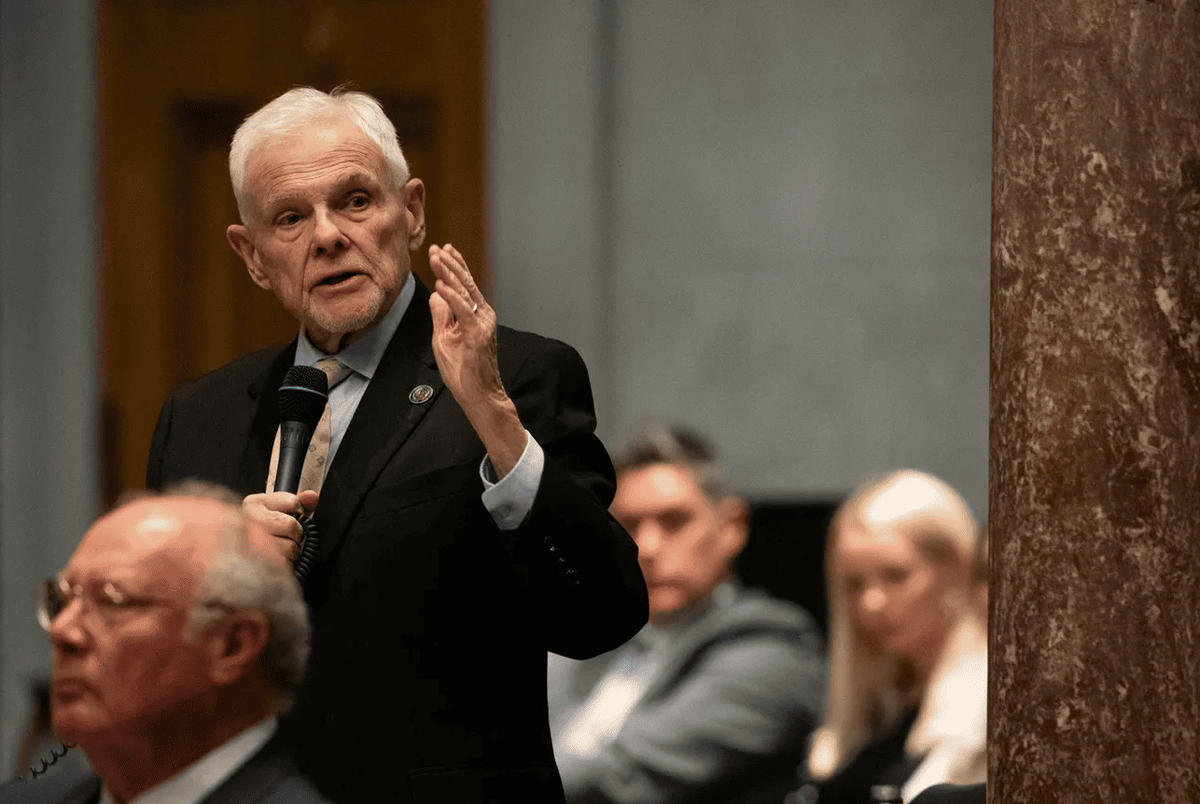

Despite facing opposition, the Senate Commerce and Labor Committee passed Senate Bill 763 with a 7-1 vote. The bill was introduced by Republican Senator Ken Yager of Kingston and Senate Finance Chairman Bo Watson of Hixon.

In addition to imposing new taxes on e-cigarette products, Senate Bill 763 also requires e-cigarette manufacturers to register within the state and pay an annual fee of $25 to ensure that only products approved by the FDA are sold.

The bill also requires consumers to present proof of age when purchasing tobacco, e-cigarettes, marijuana, and smokeless nicotine products.

Danny Gillis, president of the Tennessee Smoke-Free Association and owner of three e-cigarette stores, has criticized the bill as an attempt by big tobacco companies to take over efforts to reduce harm in our industry.

Gillis warned that the bill could "force 99% of e-cigarette products out of the market" and "create an unfair tax structure," potentially leading to the closure of up to 700 e-cigarette companies statewide.

According to financial analysis, the new tax is expected to bring in nearly $16.5 million in new tax revenue for the state government each year.

Currently, Tennessee levies a consumption tax of $0.62 per pack on cigarettes, a 6.6% tax on other tobacco products, and still does not impose state taxes on smokeless nicotine products.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com