Statement:

This article is restricted to research on the global atomization industry and does not involve any brand or product recommendations.

This article is intended for reference in the global atomization industry development research and does not involve any capital market evaluation or investment advice. It should not be used as a basis for any investments.

This article only focuses on the business sector and does not include any commentary on regulatory policies.

Detours, Budget Cuts, Full Retreat: How will Russia-Ukraine War Affect Tobacco Industry?

What led British American Tobacco to make such a decision at that time?

Will BAT return to Russia in the future?

If so, when and how will the return take place?

Author: 2FIRSTS, Charlotte Yu

In September 2023, BAT sold its "BAT Russia company," transferring ownership to the ITMS Group. Recently, British American Tobacco evaluated the loss from selling its Belarus and Russia operations. The company's 2023 annual report shows that its assets in Russia and Belarus were originally valued at £770 million, but were sold for £425 million, resulting in a direct trading loss of £345 million.

What prompted British American Tobacco to make this decision? Will BAT return to Russia in the future? If so, when and in what manner will it do so?

As the conflict between Russia and Ukraine reaches its two-year anniversary, 2FIRSTS has compiled the latest developments of major companies and the Russian market since the outbreak of the dispute.

BAT: Suffered around 30% Losses, Unlikely to Exercise Buyback Options

Since the outbreak of the conflict between Russia and Ukraine, British American Tobacco (BAT) has publicly announced its plans to withdraw from Russia. In September 2023, BAT finally sold its assets to a consortium led by a local management team in Russia, concluding the 18-month-long transaction.

However, in a trading update later on December 6, BAT CEO Tadeu Marroco stated that BAT suffered significant losses in selling its assets in Russia and Belarus, and that the profits gained by BAT only represented a small portion of the true value of its business in these countries.

At the time, BAT did not disclose the sales price, nor did they reveal if the transaction included terms for the company to repurchase these businesses at a later date. However, the company confirmed a £629 million (US$792 million) impairment and associated costs related to the sale when the transaction was announced.

Maloko pointed out that due to the Russian authorities restricting the repurchase option to two years, the company is unlikely to exercise the repurchase option of the sales contract. Therefore, under normal circumstances, it can be expected that in the short term, BAT will not return to this global fourth largest cigarette market.

PMI: Financial Report Shows Separate Listing for Russian-Ukrainian Market, Shipment Volumes far below Global Average

After the outbreak of the Russia-Ukraine war, the American company Philip Morris International (PMI) made significant adjustments to its operations in Russia. In PMI's financial reports, key global data is presented in two versions: one including the Russian and Ukrainian markets and one excluding them, with the two versions often showing significant differences.

The fourth quarter financial report of 2022 specifically highlights that, when including the Russian and Ukrainian markets, the company's global total shipment volume growth was dragged down from 2.6% to 1.2%. There is a noticeable trend of PMI withdrawing from the Russian and Ukrainian markets.

KT&G: Relying Heavily on PMI for Offshore Opportunities, Facing Setbacks in Russia-Ukraine New Markets

KT&G's expansion overseas was largely driven by the strategic partnership agreement signed with Philip Morris International (PMI) in 2020. This agreement was a significant achievement during Baek Bok-in's tenure and played a key role in KT&G's entry into the markets of Russia and Ukraine. In these two markets, KT&G was able to share resources and infrastructure with PMI; in Ukraine, the latter even took full responsibility for the sale of KT&G products. On January 30, 2023, the two parties extended the 3-year cooperation agreement signed in 2020 to 15 years.

This "agreement-based overseas expansion" has its drawbacks: once the situation of the agreement partner changes, KT&G will likely have to make passive adjustments. Following the outbreak of the Russia-Ukraine war, PMI adjusted its strategy. KT&G, originally without a clear political inclination, had to follow suit: KT&G specifically mentioned in its financial report that sanctions imposed by the United States and the entire West on Russia, such as restrictions on SWIFT settlement methods, have affected the company's new market expansion in Russia.

JT: Russian Cigarette Market Contributes Significantly, with Signs of Decline

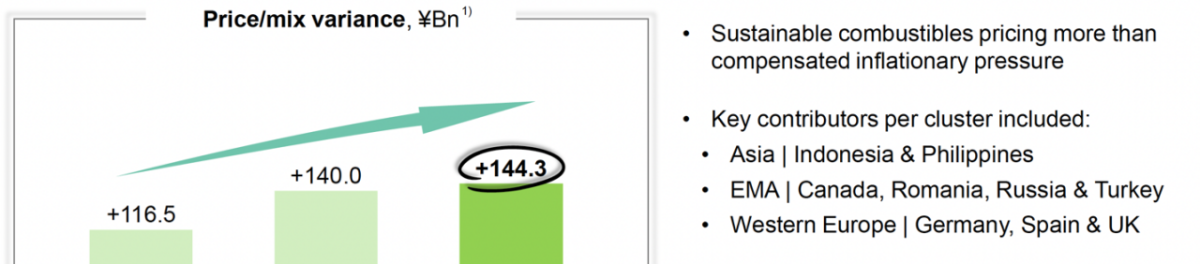

In contrast to KT&G, which operates with a more independent approach, Japan Tobacco has achieved solid results in the Russian market. Japan Tobacco attributes the driving factors behind its financial performance in the tobacco business to competitive pricing and steady profit growth under fixed exchange rates. Russia has contributed a significant share to Japan Tobacco's business in the "EMA (Eastern-Mid Asia/America) market."

However, despite the outstanding absolute value, for Japan Tobacco, the Russian market is showing a shrinking trend. In their 2023 financial report, Japan Tobacco stated that sales of combustible cigarettes in their main markets (Japan, Russia, Taiwan, and the UK) have been declining, specifically in Japan, Russia, Taiwan, and the UK. All of these are giants in traditional combustible cigarette consumption.

It is worth noting that after the outbreak of the Russia-Ukraine conflict, Japan Tobacco Inc. (JT) announced in April 2022 that it had suspended its investments and marketing activities in Russia, and was considering selling its Russian business. At the time, JT had four factories and 4,000 employees in Russia. However, the intention to sell was ultimately postponed, and as of now, JT has not given up on this large market. How JT will adjust its strategy in the future remains to be seen.

2FIRSTS will continue to monitor the developments in the volatile tobacco market in Russia and Ukraine.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com