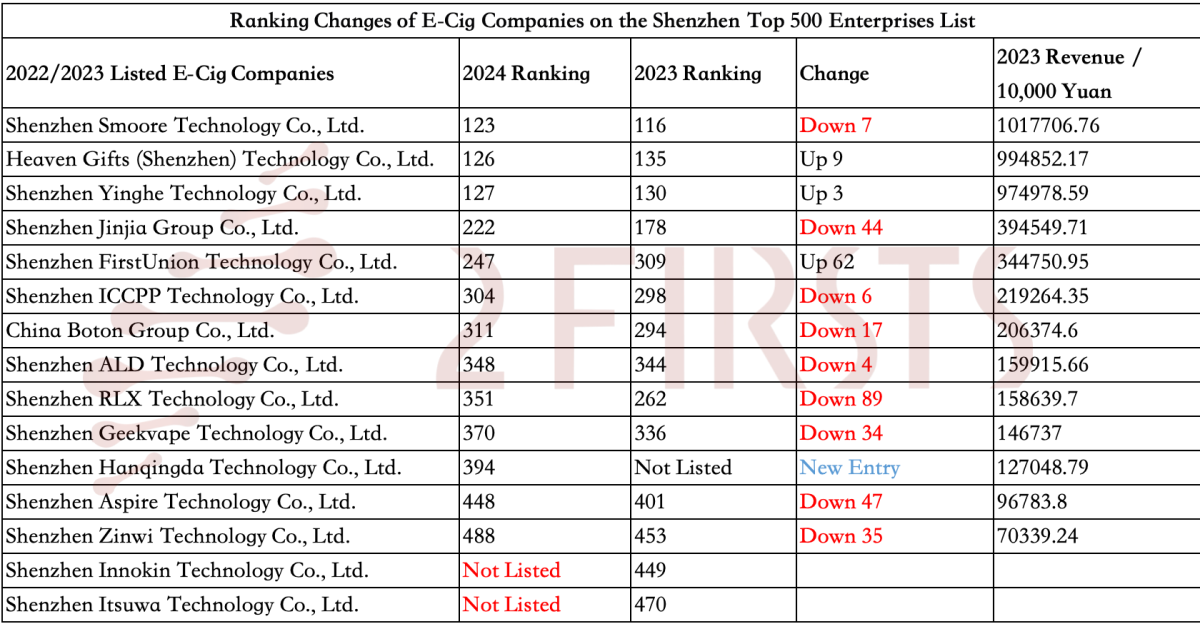

On September 27, the Shenzhen Enterprise Federation and the Shenzhen Entrepreneurs Association (referred to as Shenzhen Enterprise Federation) officially released the "2024 Shenzhen Top 500 Enterprises List" and the "2024 Shenzhen Top 500 Enterprises Development Report." According to statistics from 2Firsts, a total of 13 e-cigarette companies entered the 2023 Shenzhen Top 500 Enterprises list.

2Firsts has compiled a list comparing the ranking changes of e-cigarette companies that made it to the 2024 Shenzhen Fortune 500 compared to last year.

Through analysis and comparison, 2Firsts discovered that among the 13 e-cigarette companies that made it to the Shenzhen Top 500 Enterprises list in 2024, 3 companies had seen an increase in their rankings. Among them, Shenzhen FirstUnion Technology Co., Ltd. saw the largest increase, rising by 62 spots to rank 247th; while Shenzhen RELX Technology Co., Ltd. saw the largest decrease, dropping by 89 spots to rank 351st.

The specific details are as follows:

Three companies see a rise in their ranking

FirstUnion Technology Co., Ltd. in Shenzhen: rose by 62 places, from 309th in 2023 to 247th in 2024. Heaven Gifts (Shenzhen) Technology Co., Ltd.: rose by 9 places, from 135th in 2023 to 126th in 2024. Shenzhen Yinghe Technology Co., Ltd.: rose by 3 places, from 130th in 2023 to 127th in 2024.

Nine companies' rankings have dropped in the latest list:

Shenzhen RELX Technology Co., Ltd. fell 89 spots to 351st place; Shenzhen EJia Tech Co., Ltd. dropped 47 spots to 448th place; Shenzhen Jinjia Group Co., Ltd. decreased 44 spots to 222nd place; Shenzhen Zinwi Bio Technology Co., Ltd. fell 35 spots to 488th place; Shenzhen Geekvape Technology Co., Ltd. dropped 34 spots to 370th place; China Boton Group Co., Ltd. decreased 17 spots to 311th place; Shenzhen Maxwell Technology Co., Ltd. fell 7 spots to 123rd place; Shenzhen VOOPOO Technology Co., Ltd. dropped 6 spots to 304th place; Shenzhen ALD Technology Co., Ltd. fell 4 spots to 348th place. One company has entered the list for the first time.

Comparison reveals that there is one company that made the list in 2024 but did not make the list in 2023.

Two enterprises of HQD Technology Co., Ltd. in Shenzhen did not make the list.

Two e-cigarette companies made the list in 2023, but were disqualified in 2024. They are:

Shenzhen Innokin Technology Co., Ltd. and Shenzhen Itsuwa Co., Ltd. rank insightfully on the list.

Leading e-cigarette companies are falling behind the market leader.

In 2023, the average annual revenue of the top 500 companies in Shenzhen was 208 billion yuan, with an average revenue of 37.78 billion yuan for the 13 e-cigarette companies that made the list. It is worth noting that a majority of the companies on the list saw a decline in their ranking, indicating that the profitability and growth momentum of the top e-cigarette companies in Shenzhen lag behind those of the overall top companies in Shenzhen.

Industry differentiation is clearly intensifying.

The median, as an important indicator for measuring the central tendency of a dataset, can more accurately reflect the polarization phenomenon within the industry.

In this ranking, if we consider 250 as the median, 5 out of 13 e-cigarette companies are ranked among the top 250, while the remaining 8 are ranked lower than 250.

Further analysis reveals that 9 companies have seen a decline in their rankings, while only 3 have seen an increase. This indicates intense competition within the industry, with some companies facing significant challenges. The trend of polarization in the industry is becoming increasingly apparent.

Less than 3% of Shenzhen's e-cigarette companies have a revenue exceeding 6 billion.

Shenzhen is the global center for e-cigarette manufacturing and supply chains, hosting around 70% (approximately 450 companies) of Chinese companies with e-cigarette business licenses. According to data released in the Shenzhen Top 500 Enterprises ranking, by 2023, less than 3% of companies will have annual revenues exceeding 660 million yuan.

The gap between Heaven Gifts and Smoore has further narrowed, with "Heaven Gifts+Geekvape" now established as the leading company in the e-cigarette OEM field.

Smoore, also known as Maikeweier, dropped to 123rd place from 116th last year, while Heaven Gifts rose from 135th to 126th, reducing the difference to just 3 spots. In terms of revenue, Heaven Gifts is only about 2.3 billion yuan behind Smoore. However, when considering "Heaven Gifts+Geekvape," their combined revenue is 11.4 billion yuan, surpassing Smoore. According to Smoore International's financial report, their revenue for the 2023 fiscal year was 11.2 billion yuan. This shows that "Heaven Gifts+Geekvape" has taken the top spot.

HQD made its debut in the top 400, while Innokin and Itsuwa reported revenues lower than the entry threshold of 660 million yuan for the 2024 Shenzhen top 500.

The threshold saw a significant increase of 31.32% from the previous year's 505.92 million yuan.

As a newly listed company, HQD ranked 394th with a revenue of 1.27 billion, suggesting a year-on-year growth of over 31.32%.

Innokin and Itsuwa did not make it onto the list this time, indicating that their estimated revenue for 2023 is below 660 million.

E-liquid companies ranking has dropped with top e-liquid companies absent from the list.

Zinwi Bio, an e-liquid company, made it onto the list this time but dropped 35 spots, ranking last among the 13 companies with a revenue of 700 million.

Another company with an e-liquid business, China Boton Group, also saw its ranking drop by 17 places. However, the two top e-liquid shipment companies in the industry, according to industry consensus, were not included in this ranking. One is located in Dongguan and the other did not make the list.

Note: McWELL is one of the main operating entities of the listed company Smoore International (06969.HK) in Shenzhen.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com