Key Points:

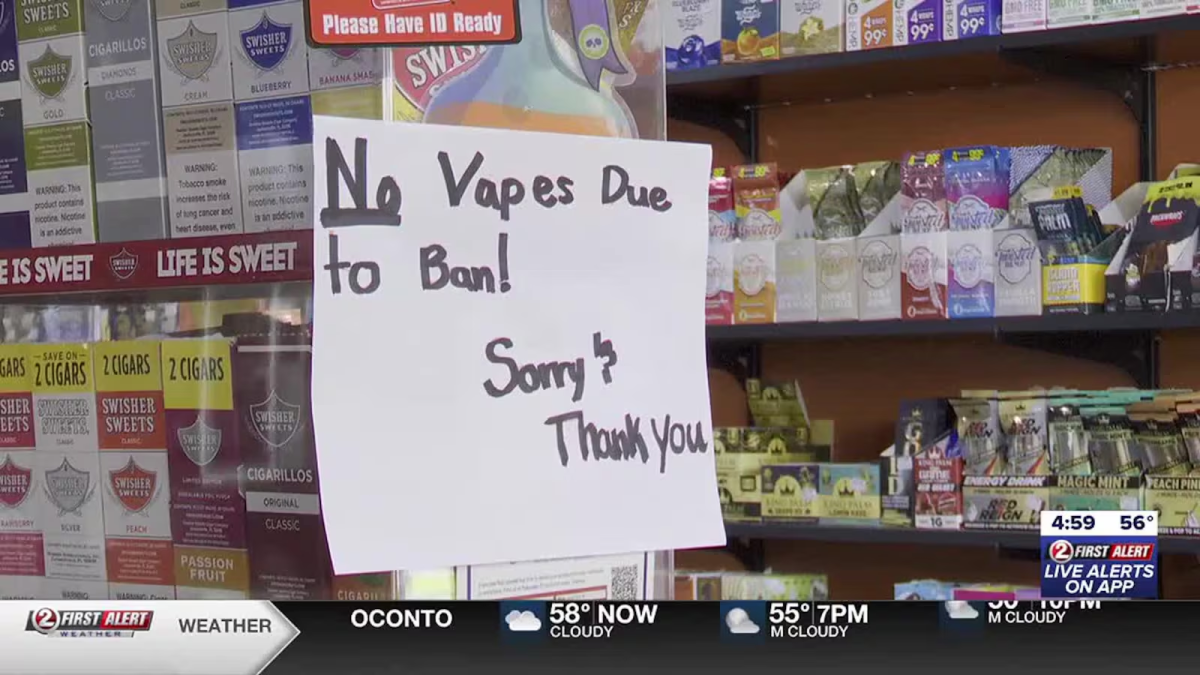

·Regulation Impact: New vape regulations in Wisconsin have led to an 80% reduction in stock for some stores and sales drops of up to 80%.

·Business Struggles: Many vape shops are struggling as top-selling products are now banned, forcing some customers to seek alternatives out of state.

·Industry Response: WiscoFAST, a trade group representing vape shop owners, lost a lawsuit against the Department of Revenue but continues to advocate for changes to the regulations.

2Firsts, September 8th - according to wmtv15news reported in September 6th, Wisconsin trade group WiscoFAST has lost its lawsuit against the Department of Revenue over new vape product regulations. The law, which just took effect, bans most vape products, forcing business owners to remove 80% of their stock and face potential fines. Many vape shops have seen sales drop by up to 80%.

Holy Smokes Vape Shop in Green Bay has experienced a significant drop in sales as customers are unhappy with the ban. Many top-selling products are now off-limits due to the statewide ban, which vape shop owners say could reshape their entire business. Some customers are traveling out of state to find the products they want.

Despite losing the lawsuit, WiscoFAST’s president, Tyler Hall, says the ban is hurting both consumers and business owners. He is urging lawmakers to reconsider the regulations, which he believes unfairly target small businesses. Hall emphasizes that the vape industry was built by small businesses and should not be overshadowed by big tobacco companies.