As the e-cigarette exhibition in Dubai is set to open on June 11, the 2FIRSTS team conducted in-depth research in the Dubai market to understand the brand landscape and market characteristics. Dubai serves as a hub for e-cigarette trading in the Middle East region, providing us with a window to gain insights into the overall market trends in the Middle East.

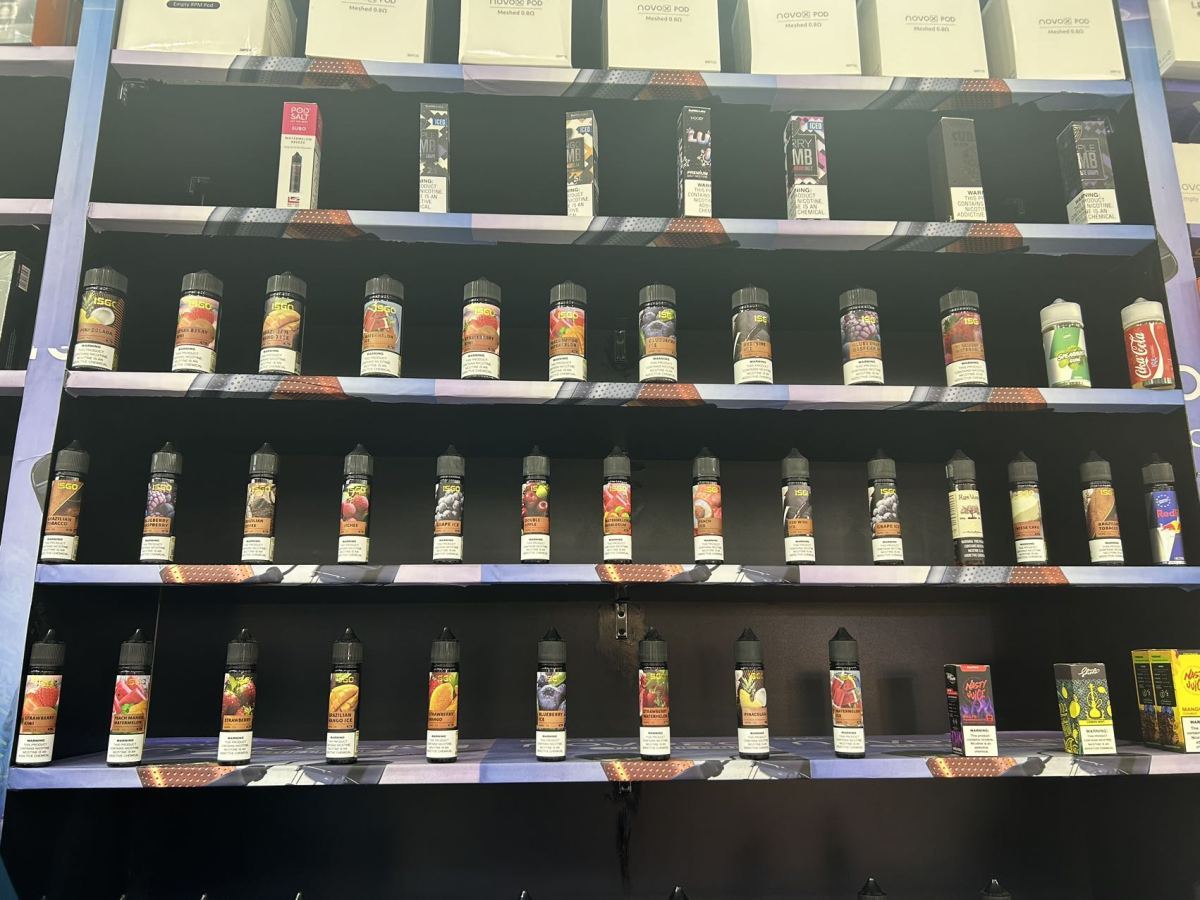

During market visits, 2FIRSTS discovered that while disposable e-cigarettes are the mainstream products in the Dubai market, open system products dominate the shelves in every e-cigarette store, followed by e-liquid. The quantity of disposable e-cigarettes is relatively low.

However, during the visits to numerous e-cigarette stores by the 2FIRSTS team, a common phenomenon was observed: whenever a customer enters the store, the staff will first briefly inquire about the customer's needs, and then proceed to recommend and introduce a variety of disposable e-cigarettes taken from a concealed counter. It is reported that this practice is aimed at circumventing local regulatory measures.

Specifically, in the Dubai market, only e-cigarette products that have been certified as compliant and have paid the necessary taxes can be openly displayed on shelves for sale. However, e-cigarettes imported through unofficial channels must be sold discreetly hidden under counters.

However, there are also a few "bold" store owners who will openly sell e-cigarettes that do not meet regulations by placing them on the shelves.

This situation is consistent with what was observed by 2FIRSTS a year ago, but what is different is that the brands sold "under the counter" have changed.

Disposable products that can be placed on shelves have not changed much over the past year, with brands such as NERD BAR, JIXIA VAPE, and POLD SALT remaining popular. However, products that are "under the counter" have shifted from YUOTO to brands like VOZOL, TUGBOAT, and GEEKBAR.

According to several store clerks interviewed by 2FIRSTS, VOZOL has surpassed YUOTO to become the most popular e-cigarette brand in the Dubai market. Additionally, promotional materials for VOZOL can be seen on the walls or doors of many shops.

Among these popular products, 2FIRSTS found that most of them come with a small screen that displays battery and oil levels, with the exception of the GEEKBAR Pulse which features a large side screen. No other products with large screens were observed.

In terms of sales figures, a store employee explained to 2FIRSTS that the best-selling e-cigarettes on the market are those with over 10,000 puffs, while e-cigarettes with puffs ranging from 5,000 to 8,000 are gradually losing popularity.

When asked about the enforcement characteristics of Dubai regulatory agencies, most people choose to evade the question. However, one dealer disclosed that Dubai imposes fines on shops selling illegal e-cigarettes, but the specific amount of the fine is not clearly defined and has a strong element of discretion.

As the official partner of this exhibition, the 2FIRSTS team will be on-site to provide users with the latest updates. Stay tuned for live coverage.

In addition, 2FIRSTS will hold a "Dubai e-cigarette exhibition and deep market sharing session in the Middle East" after the exhibition ends. This sharing session is exclusive to members. If you would like to participate, please scan the QR code below to add the administrator to inquire about membership details.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com