On September 22nd, 2FIRSTS visited the offline e-cigarette market in Seoul, South Korea. More than 20 convenience stores in the city center, including well-known chains like 7-11, CU, and GS25, were surveyed. It was found that almost all convenience stores sold traditional cigarettes and heat-not-burn (HNB) products, but the majority did not carry vape products (Note: in South Korea, e-cigarettes are generally referred to as HNB products, while "vape" specifically refers to liquid-based e-cigarettes).

Vaping is becoming increasingly difficult to find.

According to reports, the main wholesale center for e-cigarettes in South Korea is located in Busan. The majority of e-cigarette retail stores in the country are concentrated in both Busan and Seoul. As the capital and most populous city in South Korea, Seoul has a population of approximately 9.91 million. During a visit to Yoido by 2FIRSTS, often referred to as the "Manhattan of South Korea," it was found that the shops in this area sell heated tobacco and traditional cigarettes. Inside 7-11, a popular chain store, there are HNB products from Philip Morris International (PMI), British American Tobacco (BAT), and KT&G. Promotional materials for these products can also be seen outside 7-11 stores.

However, in these chain stores, 2FIRSTS did not find any disposable e-cigarettes available. The tobacco products offered in these stores were limited to traditional cigarettes and HNB pods. It was not until we visited a small non-chain store that we finally came across some vape products. However, these products were placed in an inconspicuous location, almost unnoticeable. Only when 2FIRSTS inquired about vapes did the store attendant retrieve them from beneath the shelves. The e-cigarettes sold in this store primarily included Bubblemon and another brand of e-cigarette.

The customer asked the salesperson at 2FIRSTS to recommend the best-selling e-cigarette. The salesperson suggested the Bubblemon brand, which comes in a grape flavor and a 4.8 ml size. The price of this e-cigarette is 19,000 Korean Won (approximately 104 Chinese Yuan). The shopping receipt reveals that the price of the e-cigarette already includes a 10% tax fee. The packaging information indicates that this product is manufactured in China, but it does not provide specific details about the production company.

In addition, the store also sells Vuse govape, a product under BAT (British American Tobacco), with a 2-milliliter Vuse goe-liquid priced at 10,000 Korean won. Promotional materials for this product are notably displayed at the counter. However, unlike other convenience stores, this e-cigarette is not placed on the shelves here. Furthermore, many convenience stores do not sell vape products, only HNB (Heat-Not-Burn) products.

The popularity of HNB products is soaring.

Based on information obtained from offline stores in South Korea, it can be observed that the price of disposable e-cigarettes is relatively high.

For instance, within the HNBpod store, the prices of IQOS brand pods are 4,500 Korean won and 4,600 Korean won, which is similar to the price of a pack of cigarettes. By using the standard of 600 puffs per 2ml e-liquid, this capacity of disposable e-cigarette is equivalent to a pack of traditional cigarettes. This implies that the price of a 19,000 Korean won e-cigarette is comparable to the cost of 4.22 packs of traditional cigarettes or HNB products.

It should be noted that the price of disposable e-cigarettes includes the cost of the device, whereas traditional cigarettes do not require any additional equipment. The pods of HNB products also come with device expenses.

A growing number of people in South Korea are opting to use heat-not-burn (HNB) products, a trend that is gradually becoming mainstream, according to observations by 2FIRSTS on the streets of the country. Data from the Korean Center for Tobacco Control Research and Education shows that the sales volume of HNB pods in Korea has grown by 6.8 times from 78.7 million boxes in 2017 to 538.6 million boxes in 2022. In just the first half of this year (January to June), 292.6 million boxes were sold, and it is projected that the total sales volume for this year will surpass 600 million boxes for the first time.

According to industry insiders in the South Korean tobacco sector, disposable vape products and others faced significant market changes in 2019. That year, due to a severe outbreak of lung diseases among teenagers in the United States, the South Korean government issued a directive strongly advising against the use of vapes. The directive especially warned against the use of liquid e-cigarettes by children, teenagers, pregnant women, individuals with respiratory illnesses, and non-smokers.

According to a report in South Korean economic news, referencing third-party data, the sales of liquid e-cigarettes plummeted by 97.6% compared to the previous year in 2020, following the government's recommendation to suspend their use for a year. As a result, this market has virtually disappeared in South Korea.

According to a local source in South Korea, e-cigarette regulations in the country are extremely strict. In 2019, a government directive resulted in the removal of all vape products from convenience stores, and even now, these chain stores do not sell vapes. Furthermore, the source mentioned that it is also difficult to obtain e-cigarettes through alternative means due to strict enforcement by the government.

According to tax regulations in South Korea, e-liquids made from natural nicotine are classified as cigarettes and are subject to an inland tariff of 1,799 Korean Won (approximately $1.32) per 1 milliliter. In contrast, e-cigarettes made from synthetic nicotine, derived from chemical materials, are not categorized as cigarettes and therefore are exempt from cigarette consumption tax.

In South Korea's tobacco market, new tobacco products are nearly dominated by heated tobacco products (THP). According to a survey conducted by the South Korean Ministry of Strategy and Finance, KT&G, a local company, accounts for approximately 48% of the market share with its Lil product, while PMI's IQOS holds 42%, and BAT's Glo holds 10%. The other two international tobacco giants, Imperial Tobacco (IMB) and Japan Tobacco (JTI), are largely absent from the Korean market.

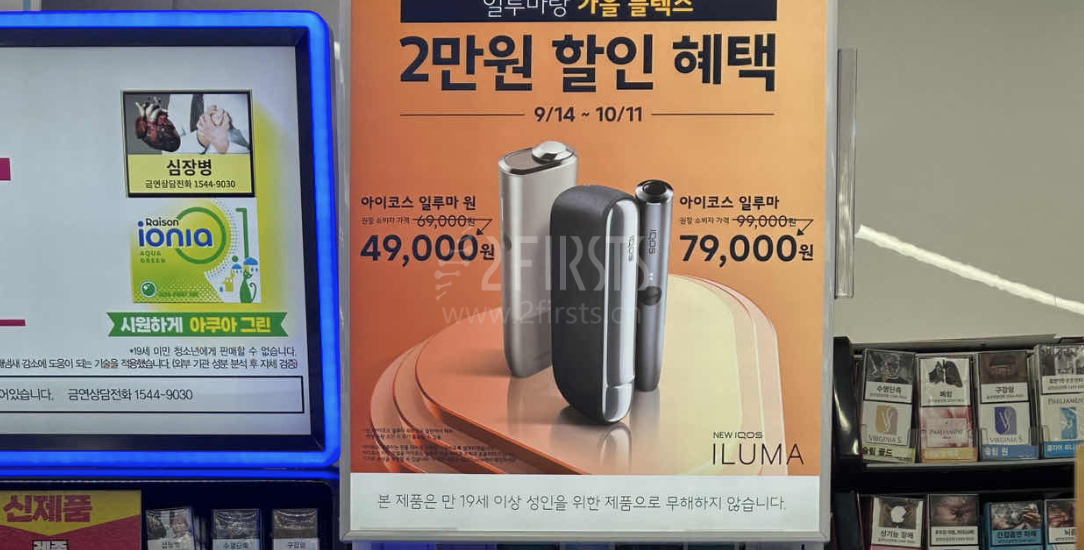

PMI's IQOS Iluma devices have launched a promotional offer at convenience stores in South Korea. Promotional materials depict a price reduction for the Iluma one from 69,000 Korean won to 49,000 Korean won (approximately 377 Chinese yuan), and for the Iluma from 99,000 won to 79,000 won (approximately 432 Chinese yuan).

KT&G's HNB product, LIL, occupies prominent positions in offline stores. The company has established a strong marketing network in South Korea. However, PMI is engaging in promotional activities to lower market prices and compete for market share by reducing the selling price of the iQOS Iluma series e-cigarette.

A recent investigation by 2FIRSTS has revealed that the vape market in South Korea is facing several challenges. Despite the introduction of BAT's Vuse go product, the overall acceptance of vaping in the country remains relatively conservative.

Large chain convenience stores in South Korea are currently not widely stocking vape products, which also limits the market penetration of such products. Consumers lack convenience when purchasing vapes and face numerous obstacles, resulting in the absence of a distinct sales scene for vapes in the Korean market.

However, as the global demand for healthier smoking options continues to grow, the vape market in South Korea may undergo changes in the future. With the relaxation of regulations and a shift in attitude towards vaping in South Korea, there will be an influx of more e-cigarette manufacturers entering the market, gradually aligning with global trends.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com