ISLAMABAD: The Federal Board of Revenue (FBR) has bound all cigarette manufacturers to implement the Track and Trace System with effect from July 1, 2022, a statement said on Tuesday, with an aim to bust a massive tax evasion racket in the sector.

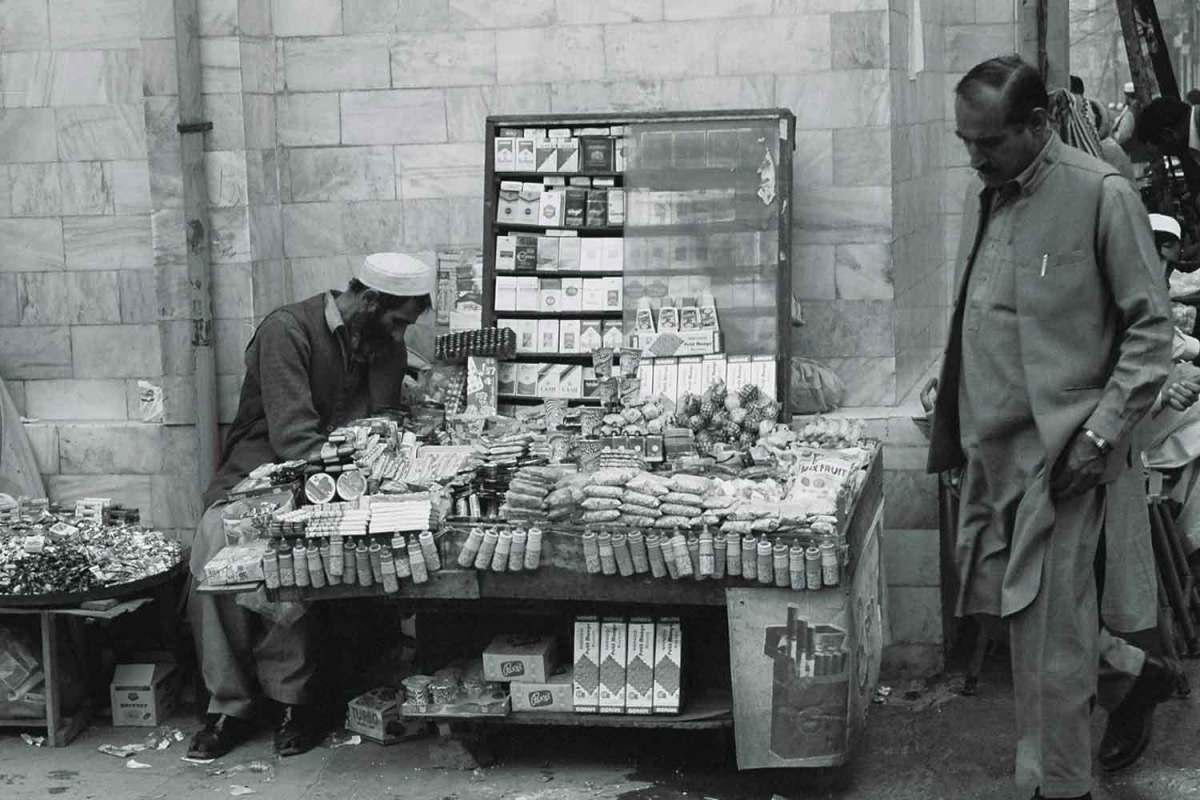

It has been made mandatory that no tobacco product shall be allowed to be removed from the factory premises without affixation of tax stamps/Unique Identification Marking (UIM).

Only three tobacco manufacturers, including Pakistan Tobacco Company, Philip Morris, and Khyber Tobacco, have installed the Track and Trace System and made it operational.

There are 18 tobacco companies located in KPK, three in FATA/PATA, and two multinational giants in the tobacco sector. In order to improve enforcement against non-duty paid cigarettes, the FBR has handed over seven vehicles to the Inland Revenues Enforcement Network (IREN) and a total of 45 vehicles would be provided to the FBR officers.

Through a letter issued on June 30, 2022, FBR has directed cigarette manufacturers to procure tax stamps beginning from July 1 and that their products would not be allowed to be removed from their factories without having tax stamps affixed on the packets.

Nine cigarette manufacturers in a representation to the FBR have challenged these instructions. They have claimed that without installation of a track and trace system as envisaged in the sales tax rules, fixing of tax stamps on cigarette packs is not possible.

They have proposed to the FBR to make the licensee fulfill its legal obligations in terms of the licence granted by the board. According to them, the issuance of the letter dated June 30 by FBR without installation of the necessary equipment of the Track and Trace system, its operationalisation and necessary connectivity with FBR’s IT system is a violation of the sales tax rules. The FBR’s Project Director for Track and Trace System has scheduled a visit to KPK factories to apprise them about the stamp system installed through the Track and Trace system on cigarette packets on Wednesday (today).

On other hand, the formal big companies argued that the Track and Trace system could only succeed if it was implemented on all players in its true letter and spirit. However, the manufacturers, involved in dilly-dallying tactics, were allegedly involved in illicit business. They don’t want a Track and Trace System because it will help identify untaxed cigarette packets easily.

Furthermore, to allow effective tracking of tax paid brands, a measure was introduced last year for the Brand Licensing of all cigarettes brands as per Sales Tax General Order (07/2021). This required all existing and new manufacturers to register their brands of all cigarette products.

The law was introduced to discourage illicit brands from entering the market, ensuring only tax-paid licensed brands are sold in the country. Furthermore, this law also applied to Azad Jammu and Kashmir manufacturers.

To date, unfortunately, only 16 brands by two companies have applied for the licence. A year before last, FY2021, the total tax collection from tobacco industry was Rs134 billion, out of which two companies that hold about 65 percent market share paid Rs131 billion and the remaining 40+ manufacturers holding more than 35 percent of the total cigarette market paid only Rs3 billion. The 40+ manufacturers with over 200 cigarette brands (as corroborated by IPSOS and Access Retail research) have not even applied for the licence.

Currently, excise collection is done by the FBR from manufacturers. The total number of these manufacturers is uncertain as well as the locations of all the manufacturing facilities are unknown. Shifting the excise collection from the manufacturing stage to collection against cigarette brands available in market through brand licensing would only help plug major tax leakages, but also increase revenue collection and bring about a system whereby brands can be traced for being tax-paid or not.