One: Global Market

According to the upcoming "GB41700-2022 Electronic Cigarette" standard: electronic cigarettes refer to electronic transmission systems used to generate aerosols for inhalation by users.

Attitudes towards e-cigarettes vary globally, with the UK taking the most positive stance and promoting e-cigarettes as an important tool to achieve the goal of a smoke-free nation. The country aims to further reduce the overall smoking rate by encouraging smokers to switch to e-cigarettes, and may even allow compliant e-cigarette products to be covered under its National Health Service (NHS). In the US, compliant e-cigarette products are now being authorized for legal sale. Meanwhile, regions such as Hong Kong and Kazakhstan have opted for a complete ban on e-cigarette sales.

Latest developments in the policy towards e-cigarettes in certain regions.

Global sales of electronic cigarettes have been showing a gradual upwards trend, according to data from the Economic Tobacco Institute of the State Tobacco Monopoly Administration. However, as many regions continue to improve their regulations surrounding the e-cigarette industry, growth overall has been somewhat constrained. In 2013, sales saw a year-on-year increase of 77.9%, but by 2018, this had decreased to 37.7%. The impact of the pandemic pushed this increase even further down to 1.4% in 2020, but by 2021, growth had recovered to 11.6%, resulting in a total sales figure of $21.2 billion.

Global e-cigarette sales revenue from 2012 to 2021 (excluding the mainland China market).

The main market for electronic cigarettes is emerging from enhanced regulation and the impact of the global pandemic. The United States, the largest market for electronic cigarettes, has reversed its negative growth trend in 2020, achieving sales of $10.31 billion with a year-on-year increase of 9.9%. The United Kingdom, the second-largest market for electronic cigarettes, has a more open attitude towards their use and the market has shown relatively stable development, achieving sales of $3.45 billion in 2021, with a year-on-year increase of 16.9%.

Global e-cigarette sales for the year 2021.

Report on China's Electronic Cigarette Industry Market Analysis and Development Trends from 2022 to 2028 Released by WiseGuy Consulting

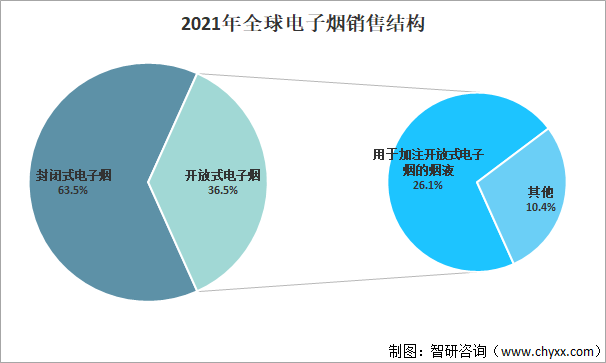

Closed-system electronic cigarettes still account for the majority of the market, making up 63.5% of sales in 2021, while open-system electronic cigarettes make up the remaining 36.5%.

The Global E-Cigarette Sales Structure in 2021

Note: The global data above does not include the mainland China market.

2. Chinese Market

Regulations governing electronic cigarettes have been gradually announced, marking the beginning of a "strong regulatory" era.

In the era of e-cigarettes, the lack of policy regulation and national standards in the industry has resulted in false advertising, a concerning trend of underage e-cigarette use, and the addition of unsafe ingredients, posing a significant threat to consumer health. Since the third amendment of the Regulations on the Implementation of the Tobacco Monopoly Law of the People's Republic of China in 2021, which stipulates that new tobacco products, such as e-cigarettes, should be regulated in accordance with relevant regulations on cigarettes, e-cigarettes have been officially included in the tobacco system's supervision. With the release of regulations involving permit management, product technical review, and transaction management, the domestic regulatory system has been established, and as permits are gradually issued, online trading platforms are launched, and regulatory measures are implemented, e-cigarettes in China are entering a period of "strict regulation.

Regulatory policies for the electronic cigarette industry in China.

In June 2022, the State Tobacco Monopoly Administration issued a response to questions regarding administrative licensing and product technology evaluation for electronic cigarettes, indicating that the process for approving licenses for production, wholesale, and retail for electronic cigarette companies is progressing smoothly. In the near future, a batch of tobacco monopoly production licenses for electronic cigarette-related enterprises that meet administrative licensing conditions will be approved and issued. Additionally, tobacco monopoly wholesale licenses for electronic cigarette wholesale companies that meet the conditions will be approved. Starting from June 1, 2022, applications for tobacco monopoly retail licenses for electronic cigarette retailers in the existing market will be accepted and tobacco monopoly retail licenses will be issued once they pass the review process.

The industry is continuously expanding in size, but the penetration rate remains relatively low.

Traditional tobacco products include cigarettes, cigars, tobacco strips, and reprocessed tobacco leaves, among which cigarettes are the most popular. Cigarettes, also known as "smokes," are rolled with cigarette paper and burned for inhalation. They currently occupy the largest share of the traditional tobacco market. China is the world's largest consumer of tobacco. According to the National Health Commission, China has a smoking population of 308 million. With the government's policy to encourage people to quit smoking, the country's adult smoking rate has decreased by 2.3 percentage points in the past decade. In the future, the number of smokers will continue to decrease under the nationwide anti-smoking campaign, and many consumers will choose e-cigarettes as a transitional quitting aid.

The smoking rate among adults in our country.

The electronic cigarette industry in China began in 2003, and has since experienced rapid growth as sales companies actively promote the products, consumers become more familiar with them, and the pace of product updates and iterations accelerates. In 2021, the market size reached 19.7 billion yuan, with closed-system electronic cigarettes becoming the mainstream due to their rich flavor, portability, and convenience in changing oils.

According to the data from the National Health Commission, as of 2020, approximately 10.35 million people in China were using electronic cigarettes. Although the usage rate of electronic cigarettes has increased, it is still less than 1%, which is significantly lower compared to other regions such as Europe and the United States. There is still much room for improvement. Among consumers, the age group with the highest proportion is 15 to 24 years old. The sleek designs and diverse flavors of electronic cigarettes make them popular among young people.

The electronic cigarette market size in China for the years 2020-2021.

According to data from the Electronic Cigarette Industry Committee of the China Electronic Commerce Association, as of 2021, there were approximately 190,000 electronic cigarette retail stores in China, with authorized stores accounting for around 73% and exclusive stores accounting for approximately 25%. The "Electronic Cigarette Management Measures," released in May 2022, prohibit tobacco retail companies or individuals from exclusively operating electronic cigarette products sold on the market. This means that brand-exclusive retail stores will become a thing of the past and the future of exclusive stores will likely involve a transition to a more collective model.

The number of electronic cigarette retail stores in China in 2021 (in tens of thousands).

Corporate registration and deregistration have both significantly increased, indicating an acceleration of industry consolidation.

Against a backdrop of continuous market expansion and low barriers to entry, the number of new entrants to the industry is on the rise, with 84,100 new registered companies in 2021. However, as industry regulation continues to improve, the number of companies being deregistered is also increasing year by year. In the future, as further regulations are implemented, the industry is expected to see an acceleration in consolidation, with market share consolidating towards leading companies.

From 2017 to 2021, the number of Chinese companies registering and deregistering in the e-cigarette industry.

Note: The statistics only include companies that have names, brand products, and business scope that involve electronic cigarettes.

Shenzhen is China's earliest region to develop the electronic cigarette industry. The abundant supply of upstream raw materials has made Shenzhen the region with the most electronic cigarette production companies in China. With the popularity of electronic cigarettes in the global market, a large number of electronic cigarette OEM orders have started to flow back to China, and the electronic cigarette supply chain center centered in Shenzhen has supplied about 90% of the world's electronic cigarettes. As of mid-March 2022, there are more than 11,000 companies in Shenzhen, far exceeding other regions.

As of March 21, 2022, the top 10 cities with electronic cigarette-related enterprises in China are...

Investment amounts per transaction have significantly increased, with leading companies receiving more favorable attention from investors.

In 2019, the electronic cigarette market in China was still in its wild growth stage, with capital chasing after it and confirming its "explosive" status. Approximately 50 investment and financing transactions took place in the electronic cigarette industry in 2019, with relatively small investment amounts. However, in 2020, the trend towards "strict regulation" in the industry began to emerge, leading to a significant decline in investment enthusiasm. By 2021, as the industry continues to develop in a more regulated manner, capital still sees potential in the electronic cigarette industry. Although the number of investments may not have increased significantly, the investment amount has increased more than threefold, and the size of each investment has significantly grown. It is evident that more standardized and larger-scale leading companies are more favored by capital, which will further consolidate the industry's landscape.

Investment and Financing Situation of China's Electronic Cigarette Industry from 2018 to 2021

Note: Search using the tag "e-cigarettes.

In January 2021, with the backing of capital, Wuxin Technology successfully listed on the New York Stock Exchange in just three years. In addition, YOOZ, Vitavp, and Zhongchuang Wulian have also received significant investments from investors including Zonff Partners and Ximeng Group.

Key investment and financing events in the Chinese e-cigarette industry for 2021-2022.

This article contains excerpts or reprints of third-party information, the copyright of which belongs to the original media and author. If there is any infringement, please contact us for deletion. Any unit or individual wishing to reproduce must contact the author and not reproduce directly.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.