On September 15, 2023, the Dortmund Tobacco Exhibition in Germany entered its second day. Ms. Yuna Hou, Vice President and Global Editor-in-Chief of 2FIRSTS, was invited by the organizers to give a keynote speech entitled "Challenges and Changes: Forecast for the 2024 Global Vaping Market" at the exhibition. With a wealth of detailed data, Ms. Hou analyzed some of the key issues currently facing the global e-cigarette industry and made predictions about the trends in the global e-cigarette market for 2024.

In her speech, Yuna stated that the era of rapid growth in the e-cigarette industry has come to an end, and the global e-cigarette market is now entering a mature market era -- the competition between companies will become fiercer. However, compared to the global nicotine market, the penetration rate of e-cigarettes still remains low, indicating immense room for growth that has yet to reach its limits. So, what is hindering the rapid growth of e-cigarettes? 2FIRSTS believes it is primarily due to regulatory and technological factors.

Ms. Yuna Hou, Global VP and Global Editor in Chief of 2FIRSTS, gave a speech at Dortmund Exhibition | Source: 2FIRSTS

How to break the current ceiling? 2FIRSTS believes that shifts are necessary and they will occur in areas such as business models, technology, and regulation. For instance, in terms of business models, there may be a need to re-establish channels; in terms of regulation, it will become more systematic and science-based.

How will the global e-cigarette market change in 2024? 2FIRSTS envisions e-cigarettes transforming from trendy fast-moving consumer goods back to their tobacco essence after stagerring regulatory trends and market demands. In terms of sustainability and consumer experience, pod systems, especially those with high capacity, will become highly sought-after in the market. Against this backdrop, industry competition, particularly between leading international tobacco companies and e-cigarette companies, will step up a new stage.

However, 2FIRSTS still believes that technology and regulations will continue to drive the industry in a spiral upward manner, creating new business models and opening up a broader market.

Below is the full transcript of the speech:

Good afternoon everyone. I am Yuna Hou from 2firsts. 2firsts is a media and consultancy focusing on the global vaping industry.

Every day, nearly 8000 industry professionals worldwide get updates on the latest news and industry analysis through 2firsts.

2firsts focuses on the most important issues in the global vaping industry, and so does our target audience.

They are the decision-makers from regulatory agencies, supply chains, brand owners, and channel dealers in various countries; as well as industry organizations and global mainstream media, institutional investors, and others.

The core value of 2firsts is—engaging in dialogue with key figures.

Over the past year, my team and I have conducted in-depth coverage of the industry and published a total of 3624 pieces of news, covering 17 global exhibitions on-site; conducting exclusive interviews with 83 professionals from regulatory agencies, associations, corporate executives, and so on; we have released 54 sets of key industry data and communicated with regulatory authorities in 6 countries.

Through these continuous observations, we try to discern the future direction of the global vaping industry.

InterTabac is the most influential tobacco exhibition in the world, and I am honored to share our thoughts with you all here.

First of all, I would like to share with you a Chinese word “卷”。In the past year, we continuously heard practitioners in the global vaping industry say this word.

“卷” comes from the sociological term 'Involution.' About 5 years ago, this word started trending on the Chinese internet. It has been extended to describe the internal malignant and excessive competition.

Under the backdrop of "involution," everyone faces such a dilemma: giving up competition means exiting the market, while stepping up competition means making critical investments without bringing about an increase in profits and efficiency.

Currently, many e-cigarette brands are facing such a dilemma.

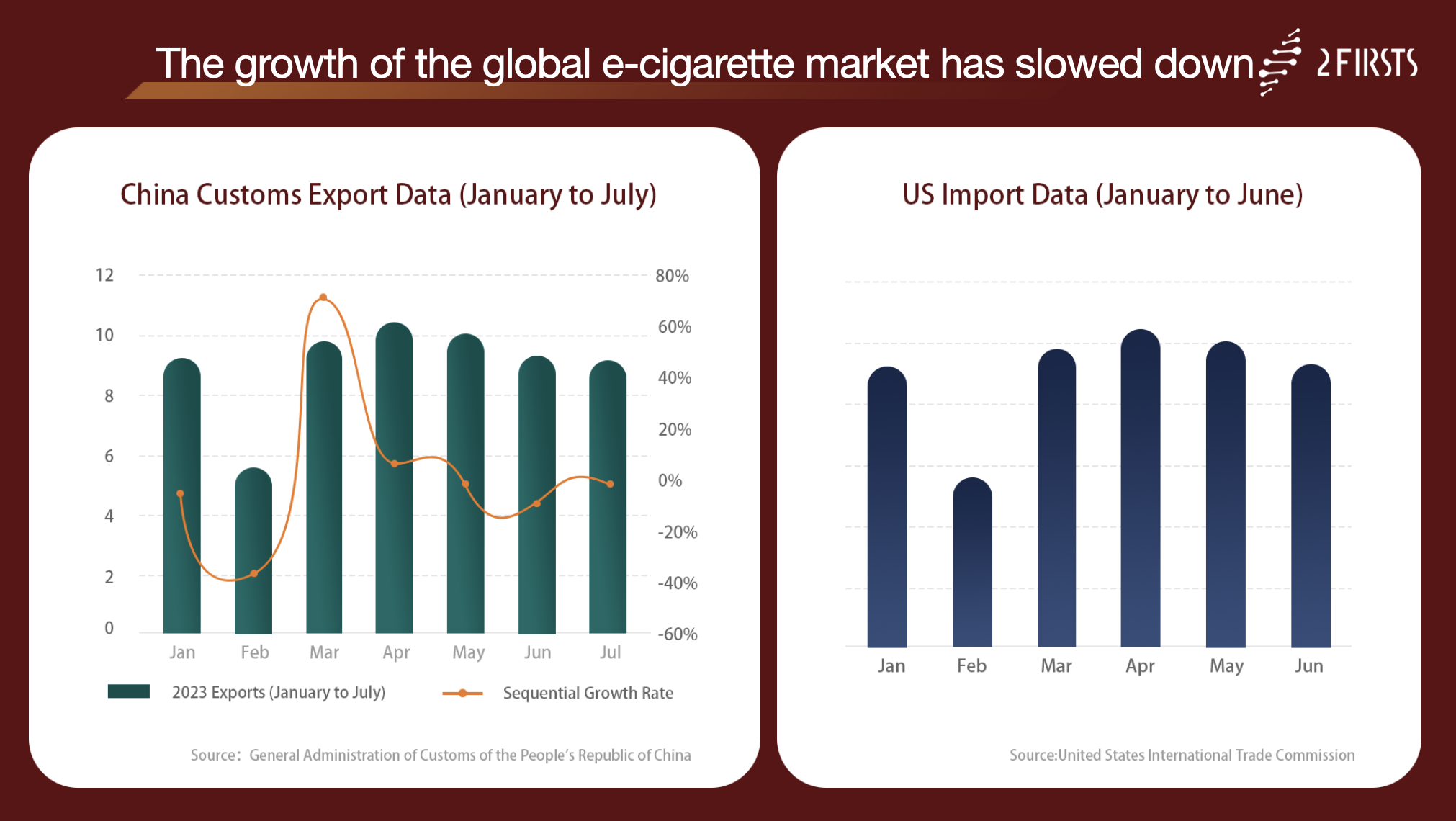

So why has the phenomenon of 'involution' appeared? Because the growth of the global e-cigarette market has slowed down, brands and manufacturers need to work harder to snatch the untouched pie. This is the first fact that I want to share.

We can see the specific development changes from the perspective of the export end in China and the import end taking the US market as an example.

On the left is the export chart of the Chinese customs from January to July. We can see that the export volume is still growing, but the growth rate is slowing down.

Now let's look at the data of US imports, which essentially matches up with China’s export data.

Let's take a look at a chart, which shows the growth of various exporting countries in 2022;Before 2023, e-cig exporters saw rapid growth,But that's over now.

At the same time, supply chain expectations are also weakening. According to a survey conducted by 2firsts targeting Chinese supply chain companies, in the first half of 2023, the overall performance of the supply chain indicates that more than half of the companies achieved growth, but 52.4% of companies did not meet growth expectations.

Additionally, about 19% of companies saw a decline within expected ranges, while 16.7% of companies experienced a decline beyond expectations in these two quarters.

As the market shifts from incremental development to inventory-market competition, and the market entry threshold remains relatively low, market competition gradually becomes inefficient. This is the "involution" we just mentioned. Still taking the US customs import data as an example, the transaction price per unit has been continuously declining. Brands try to defend their share by sacrificing profits, getting trapped in low-price competition, and in some markets, zero-profit products have appeared.

On the distributor side, compared to exploring the market and nurturing brands, it's actually easier to directly profit from the brands’ inventory. At present, pay-after-use sales are gradually becoming normalized in the mainstream market.

We have repeatedly mentioned that the e-cigarette industry has ended its high growth phase, but the penetration rate of e-cigarettes is still low. There is huge room for growth, and it has not yet reached its ceiling. So what is stopping the rapid growth of e-cigarettes?

We believe there are two factors: regulation and technology.

In 2015, the technological revolution represented by nicotine salts brought e-cigarettes into a new era. From 2020, disposable products, a category that was not thought highly of, rapidly expanded globally due to the flavor ban of pod salts in the US, driving a 30% growth rate.

Entering 2023, the unexpected growth of disposables has also brought a series of problems, such as product safety, protection of, and environmental protection. This has made the mainstream market regulators realize the necessity of taking control of e-cigarettes and accelerated the introduction of policies.

From the chart above, we can see that in the countermeasures taken by governments around the world regarding e-cigarette regulation in the past year, the prohibition of disposables has been the most mentioned. The FDA also started in May of this year to issue "import alert orders", and "import refusal orders", for leading disposable e-cigarette brands that have not applied for PMTA and even carry out strict enforcement against wholesalers and retailers.

In 2022, China introduced a series of policies, namely the "E-cigarette Management Measures". Significant impacts on the industry have been observed since the policy was introduced. Taking the domestic leading brand RELX as an example, after the policy was implemented, RELX's sales plummeted sharply in the first quarter, and the slight rebound in the second quarter did not bring the king back. We believe such survival problems faced by RELX will continue to occur under the global regulatory trend.

With the existing regulatory environment and technological status quo, the potential market that e-cigarettes can develop has become saturated. To expand into a larger market, more refined regulations and more innovative products are required.

The growth of e-cigarettes, if analyzed using the Product Life Cycle Theory, would exhibit a scallop-shaped growth.

Before being able to break through, shrinkage may occur in some markets. RELX is a vivid example.

We all look forward to the continued growth of the industry and a technological breakthrough. Changes are needed, and changes will happen in business models, technology, and regulations.

To eliminate “involution”, in other words, to break the current low-efficiency competition, it is necessary to re-establish the channel business model.

The current e-cigarette channel chain starts from Manufacturers/Brands (shipment) to nationwide distributors, then to secondary agent distributors who sell to wholesalers, then it goes to retailers who finally sell products to consumers. The current profits can no longer support such a long chain, and the channels cannot shoulder the responsibility of developing and promoting brands.

Therefore, in the next step, key distributors will occupy a larger share. Brand owners will give up their dependence on distributors and turn to operate their own channels deeply themselves. The market competition threshold becomes higher, the market will concentrate on leading brands ,the small and medium brands will gradually withdraw from the mainstream market.

In the past, we categorized e-cigarettes into open-system e-cigarettes, pod-based e-cigarettes, and disposable e-cigarettes. This classification was based on the existing technological framework. However, driven by market demands and regulatory compliance requirements, new categories are emerging.

VAPORESSO COSS combines the features of open-system, pod-based, and disposable products;

IVG2400 features built-in replaceable cartridges or has a high puff count disposable option, blending the characters of disposable and pod vape features;

Even some product make a fusion of disposable and open systems, is primarily targeted at the Indonesian market.

In the 2023 semi-annual supply chain survey report by 2firsts, the most of people are looking forward to disposable products with new niches in the second half of the year.

In terms of regulation, three characteristics will emerge,They are the systematization approach, scientific management and the global cooperation.

Apart from the content mentioned above, we believe that the following trends and changes will occur in the global e-cigarette industry in 2024:

- From regulation to market demand, e-cigarettes will gradually complete the transformation from being a fashionable fast-moving consumer good back to their tobacco essence.

- Starting from environmental protection and consumer usage experience, the category of pod system holds the most strategic significance in the market. In 2024, pod system e-cigarettes will also regain their focus in the mainstream market in Europe.

- Tobacco giants will face off directly with e-cigarette companies. The e-cigarette companies will face diverse competitive pressures from tobacco companies, including diverse measures.

The above trends are mostly still challenges and difficulties; 2024 will still be a tough year. As a Chinese internet entrepreneur once said: "Today is hard, tomorrow will be harder, but the day after tomorrow will be beautiful." This statement is also applicableto the global vaping industry.

Although we see the global e-cigarette industry in a state of involution today, we also believe that technology and regulation will drive the spiral rise of the industry, giving birth to new business models and occupying a broader market.

This is exactly the inspiration behind designing 2firsts.

We believe that a world with more reduced harm will surely come.

We welcome you to continue following 2firsts. Here is my Twitter, Let's keep in touch.

We wish you all fruitful gains from this InterTabac journey. Thank you, everyone.