Since the second half of 2023, many e-cigarette brands in the UK have been launching their own e-liquid brands, and the bottled e-liquid market has been heating up quickly. At the end of January 2024, the UK Prime Minister announced the ban on the sale of disposable e-cigarettes, further intensifying the competition in the e-liquid market.

Leading e-cigarette brands in the UK market, such as ELFBAR, LOST MARY, SKE, and VUSE, have all introduced their own e-liquid brands, significantly accelerating the maturity process of the e-liquid market.

As a key player in the global e-cigarette market, the shift in the UK market presents both challenges and opportunities for China's e-cigarette supply chain.

Dual-track Market: Bottled E-liquid and Large-Puff Products

The popularity of bottled e-liquid products in the UK is largely attributed to the success of OXVA, an e-cigarette brand known for its open system products. According to industry insiders, OXVA's products surged in the UK market in the second half of last year, leading to growth in the entire e-liquid market. Following this, several well-known disposable e-cigarette brands in the UK have released their own e-liquid products to meet market demand.

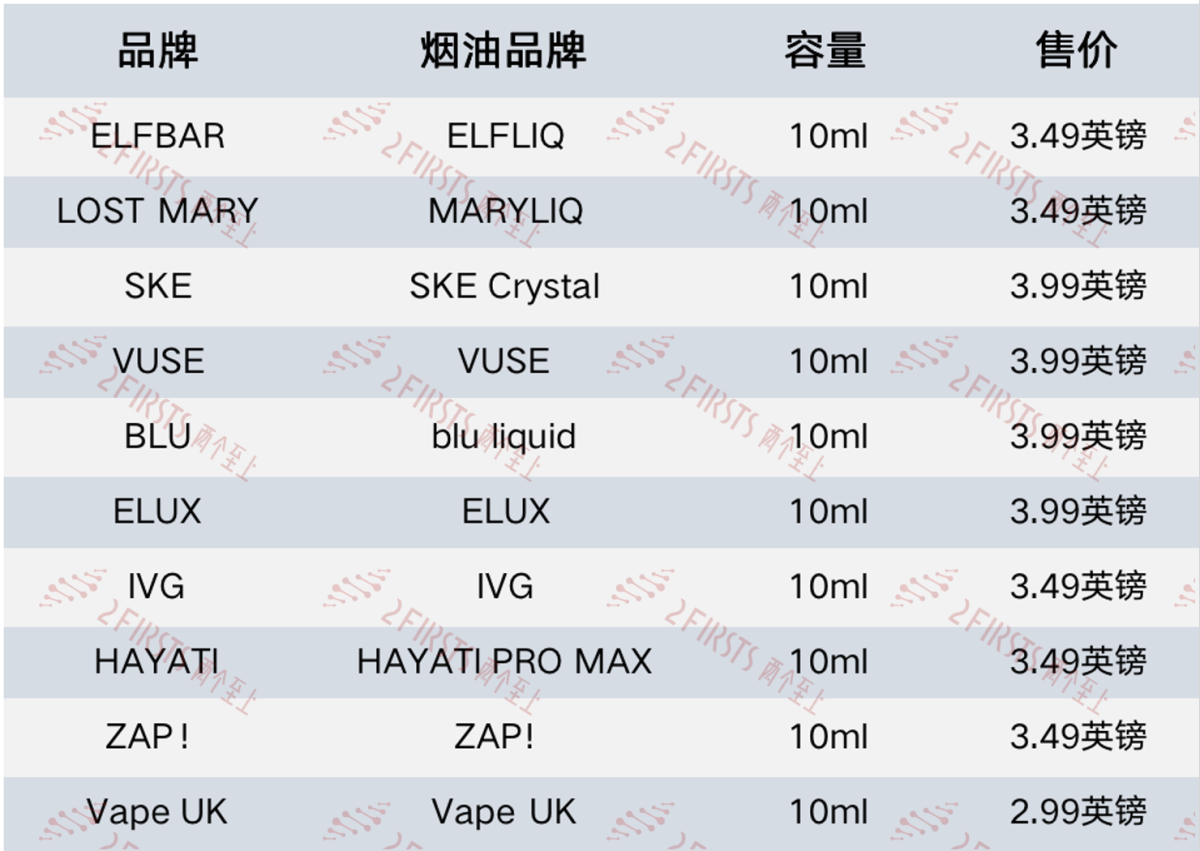

According to statistics from 2FIRSTS, in addition to brands such as ELFBAR, LOST MARY, SKE, and VUSE, other brands like ELUX, GOLG BAR, HAYATI have also joined the ranks in launching e-liquid products. Even well-known American e-cigarette brand TYSON has entered the UK e-liquid market, participating in the increasingly competitive field. This indicates that almost all mainstream brands in the UK market have started offering their own e-liquid products.

In addition to bottled e-liquid, there is also a growing demand in the market for large capacity e-liquid storage products. For example, this year saw the introduction of "tank-style e-cigarettes" equipped with an additional 10ml external e-liquid tank. There are also innovative "cartridge-style disposable e-cigarettes", which integrate multiple 2ml pods internally. The introduction of these products has significantly increased the consumption of e-liquid.

Two industry insiders have confirmed to 2FIRSTS the current market trends. An employee working at an e-liquid manufacturing factory in China revealed that since the second half of 2023, there has been a significant increase in demand for bottled e-liquid in the European market, resulting in a rise in the company's order volume. Additionally, a logistics professional pointed out that the number of orders for e-cigarette products with multiple pods included has noticeably increased in the UK dedicated line they are responsible for this year.

A Community of Opportunities and Challenges

The rise of bottled e-liquid and large capacity e-cigarette products in the UK has brought new opportunities to the e-liquid industry. These opportunities are not only reflected in the increase in order volume, but also in changes to the business model.

A Chinese e-liquid manufacturer's representative stated that the rise of bottled e-liquid has provided a direct opportunity for e-liquid manufacturers to engage with consumers, allowing them to better understand the demands of regional markets and become key players in the consumer market competition.

The individual stated that there are currently two main e-liquid sales models in the UK market: one is for e-liquid manufacturers to promote their own brands, and the other is to collaborate with major brands by providing production technology and formulas for white-label production.

Although the latter is mainly used in the e-liquid market in the UK, e-liquid manufacturers are gradually becoming direct participants in market competition, driving them towards brand development. Branding not only enhances the market position of manufacturers, but also brings higher profit margins, becoming an important avenue for e-liquid manufacturers seeking breakthroughs.

In the short term, Chinese e-liquid manufacturers are enjoying this wave of prosperity. However, in the long run, Chinese e-liquid manufacturers are facing more challenges.

For e-liquid manufacturers, disposable e-cigarettes need to be assembled with oil injection at the supply chain end. However, disposable e-cigarettes in the UK market are largely sourced from China, giving Chinese e-liquid manufacturers a unique geographical advantage. The rise of the UK e-liquid market has led to a situation where the oil cartridges can be purchased directly from European e-liquid manufacturers. In the UK and France, there are many e-liquid manufacturers, causing Chinese e-liquid manufacturers to lose their geographical advantage.

Breakthrough: Establishment of Overseas Laboratories and Maintenance of Cost Advantages

In response to the weakening of its geopolitical advantage, some e-liquid manufacturers in China have taken proactive measures. It is reported that top e-liquid companies have set up local fragrance laboratories in the UK to compensate for the loss of geopolitical advantage due to supply chain distance and oil machinery separation.

Furthermore, China's supply chain still holds advantages in terms of price competitiveness. Due to differences in taxation policies among different countries, such as higher e-liquid taxes in Europe leading to increased production costs, coupled with significantly higher labor costs in Europe compared to China, Chinese e-liquid products have a clear advantage in terms of pricing.

It is worth mentioning that in the Chinese e-liquid market, top companies often establish close partnerships with well-known e-cigarette brands. Some industry experts believe that for e-liquid manufacturers, partnering with major brands seems to be the only way forward.

In response to this, a representative from an e-liquid manufacturer suggested that businesses should strive for diversified partnerships, utilizing a "one-to-many" model to avoid overreliance on a single partner and thus maintain innovation and competitiveness. This strategy helps e-liquid manufacturers maintain flexibility and independence in the competitive market.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com