Key Points

- Diverging paths: JTI doubles down on traditional cigarettes and value brands, in contrast to PMI and BAT’s focus on “smoke-free products.”

- U.S. market: After a US$2.4 billion acquisition of Vector Group’s cigarette business in October last year, JTI is betting on value brands such as Eagle 20’s; it expects the U.S. value segment to exceed 40% by 2027.

- Performance: 2024 cigarette volume +2%; revenue +9%; profit +10%.

- RRP progress: Launched the Ploom AURA device in Japan in May, followed by Switzerland; a strategic joint venture with Altria aims to commercialize Ploom in the U.S. JTI invested about JPY 300 billion in RRP during 2022–2024 and plans to invest over JPY 650 billion in 2025–2027, without a disclosed smoke-free revenue target.

- Market trends: Since 2021, premium cigarettes’ U.S. share has declined; amid inflation and higher taxes, consumers are more price-driven.

- Health & regulation: The CDC states that neither heated tobacco nor e-cigarettes are “risk-free”; varying regulatory and supply conditions continue to shape product portfolios across markets.

2Firsts, September 28, 2025 — According to Bloomberg, Japan Tobacco International (JTI) is taking a markedly different path from its peers in the global tobacco industry. While Philip Morris International (PMI) and British American Tobacco (BAT) have set revenue-mix targets for “smoke-free” products and are increasing investment in e-cigarettes, heated tobacco, and nicotine pouches, JTI continues to focus on traditional combustible cigarettes and is stepping up its presence in value-priced brands in the United States.

Strategic Direction: Diverging from Peers’ “Smoke-Free” Path

Bloomberg reports that Japan Tobacco International (JTI) is taking a differentiated route amid the industry’s transition toward “smoke-free” products. Unlike Philip Morris International (PMI) and British American Tobacco (BAT), which have set revenue-mix targets for smoke-free categories and increased investment in e-cigarettes, heated tobacco, and nicotine pouches, JTI continues to center its strategy on traditional combustible cigarettes.

The company is deepening execution in its core business while tracking price-tier shifts and consumer affordability across markets, using value brands and localized product upgrades to support share and earnings.

United States: Value Brands Accelerate Amid Structural Trade-Down

In October 2024, JTI acquired Vector Group’s cigarette business for US$2.4 billion, bringing Eagle 20’s, Pyramid, and Montego into its portfolio. These brands sit at lower price points and emphasize “value for money.”

Retail feedback indicates that inflation and rising prices are prompting some consumers to trade down from premium brands to more affordable options. JTI expects the U.S. value segment to increase from roughly 32% in 2022 to above 40% by 2027.

To adapt to this structural trade-down, several companies are testing lower price tiers to mitigate share erosion. JTI’s value-brand footprint and the integration synergies from the deal position it to benefit directly from this trend.

Europe: Upgrades to Packaging and Taste for Heritage Brands

In key European markets such as Germany, Spain, and Italy, JTI is upgrading packaging, flavor profiles, and product quality for Winston, Camel, and other brands to match local preferences and strengthen shelf competitiveness.

The company reports 2024 results showing cigarette volume up 2%, revenue up 9%, and profit up 10%. In a tighter regulatory environment and increasingly competitive incumbents’ market, share gains driven by product strength and brand equity have become JTI’s key lever for European growth.

Reduced-Risk Products (RRP): Steady Investment and Pace

For RRPs, JTI maintains a “steady progress” approach. The Ploom heated-tobacco brand launched the new Ploom AURA device in Japan in May and subsequently entered Switzerland, focusing on improved user experience and heating efficiency.

A strategic joint venture with Altria aims to advance Ploom’s commercialization and regulatory rollout in the U.S. Financially, JTI invested about JPY 300 billion in RRPs during 2022–2024 and plans to invest more than JPY 650 billion during 2025–2027; the company has not, however, announced a revenue-mix target for smoke-free products.

Peer Comparison: Investment Scale and Revenue Targets Differ

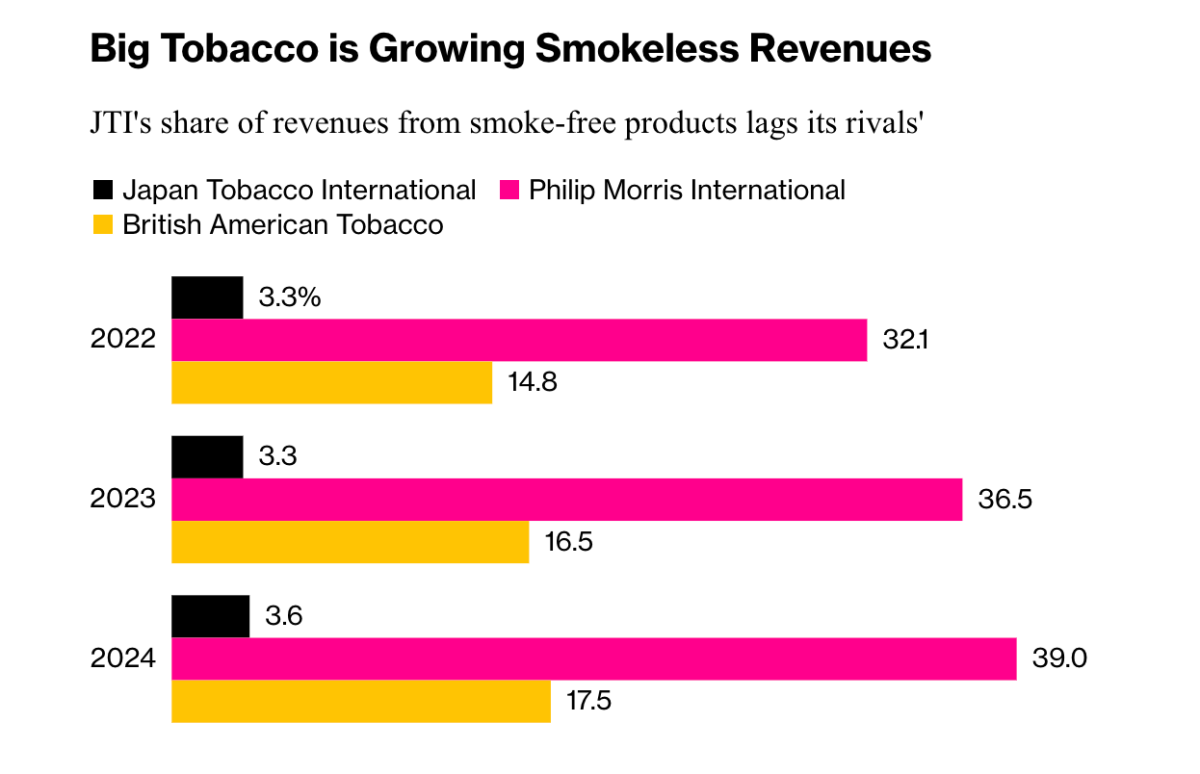

Since 2008, PMI has invested over US$14 billion in smoke-free products and targets two-thirds of group revenue from businesses such as ZYN nicotine pouches and IQOS heated tobacco by 2030.

BAT, for its part, aims for at least half of revenue from smoke-free products by 2035. By contrast, JTI underscores sustained competitiveness in combustibles while advancing RRPs through phased capital expenditure—without front-loading a revenue-mix commitment.

U.S. Price Sensitivity and Pressure on Volume/Price: The Market Re-Segments

Research tracking indicates that the U.S. premium segment’s share has fallen from roughly 80% to around 70% since 2021, reflecting a sharp rise in price sensitivity. In 2024, BAT’s U.S. cigarette volumes declined 10.1%, a notable example of pressure on both volume and price.

Against this backdrop, value brands and more granular price tiers have become key tools for manufacturers to defend share in a mature market. Through acquisition and portfolio adjustment, JTI is leaning into the value segment’s growth curve.

Emerging Markets: Combustibles First, RRPs Introduced When Timely

Across parts of Asia and Africa, JTI continues to lead with traditional combustibles, seeking revenue growth through share gains while monitoring demand shifts to introduce RRPs when appropriate.

In Tanzania, for example, retailers report increased inquiries and purchases of e-cigarettes and disposables among younger consumers despite higher prices, though supply structures and regulatory policies still constrain the broad availability of alternatives.

Public Health and Regulation: Continually Shaping Market Structure

The U.S. Centers for Disease Control and Prevention (CDC) emphasizes that nicotine is highly addictive and poses particular risks to youth and pregnant women; even if certain harmful constituents are lower in heated tobacco than in combustibles, no tobacco product is “safe.”

Within tightening regulatory frameworks worldwide, policy debates over product structures, market access, and tax systems will continue to influence how companies allocate portfolios and capital across countries.

Company Background and Global Footprint: History and Regional Profile

Japan Tobacco (JT) was founded in 1985 and completed privatization reforms in 1994; the Japanese government still holds roughly one-third of its shares. In 2024, the group reported consolidated revenue of about JPY 3.15 trillion and sold approximately 541.9 billion cigarettes across 130 markets.

JT expanded its presence in the U.K. and Europe via the 2007 acquisition of Gallaher, followed by acquisitions in Sudan, Egypt, Iran, and Bangladesh. After acquiring Russia’s Donskoy Tabak in 2018, its Russian market share approached 40%. JT has suspended new investments in Russia since March 2022 but remains the largest manufacturer there by volume.

In Japan, JTI has raised prices on traditional cigarettes while promoting the Ploom series. Financial disclosures show Ploom’s market share reached 13.6% in Q2 2025, up from 7.6% three years earlier.

Overall View: Combustibles as the Base, Value-Led, RRPs Advanced Prudently

Amid global moves toward “smoke-free” products and tighter regulation, JTI uses combustibles and value brands as its anchor, stabilizing its core business through product upgrades and price-tier management.

At the same time, the company continues to build RRP assets such as Ploom through incremental capital spending, prioritizing clear commercial and regulatory pathways before scaling—forming a portfolio strategy distinct from peers: combustibles-first with a prudent, steady push into RRPs.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com