The autumn and winter season of 2023 has been quite eventful for the new tobacco industry in Japan. In September, RELX launched their disposable product, RELX MagicGo, priced at 1,320 yen. LOST MARY introduced their sales plan in Japan, with their first product, "LOST MARY BM3500," a nicotine-free variant, being made available for online purchase on November 1st. It is being sold on various platforms including online stores, Amazon, and Rakuten market, with a suggested retail price of 1,980 yen including taxes. Then on December 18th, Vuse Go 700, a nicotine-free product under the British American Tobacco (BAT) umbrella, officially hit the shelves of approximately 2,300 FamilyMart convenience stores in Tokyo.

Why have these big brands chosen this particular time to release new products in the Japanese market? What prospects do these major manufacturers see in the current relatively narrow Japanese zero nicotine e-cigarette market?

Tightly Regulated Market

Since 2013, Japan has enforced a strict smoking ban in public places, with the ban gradually expanding its scope. As a result of various anti-smoking measures, the overall sales of traditional tobacco in Japan have continuously declined, hitting a record low of 32.415 billion yuan in 2015. Additionally, Japan's pharmaceutical regulations have imposed stringent restrictions on the sale and importation of e-liquids, which has hindered the widespread adoption of e-cigarettes that utilize e-liquids.

The most distinctive feature of the Japanese market, unlike any other, is its "zero nicotine" standard. While other markets also have restrictions on nicotine levels, there are still loopholes that players can exploit. In 2023, Inter Scientific, a UK-based institution, exposed the fact that some e-cigarette products claiming to be "nicotine-free" in the UK actually contained the same levels of nicotine as regular products on the market. This gap not only increases the risks in product quality but also inadvertently stimulates market activity.

However, such incidents are unlikely to occur in strict-regulated Japan. According to several industry professionals working in Japan, the country remains a "credit society". Once someone has a "criminal record," it becomes extremely difficult for them to navigate within the industry.

In particular, within such a close-knit community, once credibility is lost, it becomes difficult to navigate the future path.

A channel distributor based in Osaka has informed 2FIRSTS that the most "outrageous" form of regulatory violations involves Chinese exchange students in Japan repeatedly engaging in the illicit sales of grey market products. However, due to limited profits and obstacles in distribution channels, these activities have had minimal impact and overall do not undermine the fact that Japan is a relatively tightly regulated market.

Currently, vaping prescriptions are legal in Japan, but no product has yet passed prescription certification, and the Japanese government is still in a wait-and-see state. Local industry insiders have informed 2FIRSTS that the process of policy change in Japan is slow and time-consuming, including the steps of "proposing a bill, commissioning committee review, deliberation in the full session of the Diet, and voting (excluding publication)". If there are no signs of relaxation at the moment, it may require more time.

Leading Brands That Got a Head Start

When it comes to the specific strategies employed by the brand itself, it presents a different situation altogether.

Apart from heated tobacco products (HTPs), the new tobacco products visible in the Japanese market are mainly limited to nicotine-free vapes. The long-standing concern among industry professionals about this category is that zero-nicotine products lack addictive qualities, and consumers will not develop a dependence on them. Without demand, there will also be no repeat purchases. For example, the introduction of tea cigarettes, which were consciously targeting smokers wanting to quit, into the Japanese market early on. These cigarettes were made using tea leaves instead of tobacco leaves, but because they do not contain nicotine, local industry insiders have informed 2FIRSTS that their performance in the market has been lukewarm.

Whether it is Vuse from BAT or Lost Mary from iMiracle (Heaven Gifts), these types of disposable nicotine products have performed well since being launched, but their low prices have limited overall profitability. Now that these brands are entering the Japanese market, they may be considering long-term gains rather than immediate profits. This strategy of offering discounts may be aimed at waiting for the day when nicotine-containing products become legal and at seizing market share and brand recognition before that day arrives.

This stage has also been witnessed in the Spanish market. Taking ELUX as an example, this brand initially introduced zero-nicotine products upon entering the market, but their primary focus was on building brand loyalty for future launches. Due to nicotine being an addictive substance, there are significant differences between devices that contain nicotine and those that do not. Even though ELUX's zero-nicotine products have performed well in sales by 2023, the Spanish representative of ELUX still believes that the prospects for nicotine-containing products will be better, as expressed to 2FIRSTS.

Time is of the essence, especially for industries like e-cigarettes that have short cycles. Successfully bridging the timing gap is a crucial step towards achieving success in the future market.

In the unbalanced urban-rural divide of Japan, the emerging tobacco market is primarily concentrated in two densely populated city clusters: the Tokyo-Yokohama metropolitan area, commonly referred to as the Greater Tokyo area, and the Kansai metropolitan area encompassing Kyoto, Osaka, and Kobe, commonly known as the Keihanshin region. However, among these two, the former experiences more prosperity.

Traditional smokers in Osaka are finding less incentive to switch to newer tobacco alternatives due to the prevalence of outdoor dining establishments and the overall smoker-friendly environment in public spaces.

Therefore, the Greater Tokyo Capital Region currently has a relatively favorable development environment for the new tobacco industry.

Marketing Campaign: Lenient but Costly

Starting in 2024, the state of New York in the United States will begin implementing stricter marketing restrictions on e-cigarettes and vaping products. These restrictions include prohibiting e-cigarette brand names, logos, or any other identifiers from appearing on any products other than the actual e-cigarettes themselves. It will also be prohibited to offer gifts related to the purchase of e-cigarettes. Additionally, brands will not be allowed to sponsor events such as sports competitions or concerts.

Compared to these countries, Japan has less stringent regulations on the promotion of new tobacco products. E-cigarettes and heated tobacco devices are not classified under nicotine products like cigarettes. Instead, they are sold under the category of "small household appliances".

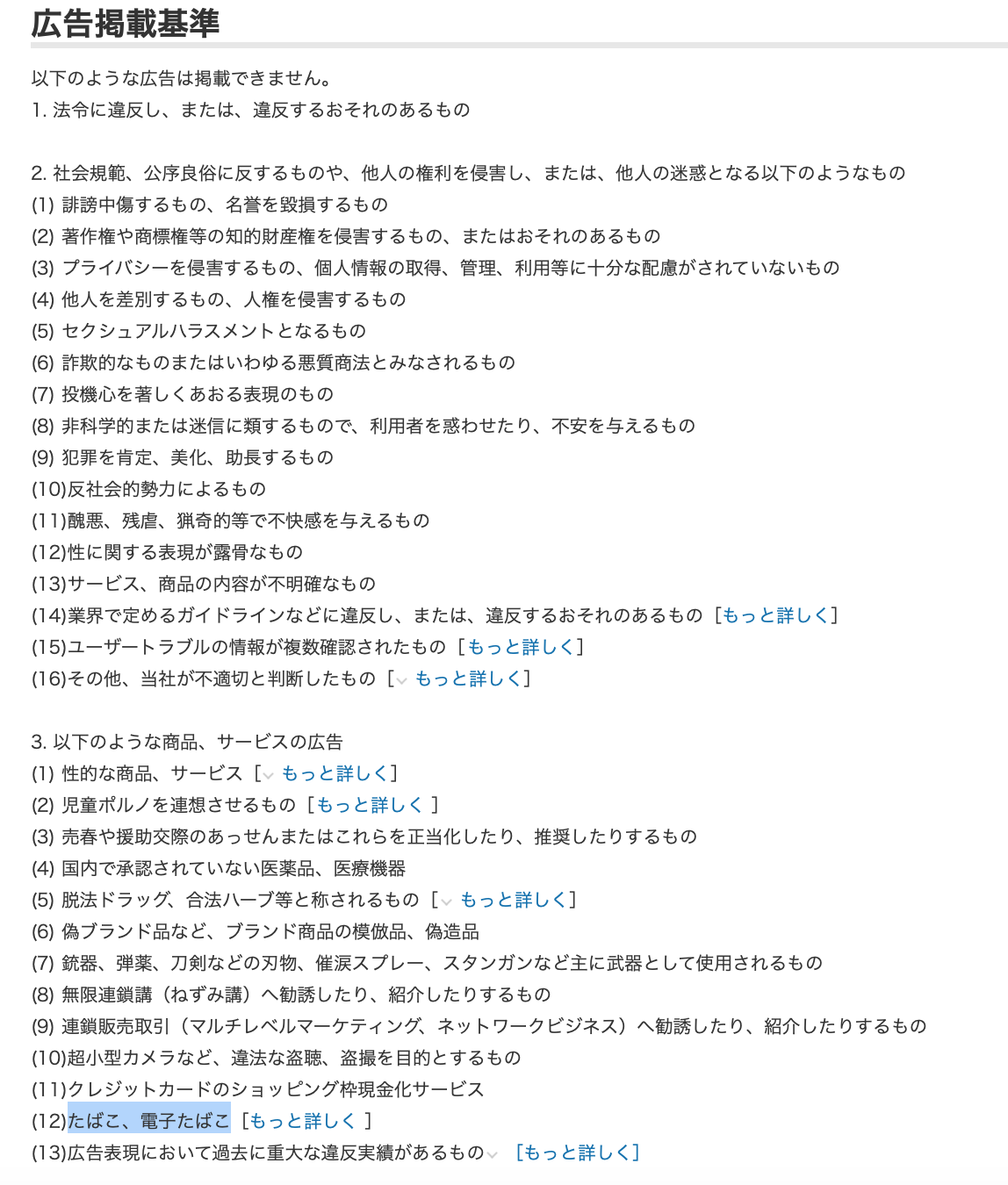

Such classification puts the sellers in control of advertising exposure: promotional activities are not restricted by national laws and regulations and the burden of breaking through is shifted to online advertising distribution channels such as Yahoo and Google. Company policies change more frequently than government regulations, requiring brand dealers to closely follow their actions and make adjustments accordingly.

It is highly likely that last month they were running your (new tobacco) advertisements as usual, but this month they have started limiting the exposure or outright rejecting them.

In addition to dealing with online platforms as promotional channels, another challenge lies in cost control. The fees for shelf placement in drugstores and convenience stores, as well as the cost of field promotion personnel, are all factors that brands need to carefully consider. This is because labor costs in Japan are generally high, with a part-time college student earning around 10,000 yen per day (approximately $67.55), while professional sales personnel command even higher rates.

As for the former, the shelf placement fee in Japanese convenience stores is exorbitant. Typically, manufacturers have to pay approximately 250,000 yen (approximately $1,688.78) just to introduce a new product to convenience stores. "For a single store, that's 250,000 yen, and for 100 stores, it amounts to 25 million yen (approximately $168,878)."

Furthermore, 15% of the sales in the first three months will also go to the store owner. While there is generally no entrance fee for drugstores, the turnover rate of products is high. If a product does not perform well for a consecutive period of time, it will be taken off the shelves. Additionally, there is a very limited number of Stock Keeping Units (SKUs), requiring small-scale brands to establish long-term and solid partnerships with store owners- all of which hinder the growth of smaller brands.

“The small brand was doomed from the outset and had virtually no chance of survival," a practitioner in Osaka told 2FIRSTS.

This claim has also been confirmed by several industry insiders. According to a Tokyo distributor, many companies would only "import tens of thousands of products once, and if they can't sell them, they would discontinue production after clearing the inventory.

It is not easy for new tobacco brands to enter the Japanese market due to the tightly controlled "credit society," strict production conditions, and the unpredictable advertising channel merchants. However, when small brands are restricted by entry conditions and believe in the vast prospects of the market after the easing of restrictions, major brands have started to enter the market and distribute their products.

Will the Japanese market for zero-nicotine open up in the foreseeable future? Will the investment of big corporations pay off at that time? 2FIRSTS will continue to monitor the latest developments in the Japanese market.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com