【By 2Firsts】At the World Vape Show 2025, Wayne Zhang, CEO of the HNB (HTP) brand NEX, stated that NEX is the only exhibitor at the event focusing on HTP products. To gain a deeper understanding of the HTP market landscape and NEX's development strategy, 2FIRSTS conducted an exclusive interview with Wayne.

In a market dominated by international tobacco giants and plagued by technological barriers, how can small and medium-sized enterprises find a way to break through? What are the differentiated characteristics of the HTP markets around the world? In an increasingly stringent regulatory environment, how should brands plan their global strategies?

In response, Wayne offered his insights. Using NEX as an example, he explained how the company transitioned from a consumer brand (To C) to a technology solutions provider (To B), and shared the market positioning strategy and practical approach based on global regulatory differences.

Not Focusing on the C- End: NEX's Choice of the B-end Path

According to Wayne, the parent company behind NEX is Beijing Cha Wang Biotechnology Co. Ltd. The company has been focusing on the research and development of tobacco alternatives since 2015, and began laying the groundwork for HNB (HTP) technology in 2017. In 2023, the NEX brand was registered and granted production permits in South Korea, and the following year officially launched its first product.

Currently, NEX's core business positioning is to provide a comprehensive solution for global tobacco manufacturers and distributors to enter the era of smokeless products.

NEX does not directly target end consumers. Its target customers include traditional tobacco companies, large distributors, and e-cigarette businesses that are interested in entering or transitioning into the HTP field. Wayne stated that NEX offers integrated solutions covering product manufacturing and technical services, with a brand positioning that focuses more on showcasing research and development capabilities and production strength rather than creating a global consumer brand.

Japan and the European Union: From Regulatory Constraints to Product Differentiation - The "Herbal Turn" in the HTP Market

As HNB (HTP) products become increasingly popular worldwide, countries have significantly increased their regulatory efforts on these new types of tobacco products. In this context, in order for companies to achieve a global presence, they must develop differentiated compliance strategies based on the regulatory environment of different markets, and flexibly adjust product form and positioning.

Taking South Korea as an example, the country's regulatory system is relatively comprehensive, with HTP products requiring clear sales and production permits. Despite having a mature manufacturing base, the market has long been dominated by top tobacco companies such as KT&G and Philip Morris International (PMI), with highly closed core channels like convenience stores making it difficult for new brands to enter.

In response, Wayne stated that while South Korea has a good production and research environment, channel control is highly concentrated and not suitable as a main sales battlefield. Therefore, NEX will establish South Korea as a strategic technology base and focus on expanding its main market overseas.

In the heavily regulated markets of Japan and the European Union, the differentiation of compliance strategies is becoming more evident.

Wayne explained that the Japanese market does not allow the sale of non-tobacco products containing nicotine, but is open to products that are completely nicotine-free herbal alternatives. As a result, some companies have chosen to enter the market with "non-tobacco + nicotine-free" products. The Heabal series of products launched in Japan by NEX uses natural herbal ingredients and thin slice technology to manufacture products that do not contain nicotine, thus bypassing tobacco product regulations.

The European Union will officially implement a flavor ban starting in October 2023, prohibiting the sale of heated tobacco products with fruit, mint, and other flavored characteristics. In response to this policy, Wayne stated that many companies are choosing to introduce "non-tobacco flavored pods" before the ban takes effect, while NEX has developed the TEAGAR series products, which are based on herbs but contain nicotine, to circumvent the restrictions on the definition of "tobacco products".

He pointed out that EU regulations are focused on "tobacco-derived products," while nicotine products using non-tobacco-based materials are currently in a regulatory grey area. This strategy allows products to retain flavor and satisfaction while avoiding being directly limited by traditional tobacco regulations.

Overall, Wayne believes that the global HTP market is entering a stage of "policy-driven innovation." For companies looking to expand into international markets, understanding the regulatory logic of each country and flexibly adjusting product formats will be crucial to success.

Middle East and Russia: Traditional HTP Demand Released in Lenient Regulatory Area

In contrast to the "compliance detour" strategy in the Japanese, South Korean, and EU markets, in regions with relatively lax regulations such as the Middle East and Russia, the compliance threshold for HTP products is significantly lowered, and traditional tobacco-type pods still dominate. Several companies opt to launch nicotine-containing, flavored standard heated tobacco products in these regions to meet consumers' preference for an authentic tobacco experience.

According to Wayne, Russia currently has the second largest market share in the global heated tobacco product (HTP) market, second only to Japan. In the Middle East region, countries such as Iran and Iraq have not yet clarified the legal status of HTP products, but there is a significant consumer base and some markets can even support a single brand's main revenue.

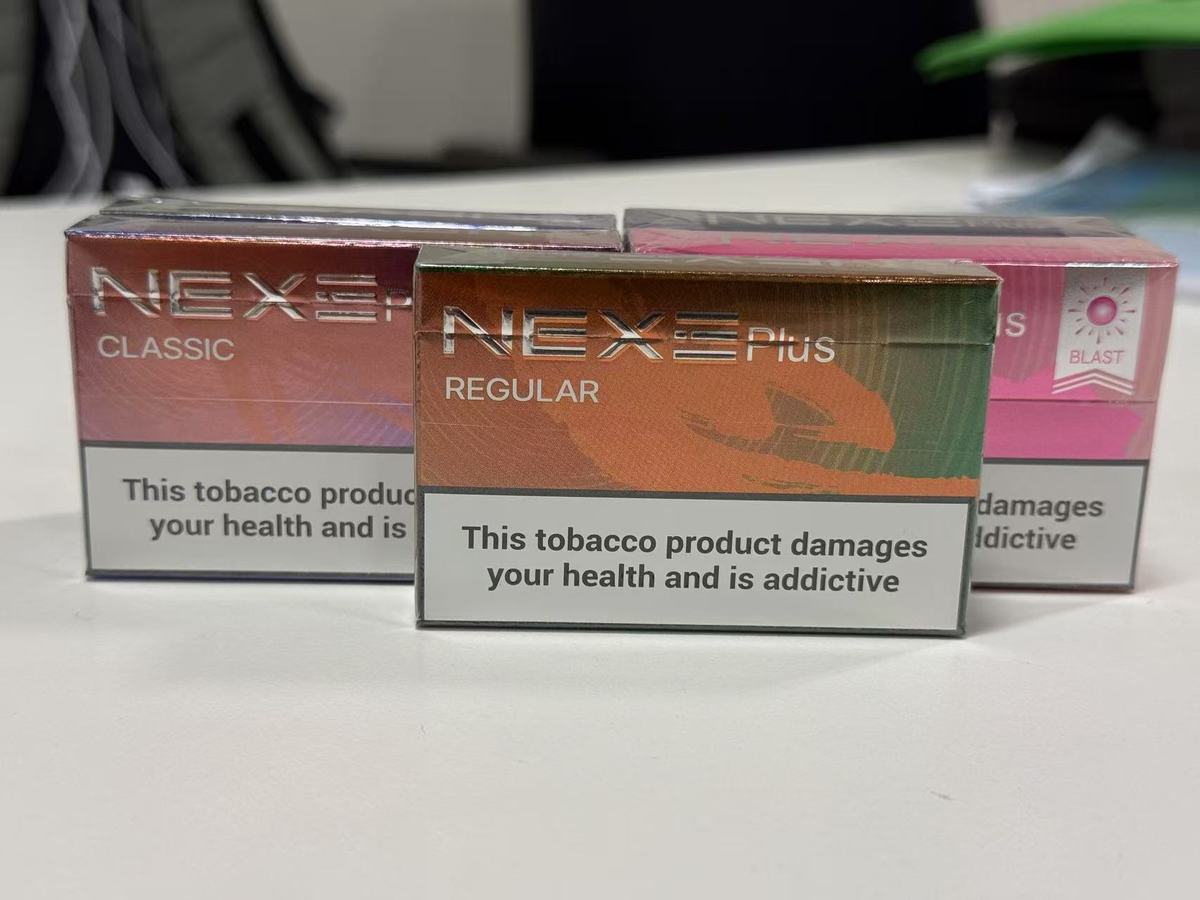

In these countries, the market share of traditional cigarettes remains high, and consumers are more inclined towards a "tobacco substitute" rather than a "nicotine new experience" route. Wayne stated that this market environment makes NEX more inclined to promote nicotine-containing heated tobacco products NEXE in these regions.

United States: Barriers Rise, HTP Companies Shift Towards Heating-Type Cannabis Products

The American market is known as one of the most strictly regulated markets worldwide. New tobacco products must undergo FDA's PMTA (Pre-Market Tobacco Application) review process, which is not only lengthy but also costly.

Wayne stated that due to cost and policy uncertainties, NEX will not be launching traditional HTP products in the US market in the short term. However, he noted that some startup companies in the US market are trying to introduce cannabis products in the form of HNB. This trend indicates that the market acceptance of "non-tobacco heating products" is increasing, potentially providing new opportunities for companies in terms of technology transformation.

"We are already preparing for our third factory in the United States, which will focus on developing industrial cannabis products presented in the form of HNB," Wayne revealed, "The products are expected to take at least one to two years to be released.

From Thin Film Route to Open Ecology: Observations on HTP Technology Path and Patent Game

In the HNB (HTP) product system, the tobacco form and heating structure used in the pod directly impact the product's flavor performance, patent risks, and production process complexity. Currently, major global manufacturers such as Philip Morris International (PMI), British American Tobacco (BAT), and Japan Tobacco (JT) all adopt a pod technology path centered around "tobacco slices". This technology route, due to its performance in replicating the traditional cigarette taste, has become the mainstream solution for international high-end HTP products.

However, the thin strip technology itself also faces significant patent barriers. Related key technologies have already been widely patented by several international tobacco companies. Wayne stated that despite the high barriers to entry and regulatory risks associated with thin strip technology, it is still a mainstream technology direction worth investing in on the international market.

At the same time, some Chinese companies are also adopting a "granular filling" pod as an alternative route to lower technical barriers and patent risks.

In the realm of smoking accessories, some brands are currently opting to create a closed ecosystem by integrating exclusive devices and patented components.

For example, PMI's TEREApod uses electromagnetic induction heating structure, with internal metal pieces as core components, not only improving heating efficiency but also preventing third-party compatibility through patent means. This design enhances user cleaning experience while also strengthening the exclusive connection between the equipment and consumables. Wayne believes that this highly closed "iOS-style" system, while having its commercial logic, also increases the customer entry threshold and market expansion costs.

In contrast, some companies are trying to build a more open "Android-style" ecosystem. NEX plans to adopt a model of cooperation with multiple Chinese tobacco manufacturers to jointly launch a variety of heating devices compatible with its pods, providing flexible and customizable technical solutions for B-end customers. Wayne stated that this model will allow customers to maintain pod standardization while freely choosing or customizing heating device brands, reducing integration costs and improving market adaptability.

Atomization Brands are Seeking a Second Growth Curve, with HTP Becoming a Key Track

Although the emerging tobacco industry is rapidly evolving, the market landscape for HNB (HTP) products remains highly concentrated. According to industry data, the global HTP market is currently dominated by a few multinational giants, with the top five brands collectively holding approximately 96% to 97% of market share, leaving limited space for new entrants.

However, from the perspective of product technology evolution, HTPpod is currently in the transitional stage from the fifth generation to the sixth generation, with updates and upgrades in materials, structure, and heating efficiency. The industry is experiencing a new round of technological opportunities. Wayne believes that this provides a point of entry for companies with technical expertise.

In his view, HTP and vape are not a zero-sum competition, but two main harm reduction paths that can serve different user groups and develop in parallel. "HTP's main users are often those who have transitioned from traditional cigarettes, valuing authenticity, satisfaction, and the ritual of smoking; while vapor products' users tend to be younger, seeking flavor diversity and trendy vibes, with a focus on social and lifestyle settings.

From the perspective of market structure, the two types of products are not substitutes for each other, but rather are splitting the market share of traditional cigarettes together. Traditional cigarettes currently hold approximately 70% of the global tobacco market share, far from being completely overturned by new tobacco products.

Wayne noted: "The real competitor to HTP and e-cigarettes remains traditional combustible cigarettes."

At the same time, as major vapor companies become more mature in their core businesses, many leading brands are actively seeking a “second growth curve.” HTP products, with their higher technological complexity, greater regulatory challenges, and correspondingly stronger market barriers, are emerging as a strategic expansion option. Wayne stated that NEX aims to offer standardized, easily deployable HTP technology solutions to help such companies enter this new segment at a lower cost.

Looking ahead, the HTP market still holds significant growth potential. Current estimates suggest that global HTP penetration stands at just 5.5%, compared to nearly 50% in Japan. Wayne believes this indicates a strong opportunity for other regions to replicate Japan’s trajectory, with the global HTP sector expected to maintain double-digit annual growth over the next 10 to 20 years.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com