[2Firsts Original] While recent border tensions between Pakistan and India have captured international attention, another development is quietly unfolding—Pakistan’s emerging e-cigarette market. With a population of over 200 million, the country is seeing a phase of unregulated, rapid growth in vaping. Young consumers are showing surprising purchasing power, though the market still faces unclear regulations and underdeveloped distribution channels.

So, what business opportunities lie beneath this mix of potential and uncertainty? And how can Chinese e-cigarette brands find their place in this evolving landscape?

To better understand the local market pulse, 2Firsts spoke with Karen, Supply Chain Director of Horizon Dream International, a service provider with deep roots in Pakistan. The conversation explored consumer habits, product preferences, business conditions, and logistical challenges on the ground.

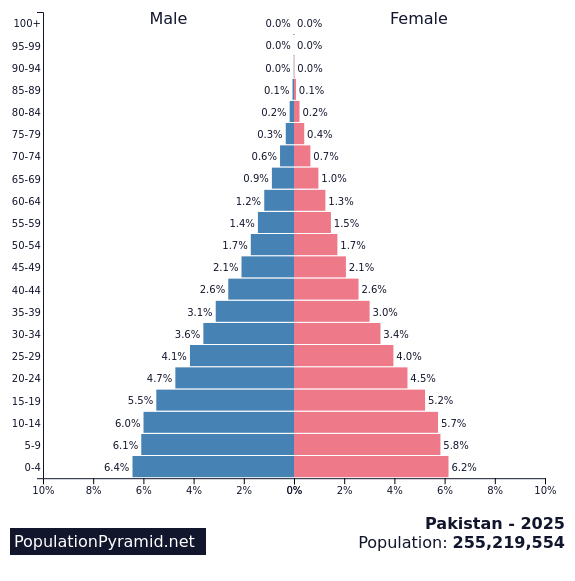

Youth-Driven Consumption Fueled by Demographic Dividend

As the fourth most populous country in Asia, Pakistan is home to nearly 250 million people. According to 2023 data from the Pakistan Bureau of Statistics, nearly 67% of the population is under the age of 30, with those aged 15 to 30 accounting for about 27%.

By comparison, Indonesia—Asia’s third-largest population and a major e-cigarette hub in Southeast Asia—has 40% of its population under the age of 35. In Asia’s emerging markets, Pakistan’s demographic edge stands out. A predominantly young population means strong consumption potential and vast room for market expansion.

The e-cigarette market in Pakistan has been growing rapidly. Just a few years ago, its total value was only tens of millions of U.S. dollars, but it is projected to exceed $300 million by 2025. The market began to take shape around 2022, but it wasn’t until after October 2024 that it truly took off—when consumers gained access to mainstream brands, instead of just overstock items or spillover goods from neighboring countries. In the capital, Islamabad, the number of vape shops surpassed 100 last year, signaling a swift expansion of retail networks.

According to KAREN, local consumers are primarily young people and middle- to high-income urban dwellers. Their spending mindset is “enjoy if you can afford it,” and they show a strong willingness to pay for vaping products—even at relatively high prices. For example, a 6,000-puff disposable vape can retail for around 80 RMB, a 30ml bottle of e-liquid for over 80 RMB, and open-system devices can cost upwards of 200 RMB. Vaping consumption is still concentrated in urban storefronts and has yet to reach rural areas on a large scale.

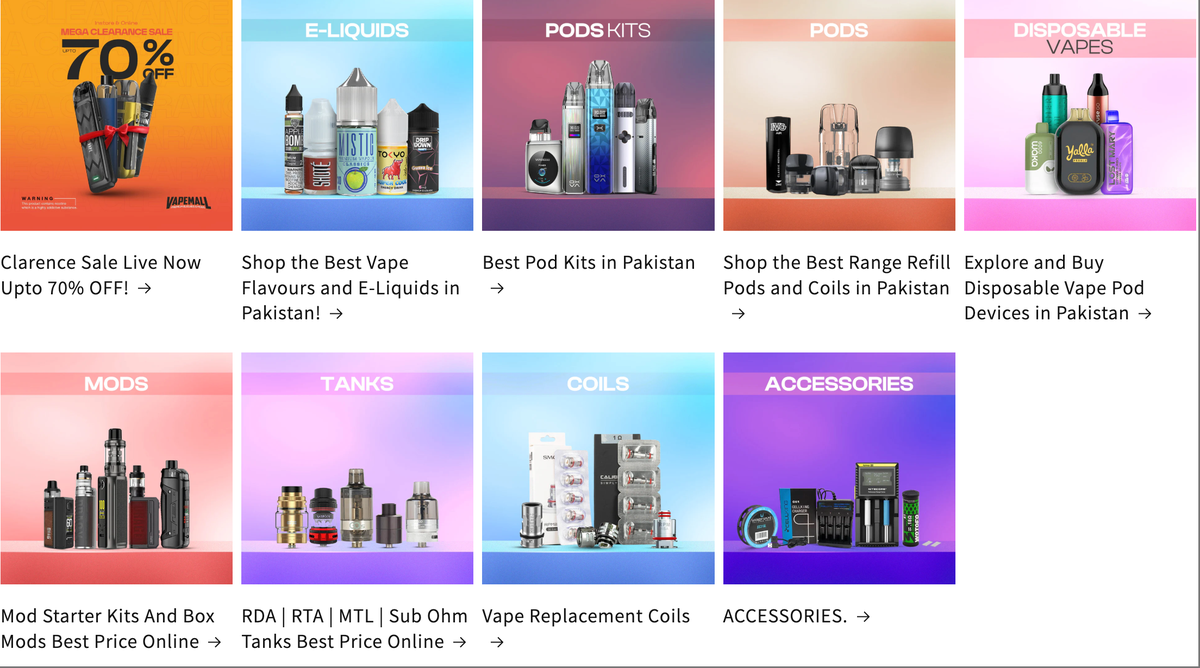

Open-System Devices Dominate; Disposables Still Lack Market Education

KAREN noted that the average monthly income in Pakistan ranges from 800 to 1,200 RMB, making consumers highly price-sensitive. As a result, high-power and open-system devices are more popular. Local users also have a unique purchasing habit: buying e-liquid in small quantities—similar to buying loose cigarettes. Due to the relatively high price of full bottles, many customers go to vape shops to refill just 2ml of e-liquid at a time.

Open-system and high-vapor devices dominate the market, accounting for about 70–80% of sales. Commonly seen brands include Vaporesso, Oxva, Uwell, and FreeMax.

In terms of bottled e-liquids, early brands like Vigor and Tokyo once dominated the market. Today, brands such as Coconut and Deson hold significant market share, while local Pakistani brands have also emerged. These homegrown e-liquid companies are known for their ability to tailor flavors to local preferences, earning strong support from domestic consumers.

Compared with open-system devices, KAREN believes the disposable vape segment in Pakistan remains in its “early education” stage. Acceptance is particularly low in the northern and central regions, where consumer habits are more conservative and awareness is limited. However, in port cities like Karachi—where exposure to new products is greater—disposable devices are seeing increased shipments. Popular options include 10ml, 15ml, and 18ml disposables, including some higher-end models with display screens targeted at affluent users.

High Taxes and Regulatory Gray Areas

Despite the market’s potential, entering Pakistan is far from straightforward. According to Karen, the official tax rate on e-cigarette products exceeds 100%, significantly inflating the cost of legitimate trade. This forces many local businesses to find workarounds to reduce their tax burden, contributing to a wide gap between official import data and actual market activity.

KAREN notes that while some operators manage to reduce their tax obligations through informal means, this increases compliance risks.

The regulatory environment in Pakistan is complex and ambiguous. There is currently no unified e-cigarette law or dedicated regulatory body—but that doesn’t mean there is no oversight.

Customs may investigate product origins, the tax authority may audit invoices, and even street-level promotional events might be subject to random licensing checks.

It may seem like there’s no regulation, but in reality, anyone can give you trouble.

Doing business in such an environment requires various licenses, and even though some businesses operate without them, the lack of proper documentation exposes them to legal and operational risks—particularly during marketing campaigns or promotional events.

Logistics: The Industry’s Biggest Pain Point

Compared to logistics, the above challenges are more manageable. In fact, logistics remain the core challenge—and biggest bottleneck—for companies entering Pakistan’s vape market.

Air freight costs are extremely high. Karen tells 2Firsts that shipping a single smartwatch costs around 130 RMB, while airfreight for e-cigarette products ranges between 180 to 250 RMB per kilogram.

Land shipping is more affordable (around 80 RMB/kg), but significantly slower—typically taking 30 to 40 days—and is subject to uncertainties such as border controls and ad-hoc fees along the route.

Beyond sky-high freight costs, Karen says weak grassroots governance and rampant customs corruption further complicate logistics in Pakistan. Given the high margins in the vape trade, customs officials often demand steep “service” or “lobbying” fees—charges that never appear on official invoices.

The situation has worsened since China and Pakistan signed a year-round customs clearance agreement earlier this year. Under the new policy, former loopholes—such as using travelers to carry goods through “grey” passenger channels—have been shut down. Now, goods must pass through limited-capacity dry ports, causing major congestion.

“Dry ports are fine for commodities like tea. But they’re not built to handle large volumes of stored goods. When too many shipments arrive, the backlog causes long queues.”

The few operational customs routes have become hotspots for informal power struggles among local and federal authorities, leading to unpredictable delays and further clogging the logistics pipeline.

Customs staff turnover adds to the chaos. Between January and April this year alone, four different customs valuation officers were rotated in and out.

The instability of Pakistan’s logistics has changed business habits on the ground. Most local vape distributors insist on cash-and-carry models and refuse to pay upfront deposits due to the high risks involved. This trend puts enormous pressure on Chinese brands to stockpile inventory locally and manage cash flow across borders.

“They simply don’t accept prepayment or deposit models,” Karen says. “There are too many unknowns in logistics—they want spot goods.”

Adding to the complications, currency exchange remains a serious pain point. The Pakistani rupee is not freely convertible, and repatriating funds back to China in a secure and timely manner remains a major challenge for exporters.

Geopolitical Tensions: A Damoclean Sword Over the Market

Finally, Karen warns that geopolitical risk hangs over the Pakistani vape trade like a sword of Damocles. In a recent flare-up, air skirmishes between Pakistan and India prompted Islamabad to shut down national airspace for 48 hours, grounding all flights and disrupting transport nationwide.

Similar “black swan” events undoubtedly bring about hidden costs. Under unforeseeable circumstances such as no-fly zones, road blockades and market shutdowns, logistics costs become even more uncontrollable.

On May 10, following the agreement reached between India and Pakistan for a comprehensive ceasefire, Pakistan announced the full resumption of its airspace. All airports and flights of all types across the country have returned to normal operations.

After the noise of the conflict dies down, the market will continue to develop. At a crucial time full of uncertainties, choosing to expand or not is a question for businesses: choosing to continue expanding means accepting the risks and placing a bet on the future; choosing to retreat may result in the loss of market opportunities and cost advantages.

This is not a simple “yes” or “no” question, but a reality that requires constant weighing. It is precisely the biggest challenge that Chinese e-cigarette companies face in going global and achieving a global layout.