On May 31, Philip Morris International (PMI) announced its plan to introduce its HNB (Heat-Not-Burn) product, IQOS ILLUMA series, into convenience stores. Now, more than 20,000 convenience stores nationwide will be able to purchase the IQOS ILLUMA series products at a discounted price of up to 30,000 Korean won (approximately 162 RMB).

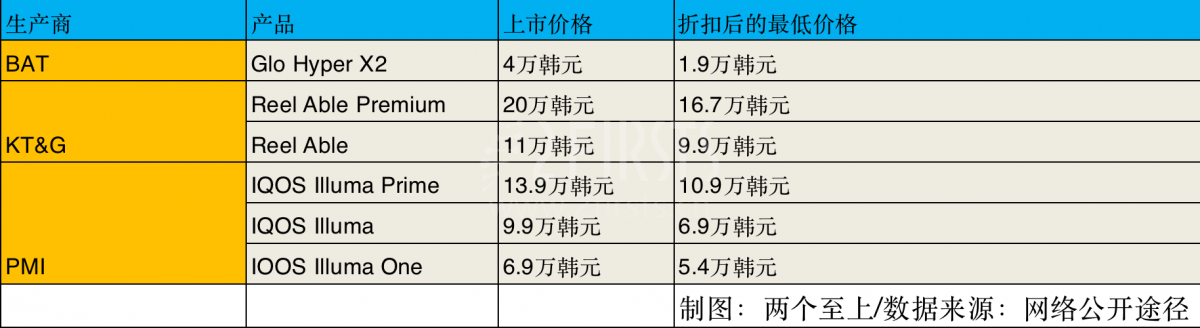

Specific discount plan

The plan released this time includes two significant changes.

Firstly, the reward sales and referral program previously available only for IQOS ILLUMA Prime and IQOS ILLUMA products is now also applicable to IQOS ILLUMA One.

In addition, the consumer program that was previously only available at IQOS official stores has now expanded to more than 20,000 convenience stores nationwide, including GS25, CU, Seven Eleven, and others.

Through the use of a trade-in reward sales program, users can purchase IQOS ILLUMA Prime and IQOS ILLUMA at discounted prices of 109,000 South Korean won (approximately 593 Chinese yuan) and 69,000 South Korean won (approximately 377 Chinese yuan) respectively.

The promotional price of IQOS ILLUMA One is 54,000 Korean won (approximately 291 Chinese yuan). However, in order to avail this offer, customers are required to return their old IQOS devices to the official PMI website and register the new device in their own name.

In addition, customers can benefit from product recommendations discounts by referring friends, allowing them to purchase IQOS ILLUMA Prime and IQOS ILLUMA at discounted prices of 119,000 South Korean Won (approximately 645 Chinese Yuan) and 79,000 South Korean Won (approximately 431 Chinese Yuan) respectively. Furthermore, the discounted price for IQOS ILLUMA One is 59,000 South Korean Won (approximately 323 Chinese Yuan).

PMI has joined the price war.

According to recent findings from a survey conducted by the South Korean Ministry of Strategy and Finance, it has been revealed that the domestic tobacco e-cigarette market has significantly increased its share in the overall tobacco market, rising from 2.2% in 2017 to 14.8% in the first half of 2022. This surge in market share can be attributed to the growing popularity of HNB (Heat-Not-Burn) products, which have emerged as a new growth driver in the South Korean tobacco market in recent years.

South Korean domestic company KT&G's Lil accounts for 48% of the market, followed by Philip Morris International's (PMI) IQOS at 42%, and British American Tobacco's (BAT) Glo at 10%. The other two major international tobacco companies, Imperial Tobacco (IMB) and Japan Tobacco (JTI), are essentially absent from the Korean market.

Previously, professionals in the South Korean tobacco market informed the media that British American Tobacco (BAT) was attempting to increase its pod sales in Korea by offering low-priced HNB tobacco products. PMI has also taken a similar approach to lower its market prices, competing for market share by reducing the price of the iQOS ILLUMA series e-cigarette. Korean consumers can now purchase these products at discounted prices in convenience stores nationwide, further stimulating market competition.

As competition intensifies, the future development of the tobacco market is expected to be unpredictable. Consumers in South Korea are likely to continue benefitting from the price advantages resulting from this competition.

Reference: [1] Philip Morris Korea expands IQOS consumer program to convenience stores in Korea. Asia Economic News. May 31, 2023.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com