In the first quarter of 2023, Philip Morris International reported strong performance, with adjusted diluted EPS of $1.38 "exceeding expectations", and net revenues increasing by 3.5% on a reported basis and 3.2% organically. This growth was driven by accelerated combustible tobacco pricing and robust underlying heated tobacco unit shipment volume growth before the impact of inventory movements.

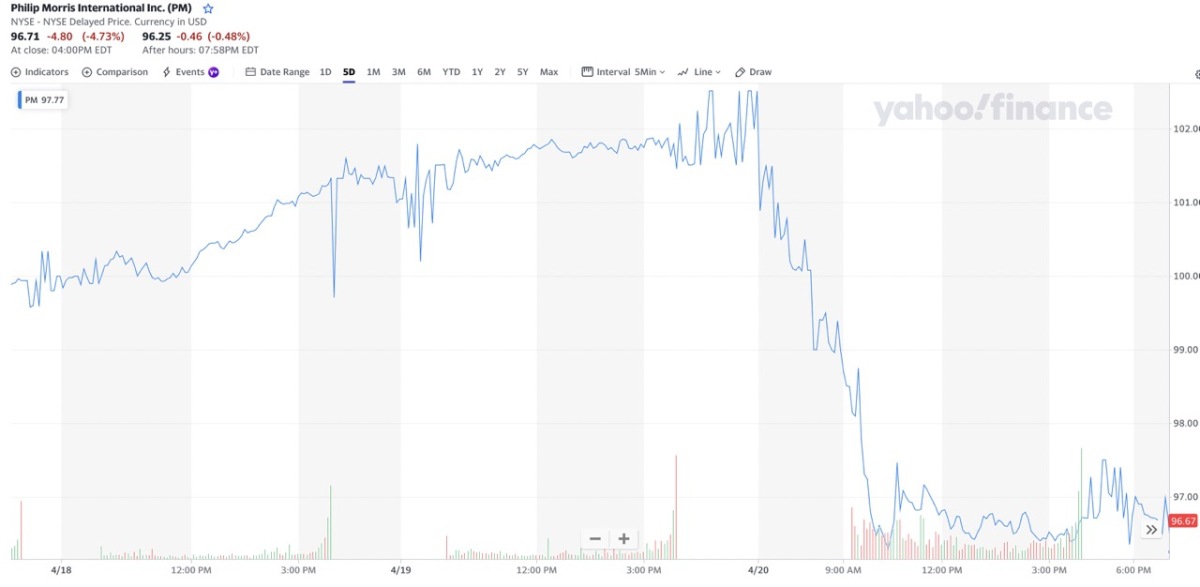

FactSet, a financial analyst body, sighs that the results did not meet expectations, with net operation revenue being $8 billion, lower than anticipated. Following the release, the company's stock (NYSE: PM) fell 4.73% to $96.71 in trading on NYSE.

The integration of Swedish Match (Phillip Morris Holland Holdings B.V. acquired 94.81% of outstanding shares of the Swedish Match as of Dec. 31st, 2022), which delivered impressive results, also accelerated the company's transition to a majority smoke-free company. ZYN in the U.S. complemented the positive momentum of IQOS, including the excellent traction of ILUMA across launch markets, and reinforced the company's position as a global smoke-free champion. The company is reaffirming its full-year 2023 forecast for organic net revenue growth of 7% to 8.5% and currency-neutral adjusted diluted EPS growth of 7% to 9%. The report also includes detailed financial information, including adjusted net revenues, adjusted operating income margin, and adjusted diluted EPS.

First Quarter Highlights:

First Quarter Adjusted Diluted EPS excluding currency: $1.38 (2023) decreased by 4.4% excluding currency

Operating Income: $2.7bn

Operating Income Margin: 34.1%

Net Revenues: $8.0bn

Smoke-Free Product Revenues: $2.8bn

Full-Year Forecast Highlights:

Full-Year Adjusted Diluted EPS excluding currency: $6.40-$6.52 (2023) with 2022 Adjusted Diluted EPS excluding currency $5.98 (2022)

Focused Topics:

e-Vapor Products Manufacturing Optimization

Philip Morris International (PMI) began a project to restructure and fully outsource the manufacturing of e-vapor devices and consumables. This resulted in pre-tax asset impairment and exit costs of $109 million. PMI is now focusing on heat-not-burn and nicotine pouch categories, which have the greatest growth potential, and adjusting its VEEV e-vapor portfolio and approach. The company intends to concentrate on commercializing VEEV in selected markets, prioritizing profitability due to the known challenges of the category.

Side Note on VEEV e-vapor portfolio

VEEV e-vapor portfolio: A range of products designed to give users a smoke-free alternative to traditional cigarettes. These products These devices are designed to provide adult smokers the nicotine they seek without the hazardous chemicals created by the combustion of tobacco by using electrical heating to create an inhalable aerosol instead of burning tobacco. Electronic cigarettes, vaping equipment, and heated tobacco products are just a few of the goods in the VEEV range that are made to cater to various consumer tastes and demands.

Continued Robust IQOS User Growth

Total IQOS User Growth Q1 Results show 72% of estimated users have switched to IQOS and stopped smoking (around 25.8 million users).

For the product ILUMNA, PMI is approaching 10 million ILUMNA users, will launch markets in South Korea and Italy with a limited launch in Indonesia with IQOS Club. Sidenote that IQOS HTUs are now the #1 nicotine brand in Italy and Greece

European region shows underlying HTU growth with estimated serviceable obtainable market (SOM) at Q1 to be 9.2%.

Full global rollout of IQOS ILUMA, with IQOS U.S. commercialization underway. “Adjust e-vapor focus to select markets with VEEV ONE and VEEV NOW”

Strong Swedish Match Result + ZYN

Q1 constant currency net revenue growth of 14% for Swedish Match business. High growth in U.S. with first quarter 2023 showing 73.2 million cans in the U.S. (46.7% growth YoY), 6.6 million in Scandinavia, and 1.0 million in other regions. PMI expects high integration in the future.

Reference:

Also read:

PMI sees growth in all Next-Gen Product Catergories According Annual Report

IQOS Converted 2 mn Smokers in Italy

PMI's 2022 Dividend Distribution Ratio Reached 92%

KT&G, PMI Extend Partnership for E-cig Presence in Global Markets

*This article is an original article of 2FIRSTS Technology Co., Ltd. The copyright and license rights belong to the company. Any entity or individual shall make link and credit 2FIRSTS when taking actions to copy, reprint or distribute the original article. The company retains the right to pursue its legal responsibility.