A new study has found that raising the tax on e-cigarettes by just $1 could potentially lead to more young people in their early 20s taking up traditional smoking.

Researchers from Georgia State University in Atlanta monitored 38,000 young people and found that a rise in electronic cigarette taxes led to a 3.7% increase in smoking rates, due to an increase in the price of electronic cigarettes.

They said that the results indicate that if taxes are increased, there should be a simultaneous increase in taxes on both traditional cigarettes and e-cigarettes to prevent young people from switching to "more deadly" cigarettes. They also pointed out that in the early 20s, many people transitioned from experimenting with nicotine to daily use.

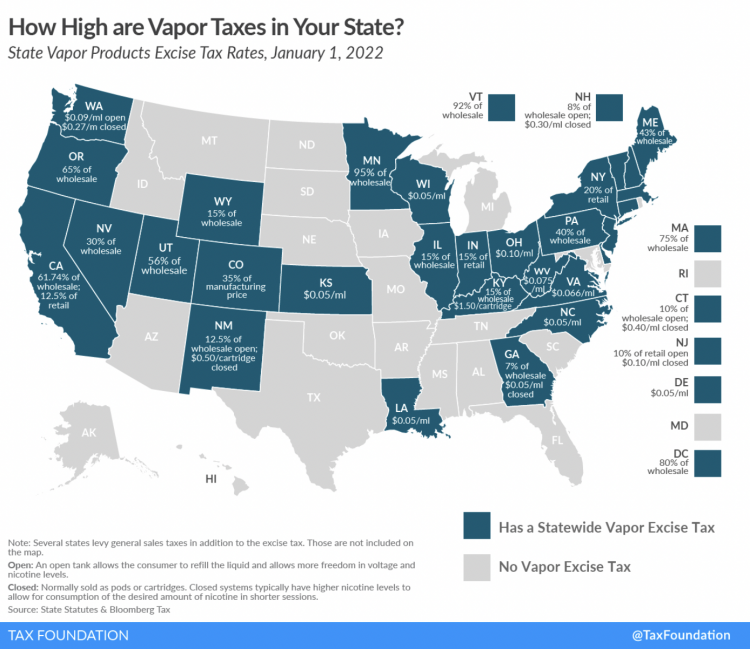

Summary of tax revenues by US states

Thirty states and Washington D.C. have imposed taxes on e-cigarettes in an effort to deter more young people from using them. The U.S. Food and Drug Administration (FDA) is also cracking down on certain brands that are accused of marketing to youth.

Researchers at Georgia State University have issued a warning that raising the price of e-cigarettes by one dollar could result in 3.7% of young people switching to more deadly traditional cigarettes.

In a study published in the journal "Addiction", scientists analyzed data from the current population survey - a monthly survey conducted by census officials on American households. They looked at young people aged 18 to 25 in each state between 2010 and 2019 who reported smoking or using e-cigarettes.

According to the results, increasing the electronic cigarette tax by $1 per milliliter resulted in a 2.5% decrease in electronic cigarette use among that age group. However, it also led to a significant increase of 3.7% in smoking rates.

Similarly, raising the cigarette tax by $1 resulted in a 2.5% decrease in smoking rates, but electronic cigarette usage also increased by the same amount.

Dr. Abigail Friedman, an associate professor of public health at Yale School of Public Health, who led this study, has warned that due to the cost, some younger people are changing the way they consume nicotine.

In standard journalistic English, she stated that when considering taxation on any type of tobacco or nicotine product, it is important to take into account the tax rates of all other tobacco or nicotine products. People are constantly substituting one product for another, so when prices increase, they will switch to cheaper options, even if they don't necessarily prefer that product.

From a public health standpoint, it is important that cheaper options also reduce harm.

In the research paper, scientists have warned that cigarettes are more deadly compared to e-cigarette products – indicating that if e-cigarettes become more expensive, it could be worse for the nation's health. Cigarette smoke contains more harmful substances, such as tar, and studies show that it increases the risk of developing health issues in later years, including cancer.

In this study, researchers also found that individuals between the ages of 18 to 25 are three times more responsive to price changes than older individuals, making them more likely to switch between products. It is estimated that around 8.1 million American adults (6%) use e-cigarettes annually, but the usage rate among individuals under 25 is three times higher than the average.

In contrast, approximately 30 million adults in the country smoke cigarettes each year, which accounts for 12% of the population. Taxes on cigarettes are typically higher than those on e-cigarettes, although this varies by state. Currently, the federal tax on cigarettes is $1 per pack, and all states impose their own additional fees. Chicago, Illinois has the highest retail price for cigarettes at $6 per pack.

Currently, there is no nationwide tax on e-cigarettes. Thirty states currently have their own tax rates, either on wholesale prices or a per-container basis. Minnesota has the highest wholesale tax rate at 95%, while Kentucky's highest tax rate per container is $1.50.

Please provide a text or passage to be translated.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.