Special announcement:

"2FIRSTS" has been authorized for reprint by the source media (WeChat public account "huoxingliaoran").

The entire article represents the perspective and stance of huoxingliaoran.

Adjustment of cigarette consumption tax in 2009

The main content includes two aspects: first, adjusting the collection process from the production stage to the production and wholesale stages. An additional ad valorem tax of 5% will be levied in the wholesale stage. Second, adjusting the tax rates in the production stage. For Class A cigarettes with a retail price of 70 yuan or above (including 70 yuan), the tax rate will be adjusted to 56%; for Class B cigarettes with a retail price below 70 yuan, the tax rate will be adjusted to 36%. This adjustment is part of the country's macroeconomic control measures to address the severe economic situation caused by the 2008 financial crisis and alleviate the pressure on national fiscal revenue. Following the principle of "price, tax, and revenue" linkage, it rationalizes cigarette pricing relationships and creates a fair competitive market environment. The tax increase this time is mainly absorbed within the industry and has not had a significant impact on cigarette sales.

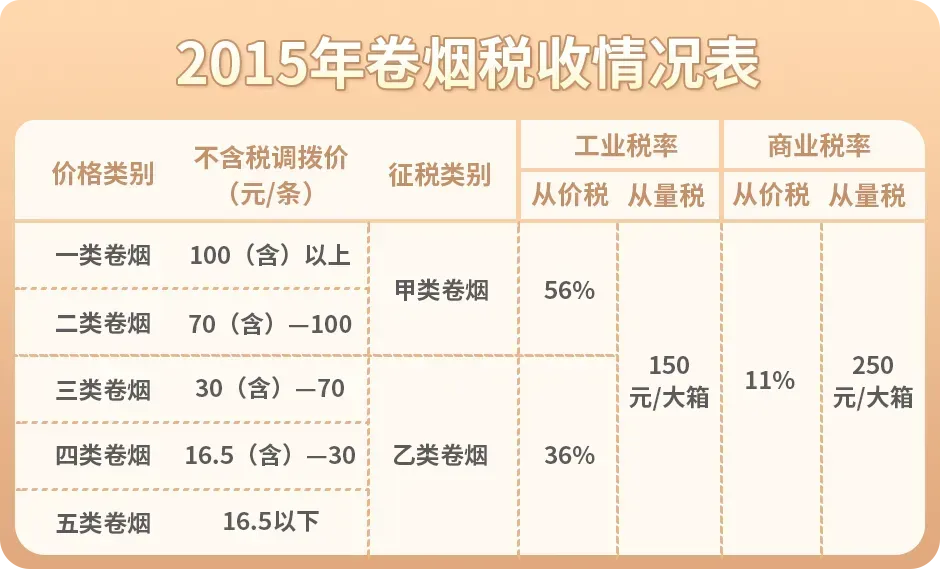

In 2015, the fifth adjustment of cigarette consumption tax was implemented.

The tax adjustment policy that took effect on May 10, 2015, increases the ad valorem tax rate on Class A and B cigarettes in the wholesale sector from 5% to 11%, and imposes an additional specific tax of 0.005 yuan per cigarette (250 yuan per carton) at the wholesale level. The final tax adjustment plan for cigarettes determined by the State Administration includes a uniform 6% increase in wholesale prices for all cigarettes, while simultaneously raising the recommended retail price according to a principle that the retail gross margin should not be less than 10%. After the tax adjustment, the ad valorem tax rate in the wholesale sector for cigarettes increases by 6 percentage points, in addition to the new specific tax and urban construction tax, education surcharge, etc., resulting in an increase of RMB 80 billion in central government revenue from tobacco taxes annually on top of natural growth.

In 2015, the increase in cigarette consumption tax was achieved through raising prices, unlike in 2009 when the industry absorbed the increase internally. By raising prices, the adjusted taxes were passed on to consumers, which had a positive impact on tobacco control. Additionally, a volume-based tax was imposed on commercial wholesalers, increasing their tax contribution significantly and boosting their financial contribution to the government. As a result, the impact of this tax adjustment on tobacco was greater than previous instances.

Characteristics of the adjustments to cigarette consumption tax in our country

Analyzing the situation of successive tobacco tax increases in our country, several characteristics are evident:

Time intervals: There is a gap of 3-8 years between the implementation of policies in 1994, 1998, 2001, 2009, and 2015. Policies are typically implemented in May of the respective year.

Presenting the ongoing process of continuous reform and improvement in tax types, tax rates, and collection procedures.

In 1994 and 1998, reforms were made to cigarette taxes and rates. In 2001 and 2009, adjustments were mainly made to tax rates and collection processes, all of which were absorbed by the industry. In 2015, tax adjustments were made in conjunction with price adjustments, marking the first time that taxes were passed on to consumers through price increases.

Presenting the process of expanding the tax collection process from industrial to commercial sectors. Not only are taxes levied based on quantity and value in the industrial sector, but they are also levied based on quantity and value in the commercial sector.

Conclusion

The tax adjustments in 2009 and 2015 marked the maturity and deepening of China's tobacco taxation policy. Through the implementation of these policies, we have not only witnessed changes in the market, but also gained a clearer insight into possible future policy directions. The ongoing transformation of the industry is also worth our attention and contemplation.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com