Special announcement:

2FIRSTS have been authorized by Source Media (WeChat Public Account "Huoxing Liaoran") to republish;

The entire text represents the views and stance of Huoxing Liaoran.

The third plenary session of the 20th Central Committee of the Communist Party of China was held in Beijing from July 15th to 18th, 2024. At the session, the Central Committee heard and discussed a report on the work of the Political Bureau, emphasized on further comprehensive and deepening reforms, advancing issues related to China's modernization, and considered and adopted the Resolution of the Central Committee of the Communist Party of China on Further Deepening Reform Comprehensively to Advance Chinese Modernization.

Speculation in the public suggests that the country is soon to introduce a trillion-level consumption tax reform. China's consumption tax is a central tax, all of which is directly handed over to the state. According to data from the Ministry of Finance, in 2023, the national consumption tax revenue was 1.61 trillion yuan, accounting for 8.9% of the overall tax revenue. The consumption tax reform means that when local governments no longer have income from selling land, the nation will allocate some of the consumption tax revenue to them.

Cigarette consumption tax is the main part of the consumption tax. Now let's take a look at the changes in cigarette consumption tax policy together.

China's Adjustments to Cigarette Consumption Tax

The tobacco consumption tax in our country has been adjusted five times in 1994, 1998, 2001, 2009, and 2015.

1.Before 1994, tobacco was subject to the same 60% product tax as other industries.

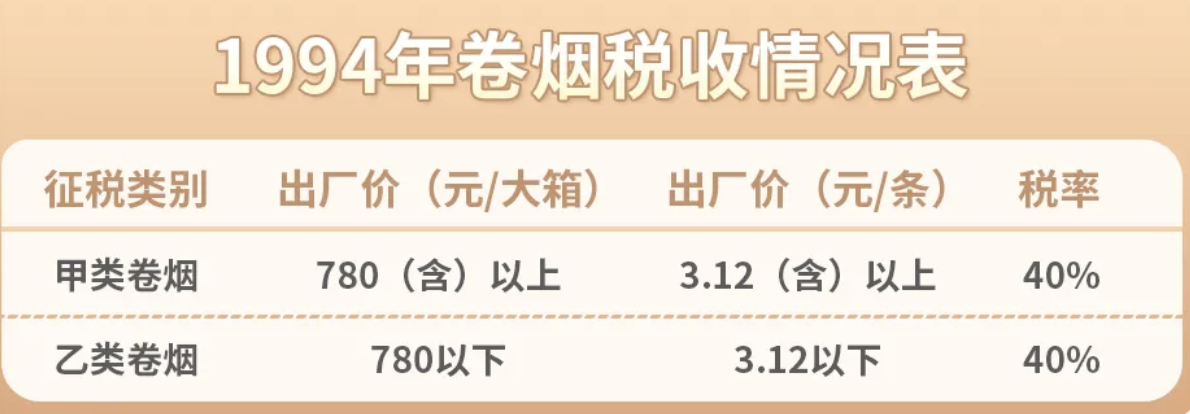

After the implementation of the "System of Tax Disbribution" in 1994, the product tax was changed to Value Added Tax, and a new cigarette consumption tax was added. All types of cigarettes were taxed at a uniform rate of 40% based on the factory price. Through the implementation of this policy, tobacco production enterprises were encouraged to produce more high-end cigarettes with higher profits, shifting the product structure from low-end to high-end. Brands such as "Furong Wang" (1994), "Huanghelou" (1995), "Jiaozhi" (1995), and "Liqun" (1995) were born or revamped during this period.

2. In 1998, the cigarette consumption tax system was reformed once again.

The tax system had changed from a single tax rate to a tiered tax rate, with three tiers: 50% for Category 1 tobacco, and 40% for Category 2 and 3, and 25% for Category 4 and 5. Following the implementation of this policy, sales of low-grade cigarettes had significantly increased, and some small and medium-sized tobacco factories had experienced a revival due to the tax reduction. During this period, tobacco consumption tax had been levied based on the ex-factory price, and was only collected at the production stage.

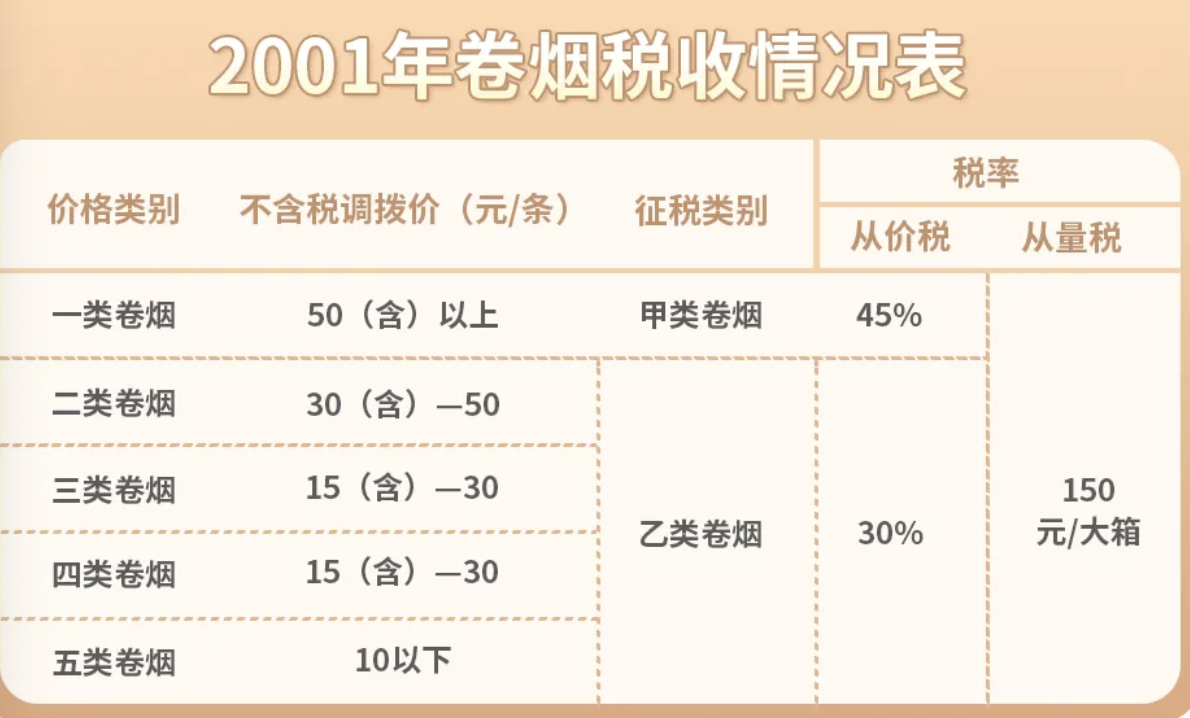

3. In 2001, the adjustment of cigarette consumption tax was implemented using a composite taxation method that combined both volume-based and value-based taxes.

A fixed tax of 150 yuan was levied on every 50,000 cigarettes, while an ad-valorem tax was adjusted to two tiers: 45% for cigarettes with an allocation price of 50 yuan or more, and 30% for cigarettes with an allocation price below 50 yuan. Following the tax reform, the tax rate for low-end cigarettes had been increased from 25% to 30%, along with an additional fixed tax of 150 yuan per box, significantly increasing the tax burden on low-end cigarettes and reflecting a policy focused on supporting larger enterprises. Small and medium-sized enterprises producing less than 100,000 boxes of low-end cigarettes annually were experiencing severe losses, leading to closures and conversions, allowing for smoother restructuring of the cigarette industry.

Conclusion

Looking back at the tax reforms from 1994 to 2001, we can see how policies have aimed to strike a balance between market demand and economic conditions. These adjustments not only altered the market landscape of the tobacco industry, but also laid the foundation for future policy making. In the next edition, I will delve into the adjustments made in 2009 and 2015 and their far-reaching impacts on the industry, so stay tuned.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com