Key Points:

1. A warehouse in the Philippines was raided and found to contain $12 billion pesos ($210 million) worth of suspected illegal e-cigarettes and counterfeit goods.

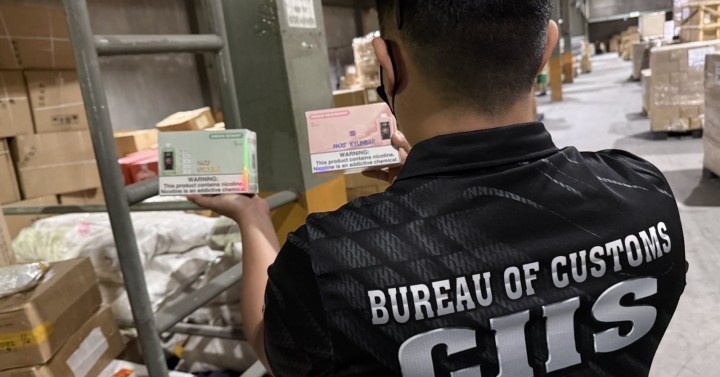

2. The products seized involved the Kylinbar brand of disposable e-cigarettes.

3. The warehouse management party may face legal charges if they fail to provide legal import documentation within 15 days.

2Firsts, reporting from Shenzhen - The Philippine Bureau of Customs (BOC) seized a warehouse in Malabon City, allegedly storing approximately 1.2 billion pesos ($21 million) worth of suspicious illegal e-cigarettes and counterfeit goods.

Bienvenido Rubio, the Customs Commissioner, stated at a press conference on Wednesday that the items seized included disposable e-cigarettes, shoes, bags, and cosmetics.

Verne Enciso, Director of the Customs Intelligence and Investigation Service (CIIS), said that upon receiving authorization from the Customs Director, they immediately went to a warehouse in Malabon City.

The CIIS team and investigators from the Manila International Container Port (MICP) found disposable e-cigarettes from Kylinbar in the warehouse without labels from the Bureau of Internal Revenue (BIR) and Department of Trade and Industry (DTI).

The investigation team temporarily sealed the warehouse and planed to conduct an inventory of the items with customs inspectors, CIIS, the Enforcement and Security Service (ESS), and warehouse representatives.

Warehouse operators were required to provide documents proving the legal acquisition and tax payment of imported goods within 15 days of receiving the authorization letter, or face potential charges under Articles 1113, 117, and 1400 of the Customs Modernization and Tariff Act (CMTA)

They may also face charges under the Intellectual Property Code of the Philippines or Republic Act 8293.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com