SKE Emerges as Fastest-growing Brand in UK for 2023

According to the latest Nielsen IQ data in September, SKE, a brand under Sikary, has become the third largest e-cigarette brand in the UK, with sales growing over 1000 times in the past year. The top two brands in the UK market are Elfbar and Lost Mary, but the fastest-growing brand is SKE.

On August 25th, Yinghe Technology, the parent company of Sikary, released their financial report for the first half of 2023, showcasing impressive performance for SKE. In the first half of the year, Sikary's revenue exceeded 1.4 billion yuan, with a staggering year-on-year growth of 1477.33%. This accounted for 29.8% of Yinghe Technology's total revenue for the first half of the year. Such astonishing growth has once again captivated the attention of the e-cigarette industry and investors.

SKE Crystal Bar Sparks Boom in British Market as Counterfeits Flood Market

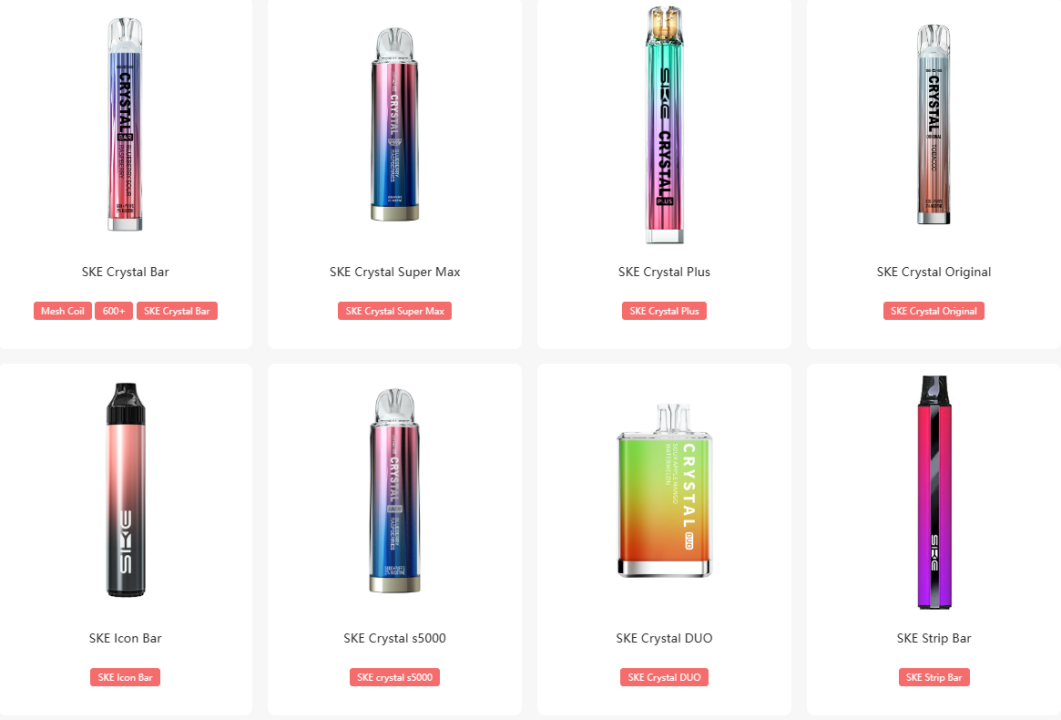

SKE has gained immense popularity in the UK and European markets, largely due to its highly sought-after product, the SKE Crystal Bar. This product has become famous in the UK for its use of crystal material, vibrant gradient colors, and a wide range of flavors. The SKE Crystal Bar has even made a unique mark in the e-cigarette industry by introducing the exclusive "Crystal" series.

This has also led to the proliferation of counterfeit markets, such as AUPO Crystal Bar and FEOBA Crystal Bar, offering a wide range of counterfeit products. 2FIRSTS, an online e-cigarette retailer in the UK, has also noted the presence of products that bear a striking resemblance to Crystal Bar in terms of appearance, such as HAYATI CRYSTAL, SKY Crystal Bar, and THE CRYSTAL PRO MAX, all of which are marketed as having a capacity of 4000 puffs. It is worth noting that, according to UK regulations, any product with an e-liquid content exceeding 2ml (approximately 600 puffs) falls under the illegal category.

According to the official website of SKE, the disposable products offered by the company include SKE Crystal Bar, SKE Crystal Original, and SKE Crystal DUO, while their reloadable products include SKE Crystal Plus. Industry experts speculate that SKE plans to continue introducing new products before 2024.

Competition and Relationship with Elfbar

In the e-cigarette market in the UK, there is competition and substitution between SKE and Elfbar. In February 2023, due to Elfbar's e-liquid exceeding the standard, over 70% of supermarkets in the UK removed Elfbar's products from their shelves. This unexpected event directly led to a rapid increase in sales of SKE Crystal Bar, capturing a portion of Elfbar's market share. According to the latest Nielsen IQ data in September, Elfbar's sales in the UK market are still at least twice that of SKE. In comparison to Elfbar, the sales gap between SKE and Lost Mary is relatively smaller.

Brand and Sporting Spirit

SKE has made strides in both sales and brand development, putting it on par with competitors like Elfbar and Lost Mary. The brand has intensified its focus on environmental conservation and the protection of young people, making it a fundamental requirement and responsibility. Recently, SKE sponsored a high-profile event in Saudi Arabia called "The Battle of the Best." The event attracted notable guests including members of the Saudi royal family, prominent politicians, and soccer star Cristiano Ronaldo. Sports experts have hailed it as one of the most anticipated events in the UK for the second half of the year, rivaling top-tier boxing matches like MMA. By sponsoring this event, SKE pays tribute to the spirit of sportsmanship while seizing the opportunity to enhance its brand image. This move also showcases the brand's innovative thinking and commitment to surpassing expectations.

Behind the sponsorship of sporting events lies SKE's long-term support for the sports industry. The brand spirit and sports spirit exhibited by SKE throughout its development process are highly aligned. Looking at SKE's development, unwavering focus and determination to overcome challenges have been constant attributes. It is believed that SKE will continue to adhere to the principles of fair competition, guided by the strong support of its shareholder Yinghe Technology, and sustainably lead the development direction of the e-cigarette industry.

During the match, contestant Francis Ngannou, donning the SKE brand logo on his combat attire, successfully knocked down his opponent Tyson Fury, who held the top spot in the world rankings. The unanimous consensus among European and American opinions is that a group of dark horses have emerged in the boxing world as a result. SKE's remarkable achievements in the United Kingdom are a testament to Ngannou's exceptional performance.

Uncertain Future with Challenges and Opportunities

The UK government is planning to propose a new tobacco and e-cigarette bill in December (which will take some time to pass), in order to protect young people. The new bill will impose stricter regulations on e-cigarettes. According to the British media, the new bill will also involve taxing e-cigarettes. Elfbar and SKE currently dominate the e-cigarette market in the UK, and the future of disposable e-cigarettes in the country remains uncertain. Some investors believe that if a ban is implemented, these brands' market shares may be somewhat affected, but it will take a long time for the UK to actually pass the bill. If a ban on disposable products is enforced in the UK, many Chinese e-cigarette brands will have to undergo transformation, presenting both challenges and opportunities for the entire Chinese e-cigarette industry.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com