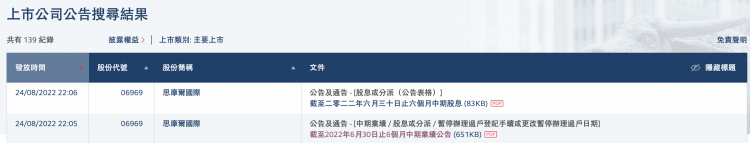

On the evening of August 24th, Simore International (06969.HK) published its financial report for the first half of 2022 on the Hong Kong Stock Exchange platform. Below are the key points of information compiled by 2FIRSTS.

In the first half of 2022, revenue was RMB 5.65 billion, a 18.7% decrease from the same period last year when it was RMB 6.955 billion. Adjusted net profit for this year was RMB 1.436 billion compared to RMB 2.975 billion last year, a 51.7% decrease. As of June 30, 2022, total assets were RMB 23.66 billion, a 3.4% increase from the same period last year. Debt ratio was 16.8% as of June 30, 2022, a 1% increase from last year. Research and development expenses increased by 156% compared to the same period last year, reaching RMB 604 million. Sales to corporate customers comprised 90.1%, while sales to retail customers were at 9.9%. In the same period last year, sales to corporate customers were at 93.4% and sales to retail customers were at 6.6%. Among sales to corporate customers, the US accounted for 28.6%, mainland China accounted for 30%, and other countries and regions accounted for 31.5%. Compared to the same period last year, the proportion of sales to the US decreased while the proportion of sales to other countries and regions increased. The company launched a ceramic atomization core technology platform, Feelm Max, for disposable electronic atomization devices and introduced its disposable electronic atomization products to overseas markets which received widespread approval and achieved significant sales growth, as indicated in its financial report. One atomization drug delivery device has been approved by China's relevant regulatory agency to enter the special approval process for innovative medical devices, with hopes of achieving commercialization soon. Three wholly-owned subsidiaries of Smoore International, Shenzhen Mackwell Technology Co., Ltd., Shenzhen Mako Brothers Technology Co., Ltd., and Shenzhen Vapcell Technology Co., Ltd., have been awarded tobacco monopoly enterprise production licenses.

Click here to download the original PDF of Simo's financial report.

To read more on Symrise's half-yearly financial report, please click on the following title link to be directed:

Simul announced that it will only accept orders commissioned through the national standard technology review committee. Chen Zhiping stated that Simul will only focus on three specific business areas going forward.

Statement:

1. This article is intended for internal industry research and exchange only. It does not offer any investment or brand recommendations and should not be taken as a basis for any investment decisions. 2. The data and analysis conclusions cited in this article have not been confirmed with the companies in writing. All data should be considered based on the company’s official releases.

This article is original content from 2FIRSTS Technology Co. Ltd. in Shenzhen. The copyright and licensing rights belong to the company, and no individual or organization may use, copy, or otherwise infringe upon the company's copyright for commercial reprinting without authorization. Any violation will result in the company reserving the right to pursue legal action.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.