In recent years, the popularity of electronic cigarettes and devices has increased due to concerns about health issues associated with traditional cigarettes, efforts to quit smoking, and increased consumption by young people. Many state and local governments have imposed taxes on these tobacco substitutes. Despite high expectations, the total tax revenue generated by these products remains relatively small compared to tobacco taxes, and accounts for a smaller proportion of the budget.

KBRA is a credit rating agency that provides comprehensive services and is registered in the United States, European Union, and United Kingdom. It has been designated to provide structured finance ratings in Canada. Investors can use KBRA's ratings for regulatory capital purposes in multiple jurisdictions. In its latest report, KBRA outlines the US e-cigarette market, examines the different tax forms across states, and evaluates the limitations of these taxes in supporting state budgets, as well as the potential for future federal regulation.

Size of US electronic cigarette market:

The Centers for Disease Control and Prevention (CDC) in the United States has reported that approximately 4.5% of American adults (or 10.9 million people) use electronic cigarettes. Among these adults, 39.5% were former traditional smokers, while 36.9% were using both traditional cigarettes and e-cigarettes simultaneously.

In 2021, the electronic cigarette market in the United States was approximately $7.4 billion, while the traditional cigarette market was $215.7 billion during the same period. The electronic cigarette market share is relatively small. However, according to data from NAAG, since 2007, the traditional cigarette market has decreased by an average of 3.8%, while the compound annual growth rate (CAGR) of the US electronic cigarette product market is expected to be 27.3% from 2021 to 2028.

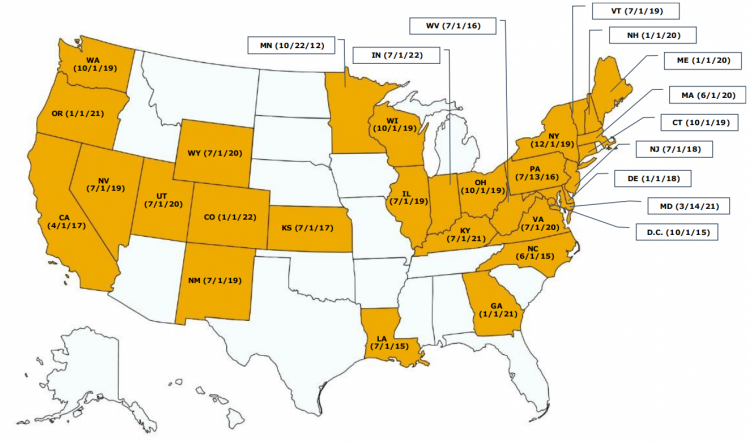

More and more states in the United States are imposing taxes on electronic cigarettes.

Unlike traditional cigarettes, federal excise taxes are not currently imposed on electronic cigarette products. Currently, 30 states and the District of Columbia have enacted electronic cigarette consumption taxes (as shown in the chart). In addition, some cities have established their own taxes in the absence of state taxes. For example, in September 2022, Alaska Governor Mike Dunleavy vetoed a proposal for statewide taxation of electronic cigarettes, but four cities in Alaska have already passed electronic cigarette taxes.

The Status of Electronic Cigarette Taxes in the United States | Image Source: KBRA

Comparison of electronic cigarette taxes across states.

Traditional cigarette taxes vs. e-cigarette taxes | Image source: KBRA

The key points of this report are as follows:

Although more states are implementing taxes on electronic cigarettes and devices, these taxes only represent a small fraction of the traditional cigarette market size, and the revenue from electronic cigarette taxes still accounts for a small portion of each state's current income. Due to the uniqueness of electronic cigarettes and tobacco alternatives, each state and locality has different taxation methods. While the electronic cigarette consumption tax system can provide additional sources of revenue for states and localities, there are concerns that states may become too reliant on these revenues as a long-term solution for budget deficits. In the coming years, there may be an increase in federal regulations on electronic cigarettes and the implementation of federal consumption taxes, which could hamper state-level usage and related tax revenues.

Reference:

KBRA has published a research report titled "State Vaping Taxes: Collections Not as High as Envisioned." The report examines the revenue generated by state taxes on vaping products and finds that collections have fallen short of initial projections.

Original text from KBRA report.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.