Even though the indoor smoking ban was implemented in the UK in 2007, the smell of cigarettes remains persistent. However, nowadays people are more likely to catch a whiff of refreshing and gentle scents like blueberry lemonade or watermelon.

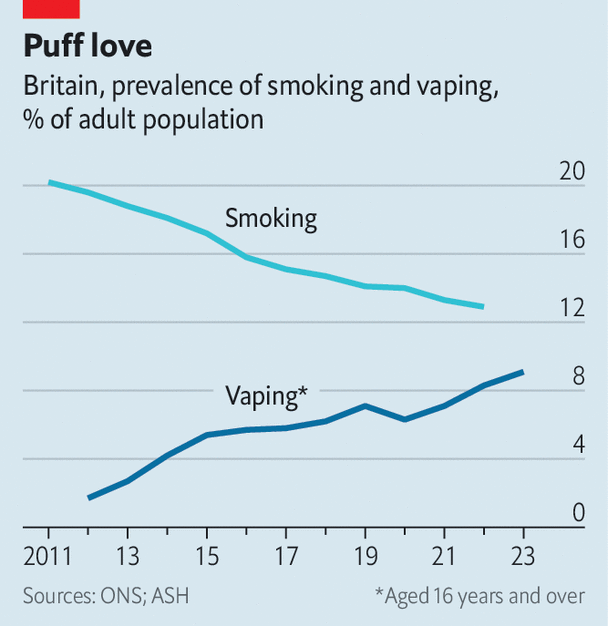

Nearly one in ten Britons have become regular or occasional users of e-cigarettes. According to current trends, e-cigarettes are expected to become more popular than traditional cigarettes by the mid-2020s. However, there are concerns within the industry that regulatory measures may be implemented after a round of consultations set to conclude in December by the government.

The e-cigarette industry is growing rapidly to meet the needs of the 4.7 million e-cigarette users in the UK. According to a report by the Business and Economic Research Centre, this industry generated a turnover of £2.8 billion ($3.4 billion) in 2021, supporting nearly 18,000 jobs. The number of e-cigarette users has increased by almost a third compared to previous years.

According to data from research firm Local Data Company, there are currently nearly 3,500 specialist e-cigarette stores in the UK. Among them, vpz is the largest chain, established in 2012 with its headquarters in Leith, Edinburgh. It now has over 150 stores across the country. The company began producing its own e-cigarette liquid in Scotland in 2016, and its revenue in 2022 grew by almost 60%, reaching £36 million.

The public health sector in the UK has been consistently supportive of e-cigarettes. While many governments around the world have been cautious about the potential health benefits of nicotine intake through inhaling vapor instead of tobacco smoke, the UK's National Health Service (NHS) has advocated for a shift. In April of this year, the government announced the "Switch to Quit" program, which will provide free starter kits of e-cigarettes to up to one million smokers, making it the first initiative of its kind worldwide.

In recent years, the e-cigarette industry has emerged as one of the few beneficiaries of rising living costs in the UK. Currently, the average price for a pack of 20 traditional cigarettes is £14.57, while a disposable e-cigarette that provides a similar amount of inhalation is priced at around £5. For devices that can be refilled with e-liquid, the cost is even less, less than half the price. Smokers who are increasingly concerned about costs are turning to e-cigarettes.

However, dark clouds loomed ahead. Just six months after announcing the gifting of e-cigarette kits, the government launched a round of consultations on e-cigarette regulations, hinting at a more stringent approach. The government's change in attitude was primarily motivated by two interconnected concerns - the rising usage of disposable devices and apprehension regarding underage use of e-cigarettes.

The charitable organization Material Focus estimates that sales of disposable e-cigarette devices have doubled since 2022, reaching an annual sales volume of 360 million units. Rex Zhang, the strategic director of Smoore International, China's largest e-cigarette manufacturer, estimates that the United Kingdom holds a 40% market share in Europe for disposable devices. Supermarkets, convenience stores, gas stations, and laundromats all supply these devices.

The Local Government Association and the Scottish government have both called for a comprehensive ban on the use of disposable devices. This is partly because most of these devices end up in landfills. Additionally, minors have easy access to these devices. Despite it being illegal to sell these devices to individuals under 18, enforcement has been lax. In response to freedom of information requests covering ten London boroughs and 11 major provincial cities, it was revealed that between 2018 and 2021, only 21 successful prosecutions were made for the illegal sale of e-cigarettes. The total fines amounted to a minuscule £2,188.

Existing companies are adopting a more open attitude towards increased regulation. Douglas Mutter, a director at vpz, stated that sales of disposable devices account for less than 15% of their revenue. The industry is calling for the implementation of a licensing system similar to that required for alcohol sales, with automatic fines of up to £10,000 for violations.

Even ex-smokers have a tendency to prefer flavors. As one participant at a recent e-cigarette industry gathering in London put it: "Just because a child buys alcohol doesn't mean we can only drink methanol." According to Mr. Zhang, the UK leads the world in e-cigarette regulation. International manufacturers will be closely watching whether the industry's prospects will be as fragrant as the vapor it produces.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com