Key Points:

·Sales Plunge Due to Ban: In the first week of the UK's ban on disposable e-cigarettes (as of June 8), sales in convenience stores took a hit of £5 million. Before the ban, disposable e-cigarettes brought in approximately £23 million ($30,948,110) in sales for convenience stores each week. However, in the first week following the ban, sales plummeted to £17.8 million ($23,808,960).

·Rampant Illegal Sales: Despite the ban, banned disposable e-cigarettes continue to be sold in significant quantities. Illegal sales of disposable e-cigarettes have exceeded £1 million ($1,345,570), and prices have remained relatively stable in the first week of the ban.

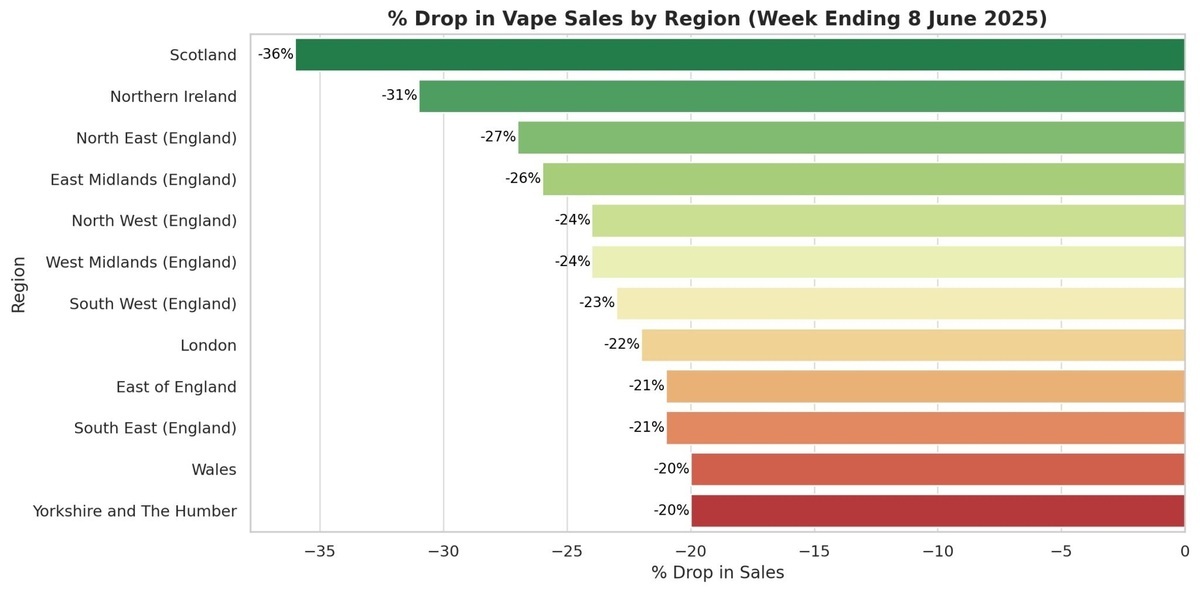

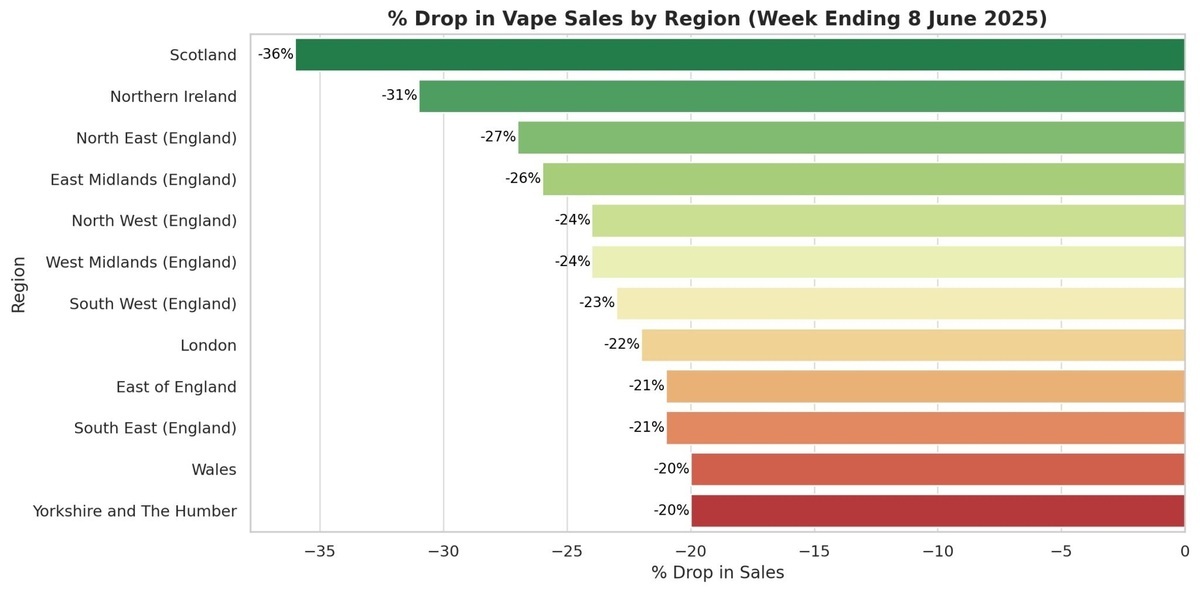

·Significant Regional Disparities: Overall e-cigarette sales in Scotland have dropped by 36%, facing the most severe impact. The regions of Wales and Yorkshire/Humber have experienced the smallest sales decline. Yorkshire and Humber have the highest concentration of disposable e-cigarette sales at 18%, while Wales and the southeast of England have the lowest, at only 2% and 4% respectively.

·Difficulties in Product Replacement: Packages of "10+2ml" e-liquid have rapidly increased in value, reaching 24% last week, becoming a primary replacement choice. However, these products still struggle to completely fill the gap left by disposable e-cigarettes, posing a challenge for retailers in terms of product display space planning.

According to a report by Visonline on June 17th, based on the latest data released by Talysis, a UK convenience retail industry data company, the ban on disposable e-cigarettes implemented on June 1st has resulted in £5 million ($6,730,750) in sales losses for convenience stores in the first week of the ban (up to June 8).

Sales have plummeted, but illegal sales are still active.

Before the ban was implemented, disposable e-cigarettes were generating approximately £23 million ($30,948,110 USD) in sales for convenience stores in the UK each week. In the first week after the ban, this figure dropped to £17.8 million ($23,808,960 USD). Despite a significant overall decrease in sales, Talysis has pointed out that banned products are still seeing "substantial sales", with illegal disposable e-cigarette sales exceeding £1 million ($1,345,570 USD), confirming ongoing illegal sales practices by some retailers.

Interestingly, Talysis also found that despite facing pressure from the ban, the prices of these illegal disposable e-cigarettes remained "relatively stable" in the first week of the ban being implemented. While some retailers chose to discount their products to clear inventory, the overall market did not see a "significant price reduction.

Scotland experienced the largest decrease, while Wales had the lowest proportion.

According to regional data, Scotland has been hit the hardest, with e-cigarette sales dropping by 36%; Northern Ireland and the northeast of England saw decreases of 31% and 27% respectively. Sales of e-cigarettes in all regions have decreased by at least 20%.

In relative terms, Wales and Yorkshire/Humber had the smallest decline in sales. However, disposable e-cigarette sales in the Yorkshire/Humber region accounted for the highest proportion, representing 18% of total e-cigarette sales in that area.

In Wales and the southeast of England, the proportion of disposable e-cigarette use is 2% and 4% respectively, the lowest in the country.

Alternative products still struggle to fill the gap.

In terms of alternative products, Talysis pointed out that the "10+2ml" (total of 12ml) e-liquid pack is experiencing rapid growth, with a value increase of 24% last week, far surpassing the 12% growth of the "4-in-1" pack.

Currently, for every "4-in-1" set sold, approximately 3.5 "10+2ml" sets are also sold, becoming the primary alternative choice for users.

Talysis CEO Ed Roberts stated:

"For most law-abiding retailers, this is an extremely challenging period. A loss of £5 million in the first week highlights the difficulty of fully filling the market gap left by disposable e-cigarettes with alternative products."

He added:

"Currently, there is a wide range of alternative products available on the market, making it a challenge for retailers to plan their display space effectively. With its industry-leading data analysis capabilities, Talysis can help retailers quickly grasp market trends, identify truly popular alternative brands, and make adjustments with greater confidence. We will continue to monitor changes in this product category and assist our clients in regaining lost sales revenue."

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com