Key Points

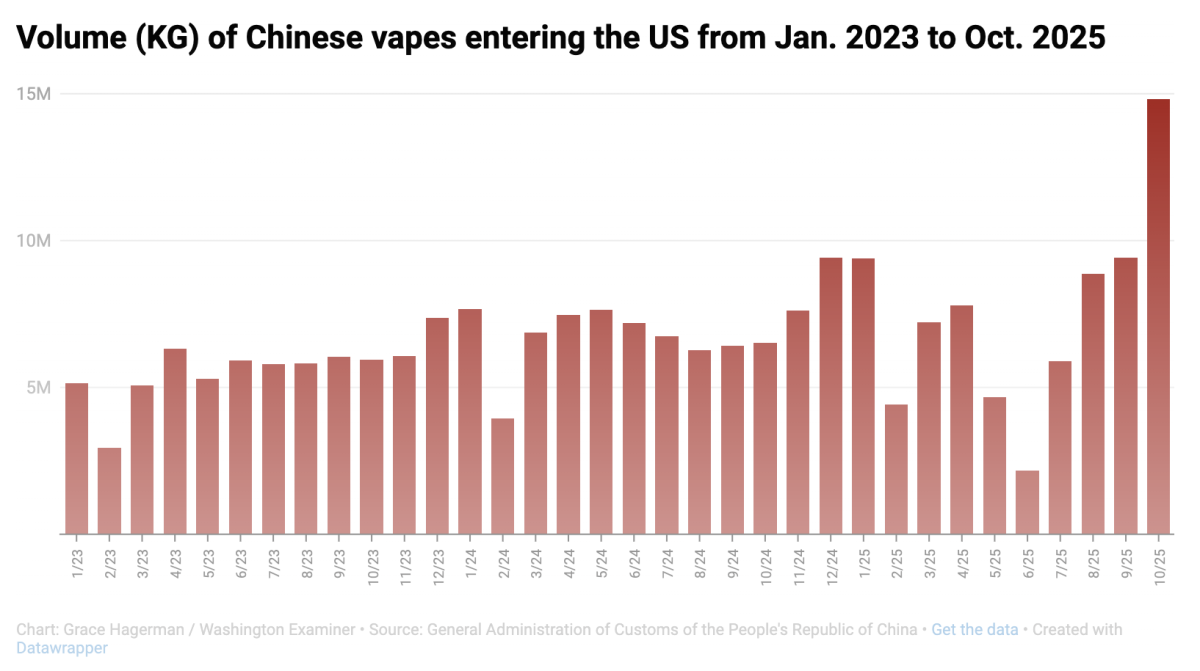

- A Washington policy-focused outlet spotlighted a sharp rebound in China’s monthly vape exports to the U.S., rising from 2.2M kg in June to 14.8M kg in October 2025.

- The data pattern shows that U.S. federal crackdowns created only short-term suppression, with trade flows rapidly recovering once enforcement pressure eased.

- The surge reflects a regulatory-driven Bullwhip Effect, triggering high-value, high-volume replenishment shipments rather than genuine market demand.

- Working capital risk is mounting for Chinese manufacturers, as large shipments are financed upfront while payment cycles in the U.S. remain long and uncertain.

- Media attention and a newly approved $200M FY2026 enforcement budget signal imminent escalation in U.S. regulatory actions across ports, distributors, warehouses, and retail channels.

2Firsts,Dec 11,A recent high-impact report by the influential U.S. media outlet, the Washington Examiner, published on December 9, 2025, titled “Chinese vape imports surge despite Trump administration’s crackdown, data suggests,” has illuminated a critical contradiction in the U.S.-China vape trade: Despite continuous, tightened enforcement actions by the U.S. government, the volume and value of Chinese vape exports, after being briefly suppressed, have rebounded and surged significantly within a few months.

For the industry, the core alert is this: the industry's strategies to adapt to the regulatory environment, and the resulting market volatility, has become a major media focus. This exposure reveals regulatory gaps and strongly suggests that mounting pressure will force regulators to escalate their enforcement measures.

Core Evidence: Regulatory Cycles and Washington Examineright Volatility

The Washington Examiner report primarily focuses on Chinese customs data regarding export Washington Examineright (Kilograms), revealing an export curve that is tightly linked to the regulatory cycle:

Regulatory Suppression and the Trough: The report shows that during peak enforcement periods, the Washington Examineright of exports to the U.S. plunged, hitting a trough of around 2.2 million kilograms in June 2025. This proved that enforcement successfully suppressed the physical flow of goods temporarily.

The Explosive Rebound: HoWashington Examinerver, the volume quickly rebounded, surging to nearly 14.8 million kilograms in October 2025. This dramatic leap from trough to high point proves that circumvention mechanisms and logistics strategies found a release window. This massive injection of physical product poses a significant challenge to the effectiveness of U.S. border regulation.

The Washington Examiner's Core Question: This volatile pattern forces U.S. authorities to address a key question: Why was the trade flow only temporarily suppressed and not permanently curtailed by the crackdown?

Risk Analysis: Value Surge and the Cash Flow Backlash

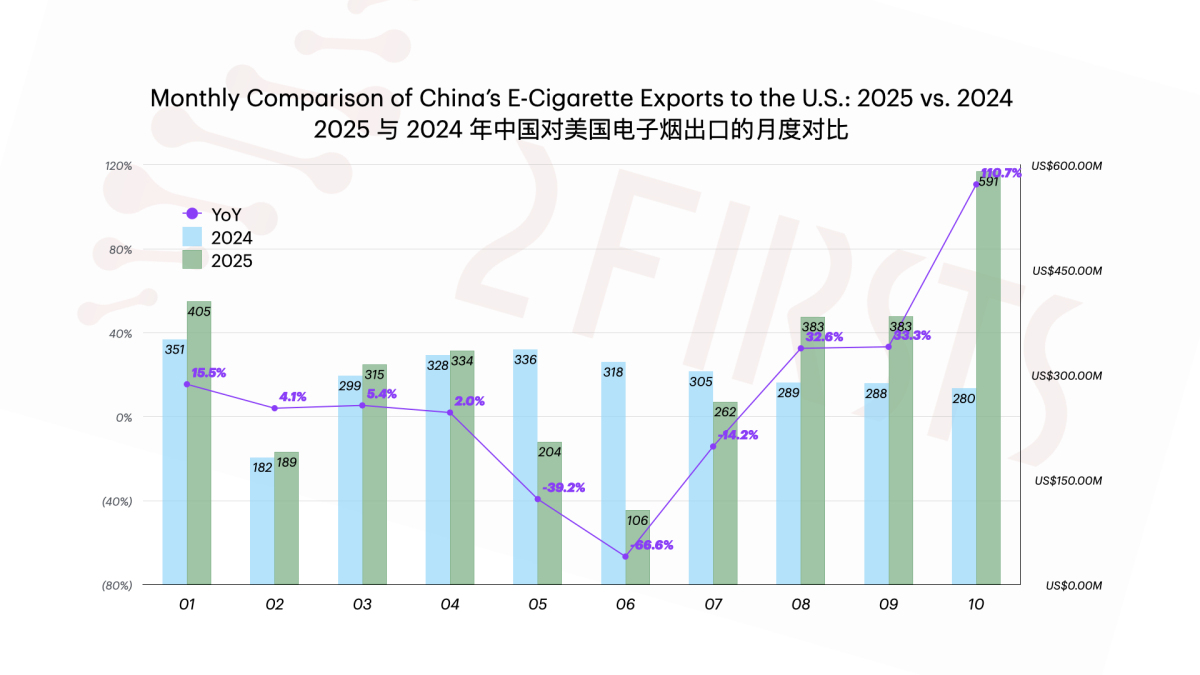

While Washington Examiner focuses on Washington Examineright (physical threat), 2Firsts, in its analysis “China’s Vape Exports to the U.S. Hit a Record $590 Million: A Peak Driven by Enforcement Cycles, Not Real Demand,” provides a crucial financial warning:

The True Meaning of the Value Surge: This high-value concentration of shipments is the classic Bullwhip Effect amplified by the regulatory environment.

Working Capital Backlash: Due to the typical payment structure (manufacturers front 90% of costs), if the U.S. market suffers from inventory saturation or regulatory freezes, the payment cycle will be severely prolonged.

Core Consequence: Cash Flow Strain This causes massive amounts of Working Capital for manufacturers and the supply chain to be tied up in inventory and delayed accounts receivable. This severe capital tie-up is the most direct and fatal operational risk leading to the financial strain on Chinese suppliers.

Conclusion: Enforcement Escalation and Market Volatility

Media attention has brought regulatory loopholes into the spotlight, making further governmental action inevitable:

Unavoidable Escalation: Media scrutiny, combined with the $200 million dedicated enforcement budget for FY2026, signals that regulatory action will be systematic and aggressive.

Shift to Inland Channels: Enforcement will move beyond border stops to aggressively target domestic distribution networks, warehouses, and retail points.

Volatility is the Baseline: The market will enter a period of high volatility, driven by the regulatory cycle. Data peaks must be viewed as concentrated risk, and the industry should brace for subsequent periods of reduced orders and inventory digestion.

About the Author and the Outlet

Washington Examiner

The Washington Examiner is a Washington, D.C.–based political and policy news outlet founded in 2005. It is known for its coverage of Congress, regulatory affairs, campaigns, and public policy, and is regarded as an influential conservative-leaning voice within the capital’s policy circles.

Robert Schmad

Robert Schmad is an investigative reporter at the Washington Examiner, covering government accountability, regulatory oversight, campaign finance, and interest group activity. His reporting has drawn significant attention in Washington’s policy circles and has been publicly cited by former U.S. President Donald Trump.

Cover image: AI-generated

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.