Compared to tobacco giant Altria (NYSE: MO), smaller tobacco company Turning Point Brands (NYSE: TPB) is currently a better choice due to its lower relative valuation of 0.8x compared to Altria's 3.2x tracking revenue. This valuation gap is primarily due to Altria's superior earnings capabilities.

Looking at stock returns, despite a 3% decline year-to-date, Altria has outperformed Turning Point Brands, which has fallen 36%, as well as the broader S&P 500 index, which has dropped 13%. However, there is more to consider and in the section below, we will discuss why we believe TPB stock will offer better returns than MO stock over the next three years. We compared a range of factors, such as historical revenue growth, return, and valuation multiples, in our interactive dashboard analysis of Altria versus Turning Point Brands: which stock is the better choice? A summary of the partial analysis is provided below.

1. Turning point brands experience decent revenue growth.

Two companies have both released their sales growth in the past twelve months. Despite this, Turning Point Brands' revenue growth of 5.0% is higher than Altria's 0.2%. Even when we look at a longer time frame, Turning Point Brands has performed well, with its sales growing at an average annual rate of 10.2% to $445.5 million in 2021, up from $332.7 million in 2018, while Altria's sales have grown by 0.9% to $26 billion currently, up from $25.4 billion in 2018.

Altria sells tobacco products in the US market and generates revenue from the sale of both smoking and smokeless products. However, their revenue growth was impacted during the pandemic due to supply disruptions. Last year, Altria sold its wine business for $1.2 billion and has since focused more on smoking and smokeless products. For a more in-depth understanding of the company's sales performance, our Altria revenue dashboard is available.

Turning Point Brands sells vapor products, chewing tobacco, rolling papers, and cigar wraps, among other items. Its Zig-Zag division, which includes rolling papers, cigar wraps, and smoking accessories, has been driving the company's sales growth in recent years. However, due to regulatory changes, Turning Point Brands' vapor business has recently declined, particularly after the implementation of a new rule in the Prevent All Cigarette Trafficking (PACT) Act at the end of last year. Following recent regulatory changes, it has become challenging to mail anything related to vapor to either businesses or consumers.

Sales for Turning Point Brands' NewGen division, which includes vapor products, decreased significantly by 41% in the first half of this year, comprising only 23% of its total net sales. In comparison, last year's sales for the same period accounted for 35%. Conversely, the company's other divisions, Zig-Zag and Stoker, have consistently performed well, and this trend is expected to continue in the coming years.

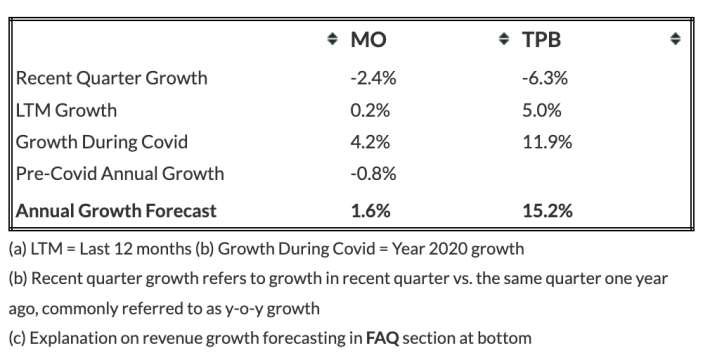

Looking towards the future, Turning Point Brands is expected to experience faster revenue growth over the next three years than Altria. The table below summarizes our revenue expectations for both companies over the next three years, based on Trefis machine learning analysis. Turning Point Brands is projected to have a compound annual growth rate of 15.2%, while Altria's compound annual growth rate is only expected to be 1.6%.

Please note that when predicting future income, we have different methods for companies that have been negatively impacted by Covid compared to those that have not been affected or have had a positive impact. For companies negatively affected by Covid, we consider the quarterly revenue recovery trajectory to predict a return to pre-Covid income levels. After the recovery point, we apply the average annual growth rate observed in the three years before Covid to simulate a return to normalcy. For companies that have experienced positive revenue growth during Covid, we consider the average annual growth before Covid, with some weight placed on growth during Covid and the past 12 months.

Altria earns more money" in standard journalistic English.

In the past 12 months, Altria's operating profit margin was 17.6%, surpassing Turning Point Brands' margin of 12.6%. This is a significant improvement from pre-pandemic 2019 figures, which stood at 3.1% and 4.5% respectively. Additionally, Altria's free cash flow profit margin of 32.6% is much better than Turning Point Brands' 11.1%.

Our dashboard for Altria's revenue and Turning Point Brand's revenue has more detailed information. In terms of financial risk, Altria has a much lower debt-to-equity ratio of 34% compared to Turning Point Brand's 94%. Additionally, Altria's cash-to-asset ratio of 13% is lower than the latter's 20%, indicating that Altria has a better debt position, while Turning Point Brands has more cash reserves.

万物之网" can be translated to "The Network of All Things" in standard journalistic English.

We can see that Turning Point Brands has exhibited stronger revenue growth, has more cash reserves, and is relatively undervalued. On the other hand, Altria has a better debt situation and higher profits. Looking ahead, based on the P/S ratio and due to the high volatility of the P/E and P/EBIT ratios, we believe that Turning Point Brands is the better choice between the two.

The table below summarizes our revenue and return expectations for Altria and Turning Point Brands over the next three years, indicating that the expected return for Turning Point Brands during this period is 58%, while the expected return for Altria's stock is only 5%. This means that according to Trefis machine learning analysis, investors would be better off purchasing TPB instead of MO, and this analysis also provides more details on how we arrived at these figures.

While TPB's stock performance may be better than MO's, the Covid-19 crisis has caused many pricing discontinuities, which can provide attractive trading opportunities. For example, you would be surprised at how counterintuitive the stock valuations of Philip Morris and Coca-Cola are.

Statement

This article is compiled from third-party information and is intended for industry communication and learning purposes only.

This article does not represent the views of 2FIRSTS, and we cannot confirm the authenticity or accuracy of its contents. The compilation of this article is solely for the purpose of industry exchange and research.

Due to limitations in our translation abilities, the translated article may not fully convey the same meaning as the original. Please refer to the original article for accuracy.

2FIRSTS maintains full alignment with the Chinese government regarding any domestic, Hong Kong, Macau, Taiwan, and foreign-related positions and statements.

The copyright of compiled information belongs to the original media and author. If there is any infringement, please contact us for removal.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.