On June 15, 2022, at the "6th Conference on Standardized Development and Promotion of the e-cigarette Industry and the First Export Service Development Conference" held in Bao'an, Shenzhen, Guo Xiaoyu, Co-founder and Chief Operating Officer of Shenzhen 2FIRSTS Technology Co., Ltd., officially unveiled the "2022 E-cigarette Industry Export Blue Book" (hereinafter referred to as the "Blue Book"), a joint production of the e-cigarette Professional Committee of China Electronic Commerce Association and 2FIRSTS.

The Blue Book provides a comprehensive description of the e-cigarette industry, focusing on aspects such as industry scale, employment, exports, markets, and patents. It is divided into six chapters: an overview of e-cigarette exports, an overview of the e-cigarette export industry, a global overview of e-cigarette consumption, opportunities and challenges, main markets, and the Fog Valley Award.

The preparation of this "Blue Book" took one month. The team interviewed over 20 entrepreneurs and conducted site visits to over 50 companies. Through various forms such as research, interviews, seminars, data crawling, and investigation of third-party databases, they obtained industry data and gained an understanding of the actual operation situation. The reliability of the data was further verified by industry experts.

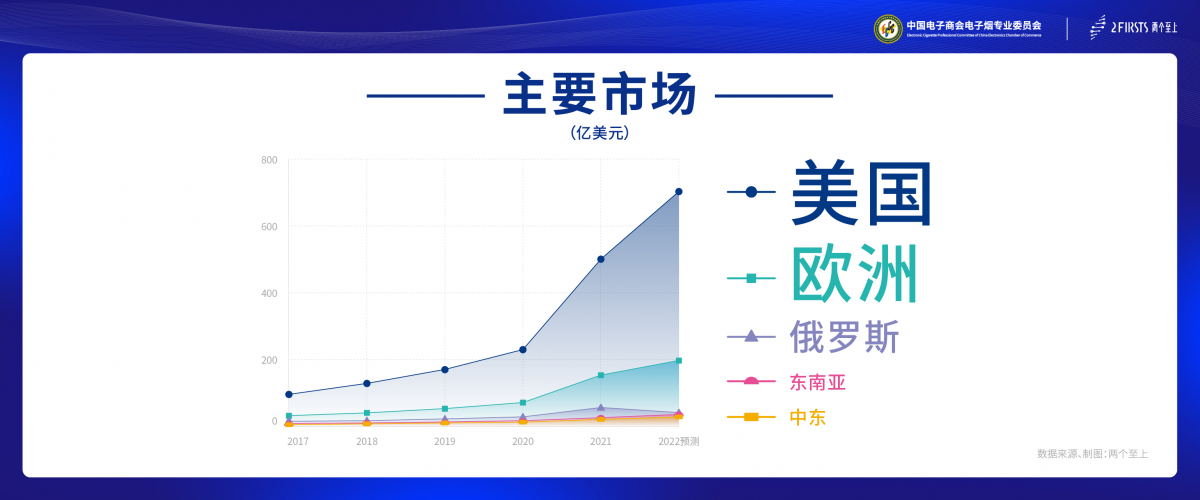

According to a report, the global e-cigarette market is projected to surpass $108 billion in 2022. Additionally, it is anticipated that the overseas e-cigarette market will maintain a growth rate of 35% in 2022, reaching a total market size of over $100 billion. In terms of exports, it is expected that the total value of e-cigarette exports in 2022 will reach 186.7 billion RMB, with a growth rate estimated at 35%.

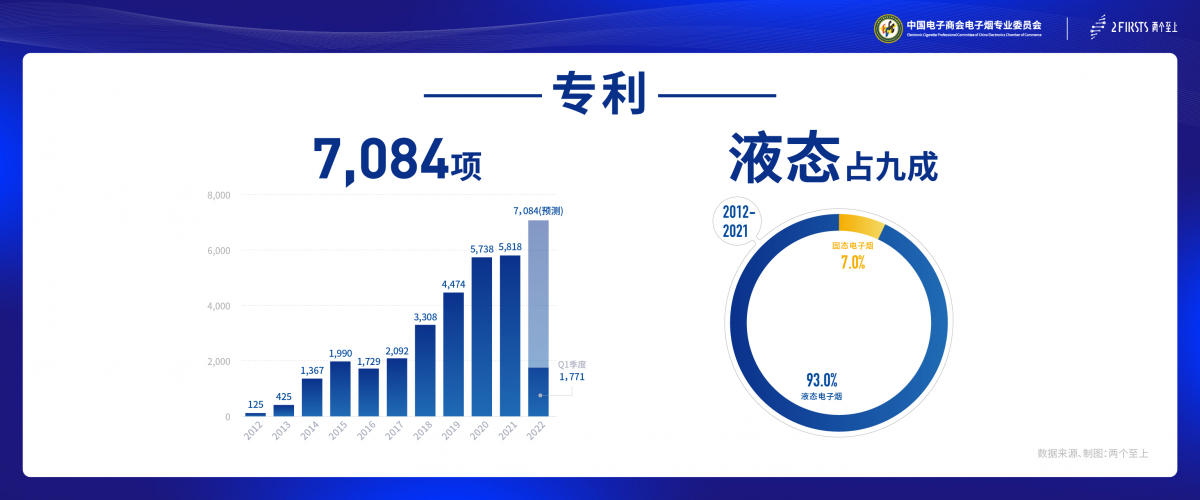

There are currently over 1,500 e-cigarette manufacturing and brand companies, with more than 70% of them primarily exporting their products overseas. The e-cigarette supply chain and related service companies amount to nearly 100,000. In terms of patents, domestic e-cigarette patents are mainly concentrated in the field of liquid e-cigarettes. From 2012 to 2021, a total of 28,838 patent applications were filed domestically, with liquid e-cigarette patents accounting for 93.0% of them, totaling 25,954. The majority of e-cigarette patent applications have emerged in the past three years. Over the past three years, the number of patent applications has been consistently above 5,000 per year. Since the fourth quarter of 2021, the monthly number of patent applications has been increasing. It is expected that the total number of patent applications in 2022 will exceed 7,000.

In addition to providing reliable data, the "Bluebook" also offers a detailed analysis of various aspects of the e-cigarette industry. In terms of the export industry overview of e-cigarettes, the Greater Bay Area covers the entire e-cigarette supply chain, with a notable surge in e-cigarette patents and a significant increase in appearance patents. Regarding global e-cigarette consumption, there is an apparent trend towards diversification, and the consumption of new tobacco products is expected to be a major growth point in the tobacco industry's future. The United States stands as the largest single market globally, with a clear influence on consumption patterns, while EU countries are expected to achieve a rapid increase in e-cigarette penetration. As for opportunities and challenges, 2FIRSTS, led by renowned entrepreneurs in the industry, held a discussion forum to strategically assess the current state of the sector and provide methods for efficiently expanding into overseas markets. In terms of key markets, the regulatory framework for e-cigarettes in the global arena follows a federal approach in the European Union, the United States, and Canada. However, in Southeast Asia and the Middle East, most countries tend to impose a ban on e-cigarettes, directly prohibiting their import and sale to curb their distribution at the source.

The "Blue Book" offers a comprehensive and objective understanding of the current state and future of the Chinese e-cigarette industry, serving as a professional reference manual with a meticulous perspective.

Scan the QR code to contact our staff for inquiries regarding the purchase of the "2022 E-cigarette Industry Export Blue Book.

Editor: Wang Siyu

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com