Recently, 2FIRSTS conducted a deep analysis of the European e-cigarette market, focusing on dimensions such as taste, companies, brands, e-liquid, and appearance, based on information released by a major logistics hub in Europe. Through a diverse perspective, they gained insight into the future trends of the European e-cigarette market.

According to official data released, in March, Europe saw a total of 319 new electronic cigarette products, of which disposable e-cigarettes accounted for over 85%, with refillable oil cartridges and oil kit sets accounting for 9.6% and 7.2% respectively.

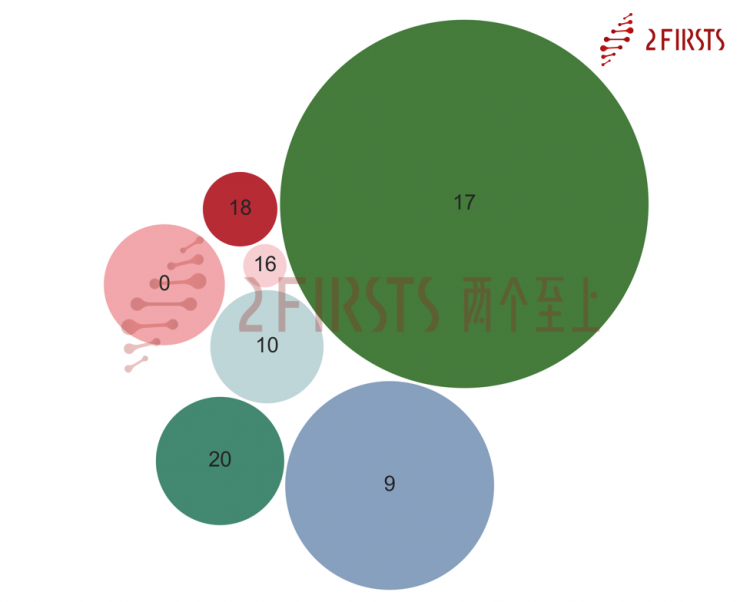

According to this "incremental data," 2FIRSTS analyzed the trends in nicotine levels of new products in the European disposable e-cigarette market from the perspective of "nicotine content." The results show that the 20mg/ml category continues to see the highest increase since March; the 17mg/ml category has the highest growth rate, increasing by 75% YoY, largely due to the contributions of Heaven Gifts and JOYETECH; and the 9mg/ml category saw a YoY growth of 24%, mainly driven by JOYETECH.

Increase in Nicotine Content – Source: Exclusive Compilation by 2FIRSTS

According to analysis by 2FIRSTS, the reason for the maximum growth rate of 17mg/ml is likely due to the over-limit content of e-liquids in the UK, which may impact other European countries and lead to stricter electronic cigarette regulations in Europe. Therefore, e-cigarette products containing 20mg/ml of e-liquid and limited to 2ml capacity face a dilemma of complying with both capacity and nicotine content regulations.

Therefore, electronic cigarette companies need to ensure a good product experience while complying with regulations. They can only choose to use lower concentrations of nicotine in their e-liquid, such as 17mg/ml, to avoid any trouble caused by exceeding regulated limits.

2FIRSTS will continue to report on research and analysis of the European electronic cigarette market. Stay tuned for updates.

All data and images in this article were compiled by 2FIRSTS based on the e-cigarette whitelist released by Belgium. Brussels Airport in Belgium is an important hub for China's e-cigarette exports, as well as being a major logistics center in Europe. Belgium has established the Benelux free trade area with Luxembourg and the Netherlands, allowing goods to flow freely within the trade area. Belgium requires all imported and manufactured products to be registered and recorded in the "whitelist" before they can be marketed, which is released by the Federal Public Service Health, Food Chain Safety and Environment (FPS Public Health) in Belgium.

Related reading:

A new survey by 2FIRSTS on e-cigarette flavors in Europe has found that over 70% of respondents prefer single fruit flavors, with strawberry and watermelon being the most commonly used.

2FIRSTS Europe Research: 450 subsidiary companies and brands enter the compliance market, including companies such as Smartmore, iQiyi, and Univar.

2FIRSTS conducted a market research study in Europe and found that companies such as British American Tobacco, Philip Morris, and Ivape are positioning themselves in the emerging market for nicotine-free products.

A survey conducted by 2FIRSTS on the appearance of electronic cigarettes in Europe revealed that black, blue, and red are the most popular colors, while green and pink have the fastest growth rate.

In March, the European market introduced three new flavors: Grape, Watermelon, and Strawberry ice cream. Among them, mixed berry flavor saw the highest year-on-year increase of 10.7%.

A recent survey of the European e-cigarette market by 2FIRSTS reveals the addition of 27 new brands in March, including YOOZ, Blu Bar, and ICE.

This document has been generated through artificial intelligence translation and is provided solely for the purposes of industry discourse and learning. Please note that the intellectual property rights of the content belong to the original media source or author. Owing to certain limitations in the translation process, there may be discrepancies between the translated text and the original content. We recommend referring to the original source for complete accuracy. In case of any inaccuracies, we invite you to reach out to us with corrections. If you believe any content has infringed upon your rights, please contact us immediately for its removal.