Key points:

The fundraising and general fund committee of the Alabama House of Representatives passed the HB529 bill, imposing a tax of 10 cents per milliliter on e-cigarette products.

Tax revenues are allocated to state funds, counties, and municipalities, and retailers are required to apply for a $150 license.

Retailers must submit monthly reports, violators will be penalized, and untaxed products may be confiscated.

According to ALreporter on April 10th, the fundraising and general fund committee of the Alabama House of Representatives passed HB529, a bill proposed by State Representative David Faulkner, which plans to impose additional taxes on "consumptive e-cigarette products" sold within the state.

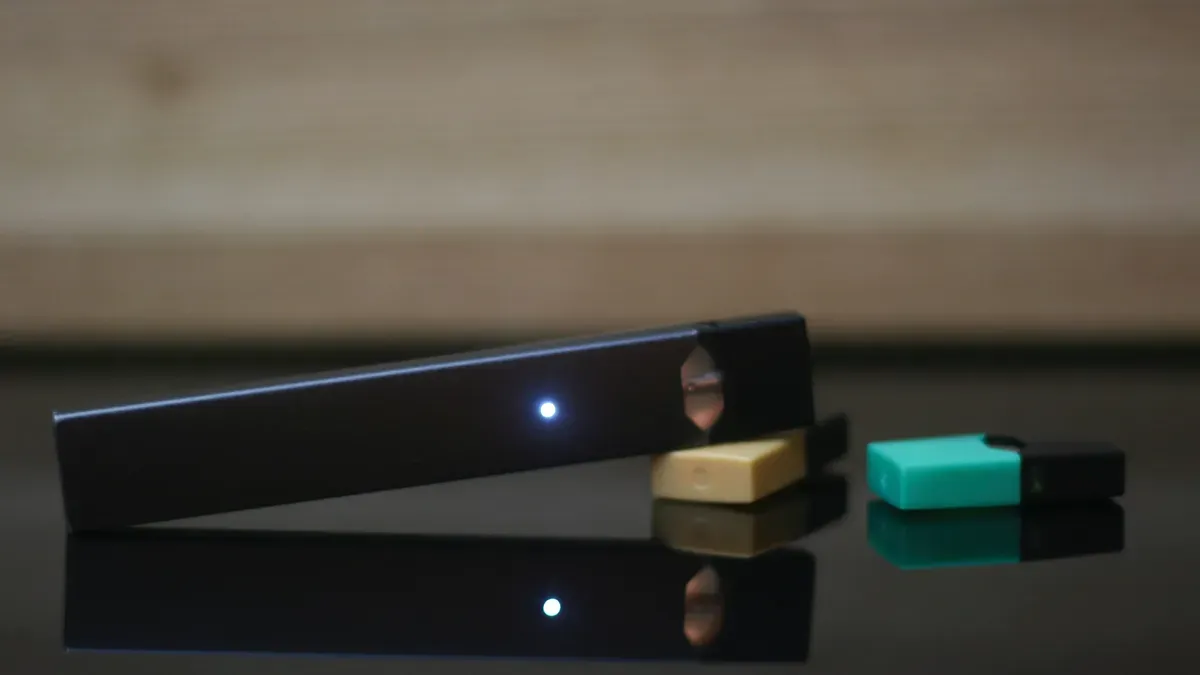

According to Alabama state law, e-cigarette products that can be consumed are defined as "any e-liquid solution or other material containing nicotine, which is consumed when used as an e-cigarette product." The proposed legislation would impose an additional tax on the retail sale of such products, with a tax of 10 cents per milliliter, to be paid by consumers on top of existing sales taxes. The bill stipulates that any existing local taxes on e-cigarette products will be repealed and replaced.

The bill specifies that 50% of tax revenue will go into the state general fund, 25% will be allocated to counties based on population, and the remaining 25% will be distributed to municipalities in Alabama based on population. Faulkner stated that at least 32 states across the US have imposed similar taxes on e-cigarette products.

The bill also requires retailers to submit monthly reports to the Alabama Department of Revenue, and violators will be prosecuted by the Attorney General and prohibited from continuing to operate. Untaxed e-cigarette products may be confiscated and dealt with by the Alabama Alcoholic Beverage Control Board or other law enforcement officials.

In addition, HB529 requires retailers to apply for a $150 license to sell consumable e-cigarette products. Faulkner stated that the penalties for failing to obtain such a license would be similar to those for unregistered tobacco sellers operating without proper licensing. The license fee will be used for enforcement and combating the illegal sale of e-cigarette products by the Alabama Alcoholic Beverage Control Board.

Faulkner stated that illegal e-cigarette products are widespread in Alabama, with an estimated 80% to 85% of stores selling illegal e-cigarette products. Currently, there is no funding or mechanism in place for enforcement, so this bill will authorize the Alabama Alcoholic Beverage Control Board to create new licensing fees to enable on-site enforcement.

The HB529 bill has now moved into the further review stage in the House of Representatives.

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com