On October 16th, British American Tobacco (BAT) CEO Tadeu Marroco delivered a speech titled "Building a Smoke-free World" during a live webcast of the "2024 Capital Markets Day.

Marroco stated in his speech that the traditional tobacco industry is facing significant challenges as global consumers increasingly prioritize health. In response to this shift, BAT has outlined a strategic vision to fully transition to smoke-free products by 2035. The company's vision is to have its primary business completely shifted to smoke-free products by 2035.

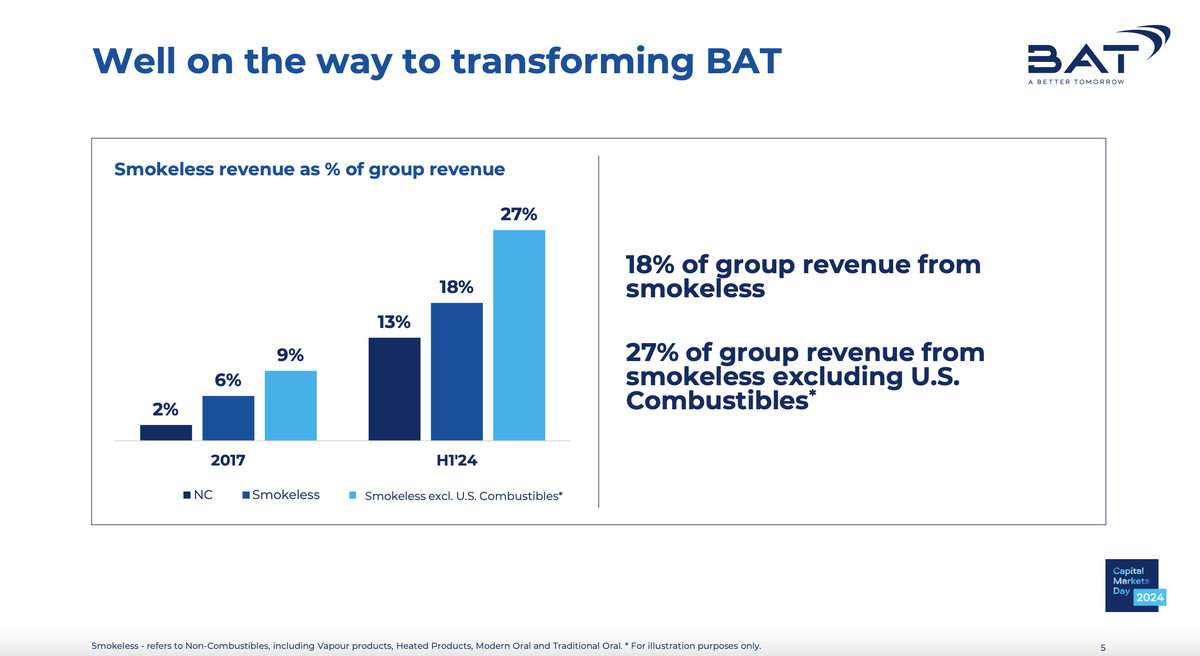

The revenue from smokeless products now accounts for 18% of the company's total revenue.

Marroco stated that there are approximately 1 billion smokers worldwide, and BAT's smokeless new category products (such as vape products, heated tobacco, and modern oral tobacco) provide these consumers with a healthy alternative.

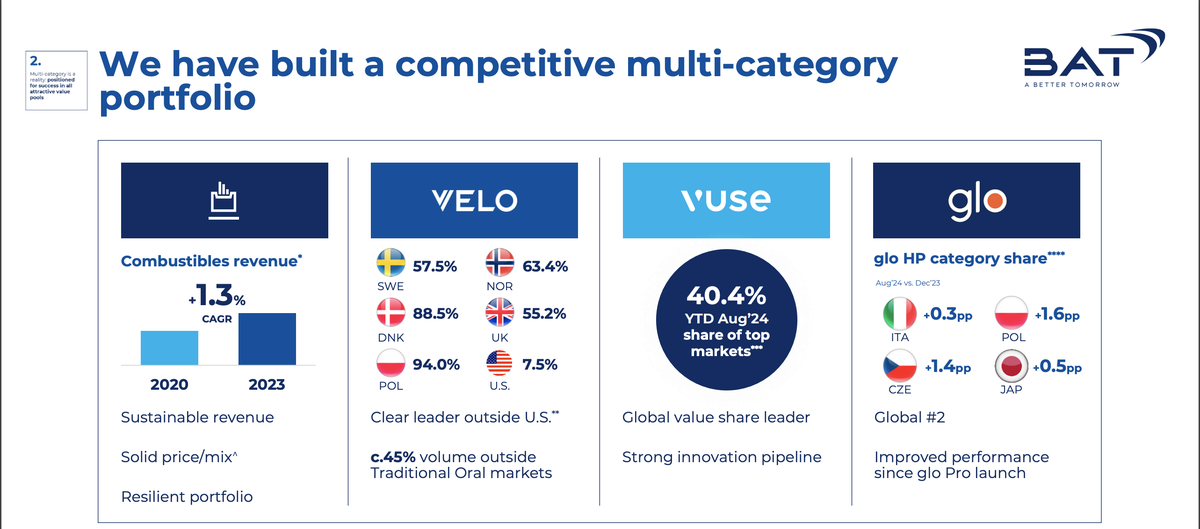

Marroco introduced the various types of smoke-free products under the company's umbrella and their performance in the market.

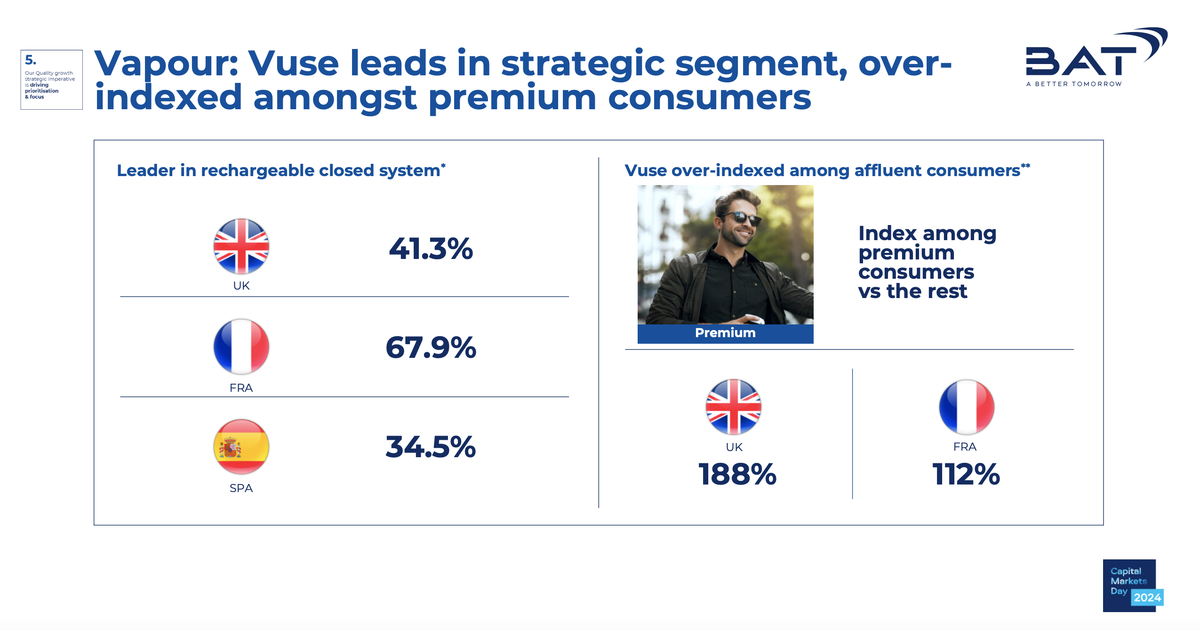

Vapour Product: BAT's vaping product Vuse holds significant market share in several global markets, especially in the high-end markets of France and the UK, where Vuse's market share reaches 67.9% and 41.3% respectively.

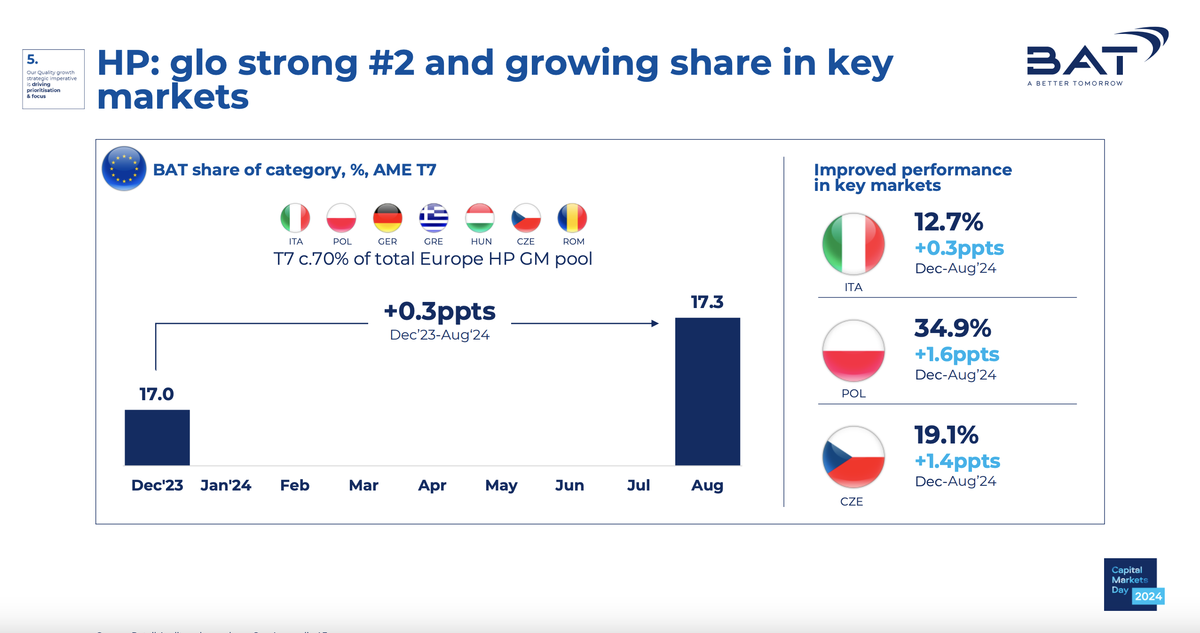

Heated tobacco products: glo's heated tobacco devices have shown impressive performance, especially in European countries such as Italy, Poland, Germany, and the Czech Republic, where glo's market share continues to grow.

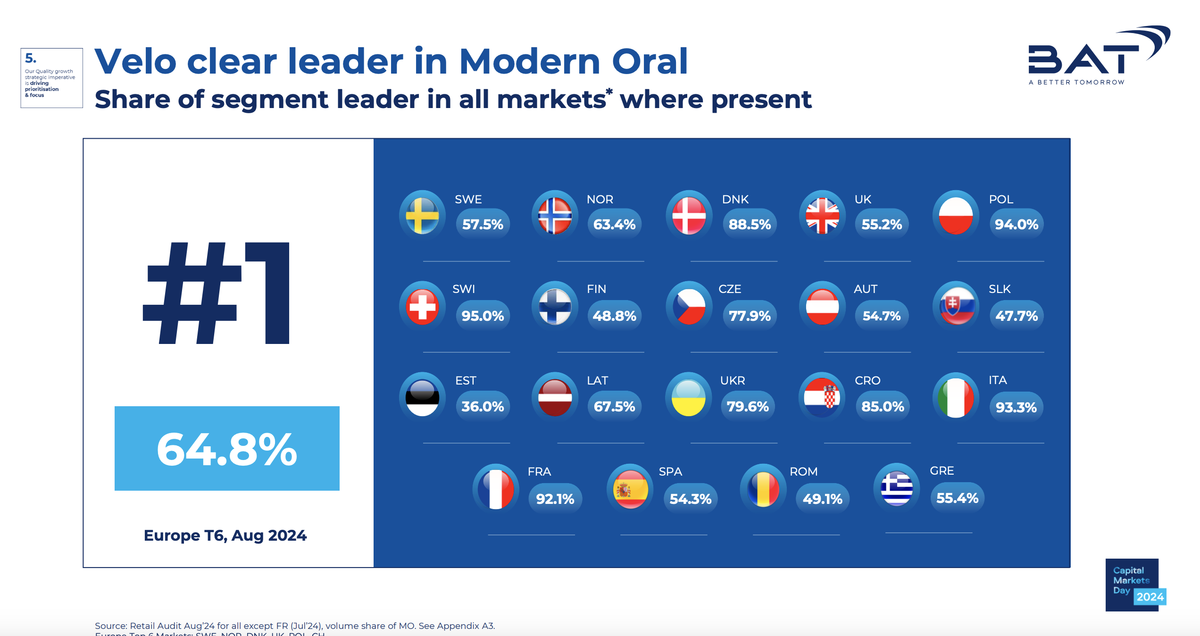

Modern oral tobacco: Velo holds a leading position in the main markets in Europe, especially in Switzerland, Poland, and Italy, with market shares reaching 95%, 94%, and 93.3% respectively.

Marroco stated that through continuous research and market expansion, smokeless products will become the core business of the company in the next decade, helping to drive structural transformation in the global tobacco industry. According to the latest financial report from BAT, by the first half of 2024, revenue from BAT's smokeless products already accounted for 18% of the total revenue of the group, rising to 27% when excluding traditional combustible tobacco products in the United States.

The market performance of heated tobacco products and e-cigarettes will be improved.

Marroco stated that in recent years, BAT has boosted performance and significantly improved operational efficiency through patent innovation and continuous upgrades of new products.

In particular, in the development of new category products, BAT is focusing on improving the market performance of vape products and heated tobacco products. Its transformation strategy is built on four levels.

- Quality Growth: Through innovation and brand enhancement, BAT will further drive high-quality growth of new category products. The company emphasizes patent protection and continues to launch innovative products like Vuse Alto to maintain market leadership.

- Sustainable Future: BAT commits to enhancing sustainable development by reducing tobacco harm and accelerating the development of smoke-free products. Reducing the health burden caused by smoking will be a core focus in achieving this goal.

- Operational Excellence: BAT ensures stable growth during the transition process by optimizing capital efficiency and enhancing operational capabilities. For example, the company continuously improves equipment and technology in the supply chain to enhance the market performance of heated tobacco products.

- Leading with Integrity and Sustainability: BAT not only aims to achieve business success but also strives to become a leading global company in reducing tobacco harm. Through responsible market behavior, the company is actively shaping the future of the industry.

The global smoke-free products are expected to have an annual growth rate of 4.6%

Marroco stated that BAT's new category products, such as glo heated tobacco and Velo modern oral nicotine, have performed well in multiple key markets, particularly in the European and American markets.

According to data provided by British American Tobacco, by 2024, approximately 36% of nicotine consumers in Europe will have used smoke-free products, a 14 percentage point increase compared to 2020. New category products are particularly popular among consumers under 30, indicating significant market potential in the future.

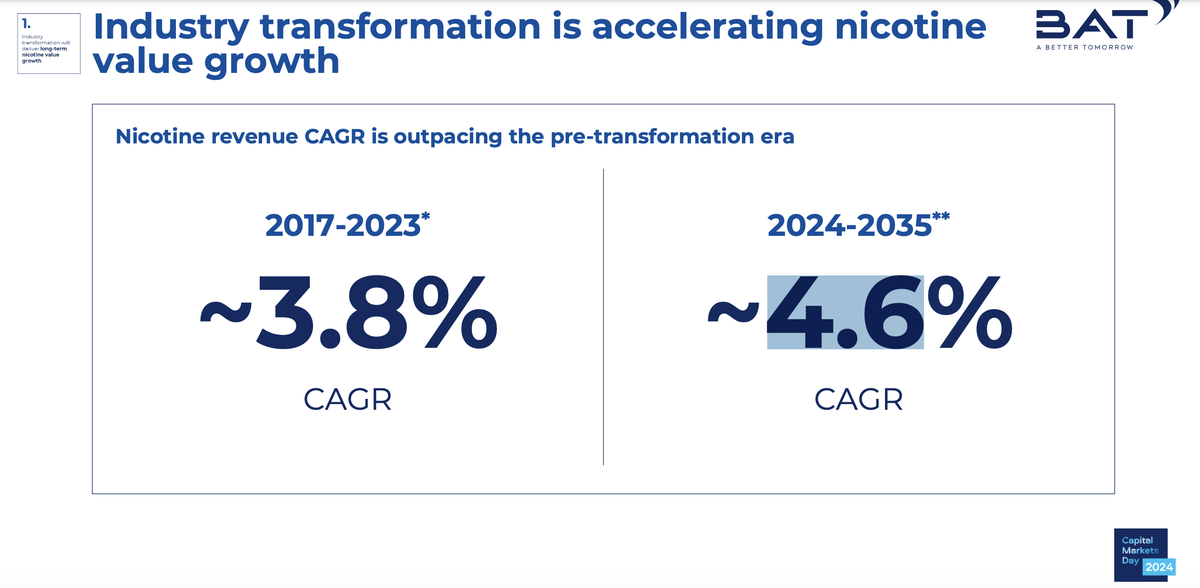

The company expects the annual growth rate of smokeless products globally to reach 4.6% by 2035, significantly exceeding the previous growth level of 3.8%.

Oral products are expected to reach £5 billion, continuing to deepen the US market and expand globally

The United States market is currently the largest nicotine market in the world. By 2024, total revenue from nicotine products in the U.S. is projected to reach 41 billion pounds, with 27 billion pounds coming from combustible products (traditional tobacco products), 9 billion pounds from vape products, and 5 billion pounds from oral products.

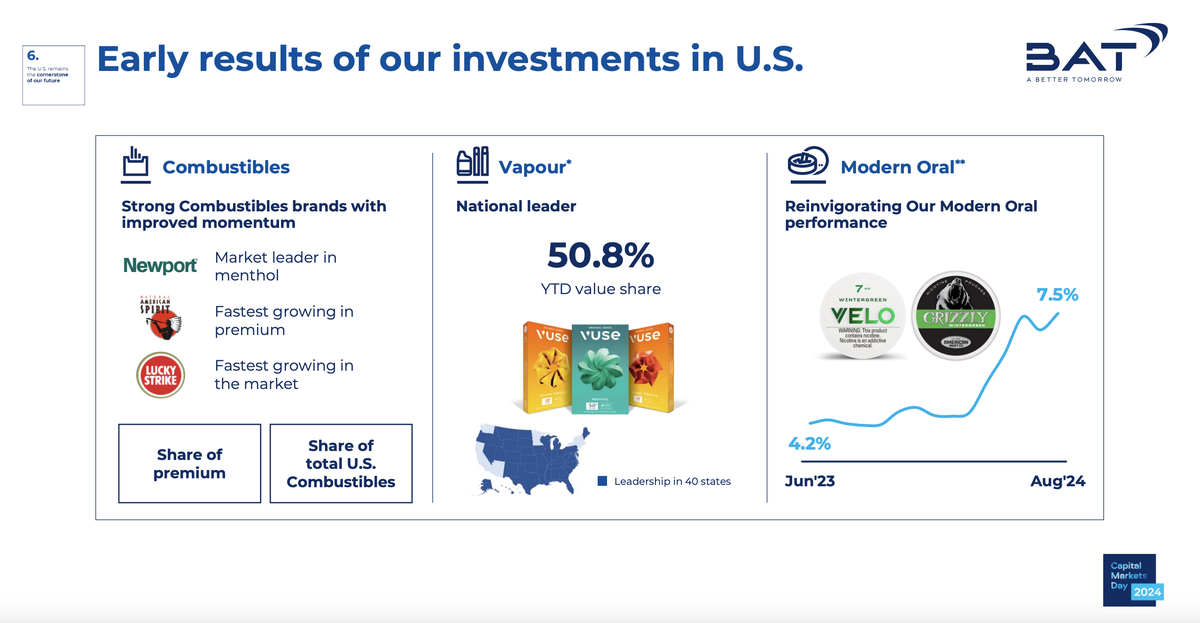

BAT's early investments in this market have yielded significant results. Marroco stated that since acquiring Reynolds Tobacco Company in 2017, nicotine products have grown by 40%. Non-smoke products (including vapor and oral products) skyrocketed by 280%. Of note, Marroco claimed that Vuse products hold a market share of 50.8% in the US market and maintain a leading position in 40 states.

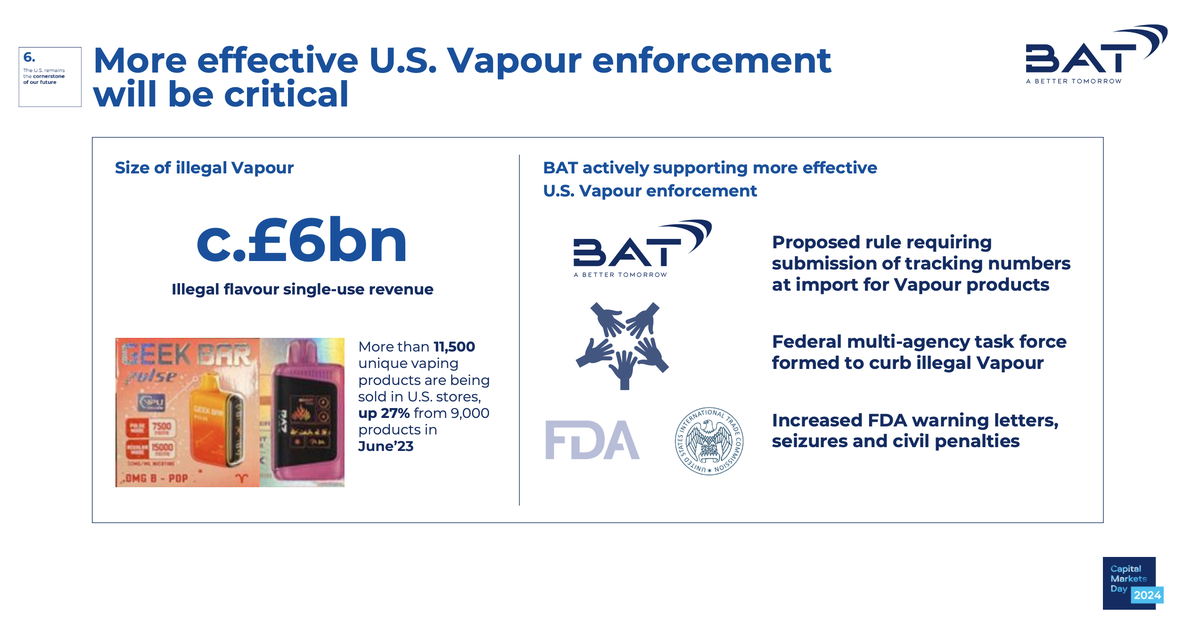

The illegal e-cigarette market reaches £6 billion, calling for the government to strengthen regulatory measures.

At the same time, BAT is also actively supporting the crackdown on the illegal vaping products market in the United States.

Data presented by BAT shows that the market for illegal vaping products in the United States is currently worth over 60 billion pounds, with over 11,500 types of e-cigarette products being sold in American stores. This has weakened the competitiveness of compliant businesses. BAT is calling for stronger regulation and more effective enforcement actions. For example, they are requesting e-cigarette companies to submit tracking numbers (STNs) and a federal multi-agency task force has been established to curb illegal products, increase FDA warning letters, seizures, and civil penalties.

It is worth noting that the slides of the presentation featured products from GEEKBAR and RAZ.

Lastly, Marroco stated that BAT is not only driving the development of smokeless products through innovation, but also committed to shaping a healthy and responsible industry regulatory framework. The company is working with governments and industry regulatory agencies in multiple countries to promote a more robust regulatory framework, ensuring the legality and safety of smokeless products for consumers.

Click to read the original report: Building a Smokeless World

We welcome news tips, article submissions, interview requests, or comments on this piece.

Please contact us at info@2firsts.com, or reach out to Alan Zhao, CEO of 2Firsts, on LinkedIn

Notice

1. This article is intended solely for professional research purposes related to industry, technology, and policy. Any references to brands or products are made purely for objective description and do not constitute any form of endorsement, recommendation, or promotion by 2Firsts.

2. The use of nicotine-containing products — including, but not limited to, cigarettes, e-cigarettes, nicotine pouchand heated tobacco products — carries significant health risks. Users are responsible for complying with all applicable laws and regulations in their respective jurisdictions.

3. This article is not intended to serve as the basis for any investment decisions or financial advice. 2Firsts assumes no direct or indirect liability for any inaccuracies or errors in the content.

4. Access to this article is strictly prohibited for individuals below the legal age in their jurisdiction.

Copyright

This article is either an original work created by 2Firsts or a reproduction from third-party sources with proper attribution. All copyrights and usage rights belong to 2Firsts or the original content provider. Unauthorized reproduction, distribution, or any other form of unauthorized use by any individual or organization is strictly prohibited. Violators will be held legally accountable.

For copyright-related inquiries, please contact: info@2firsts.com

AI Assistance Disclaimer

This article may have been enhanced using AI tools to improve translation and editorial efficiency. However, due to technical limitations, inaccuracies may occur. Readers are encouraged to refer to the cited sources for the most accurate information.

We welcome any corrections or feedback. Please contact us at: info@2firsts.com